Forums › Trading System Mentor Course Community › Trading System Brainstorming › Incorporating an Index Volatility Based Trailing Stop with the WTT

- This topic is empty.

-

AuthorPosts

-

May 14, 2020 at 11:55 pm #111435

Stephen James

MemberNo, limited only by your imagination really.

I usually start with something the system already uses and go from there (e.g. ROC in this case)May 16, 2020 at 5:47 pm #111441BenJeffery

MemberJust concerned I might have a coding error or didn’t interpret the rules properly.

If a backtesting setting or PositionScore is why I only get 11% vs 17%, then I’m fine with that.

Here is a txt file of my rules and looping. If anyone wants to do a quick check, much appreciated.

May 17, 2020 at 12:13 am #111457Nick Radge

KeymasterBen,

Have you tested using historical constituents? And dividends on, especially for ASX?May 18, 2020 at 5:23 am #111337JulianCohen

ParticipantJust checking Nick. For ASX do you have the last button checked to account for dividends?

May 18, 2020 at 5:52 am #111460

May 18, 2020 at 5:52 am #111460BenJeffery

MemberYep Nick, I have historical constituents and dividends on.

Haven’t tested on asx yet as I only have US data, but the asx is where I’m looking to bring it in, or a rotational system.

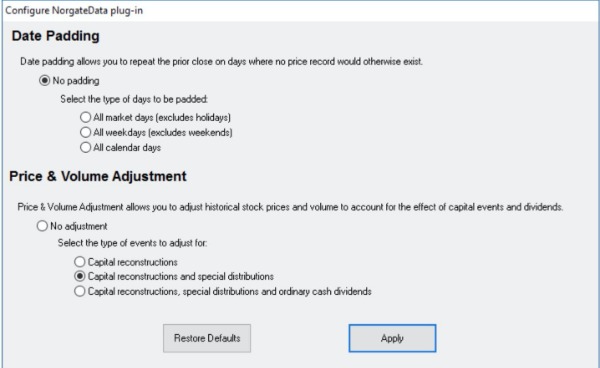

Just wanted to compare with R3000 for coding or rule errors.settings: https://imgur.com/a/dfKcMXv

May 18, 2020 at 6:32 am #111461Stephen James

MemberCode & parameters look OK.

You might find ‘AND NOT OnSecondLastBarOfDelistedSecurity’ will work better on the entry bar (LE).May 19, 2020 at 3:07 pm #111462BenJeffery

MemberThanks Craig.

May 21, 2020 at 2:27 am #111470TrentRothall

ParticipantFor guys trading weekly/daily trend systems do you have a entry condition that open must be within x% of the signal bar close to get a fill? I imagine on the ASX guys are placing a LMT entry 3-5% higher than last close to get the opening price. So if price has a big gap you might not get filled.

May 21, 2020 at 2:42 am #111480TrentRothall

ParticipantAnother question for you Glen, have you had any trouble with low-volume stocks? I see that your turnover filters are set to $500,000. Which over a week is only $100,000 a day have you had any trouble with fills or slippage?

May 21, 2020 at 2:43 am #111481GlenPeake

ParticipantHi Trent….

I chase it on the open…. e.g. just recently the WTT threw out buy signals on a number of gold stocks which gapped on the open….. i.e. around 5%++ etc….. and as I was online at the time….. I adjusted my order(s) to get the fill on the OPEN…. (I’ll double check the liquidity/market depth of the stock and make sure there’s enough liquidity etc and I’m not the one moving the market etc….)

…..also I know if I don’t ‘chase it’ on the open to get a fill, the stock will just keep on keeping on without me on board…. (Murphy’s Law etc)

…… that’s my approach anyway…..May 21, 2020 at 5:12 am #111482

…… that’s my approach anyway…..May 21, 2020 at 5:12 am #111482TrentRothall

ParticipantCheers Glen, that makes sense

May 21, 2020 at 6:53 am #111484BenJeffery

MemberI’m finding when randomly checking the backtest, about 15% of the trades are appearing like this chart, with the bright green arrow as the actual trade.

It’s picking up the trailing stop from the first time LE is met – rather than when the trade is made. any idea? :unsure:May 21, 2020 at 7:18 am #111485TrentRothall

ParticipantDo you mind posting your looping code ben, the issue might be there. It looks to me that the backtester didn’t know you were already ‘in that position’ if that makes sense.

May 21, 2020 at 7:23 am #111487Stephen James

MemberLooks like ‘Trade Arrows’ Ben.

They appear when you double click symbols in the analyser. Check ‘Sync Chart on select’ is ticked in the analyser drop down settings (small arrow on the wrench button). Then single click from there.

They can also be turned off in chart parameters>Axis and Grid tab.

May 22, 2020 at 4:35 am #111488BenJeffery

MemberYep it’s a trade arrow. To get that arrow I right click ‘show current trade arrows’, which is where the actual trade is taken in the backtester. I can’t replicate that trade, but for that example, the backtester showed a buy at about 200 and sold at 193. If it wanted to buy at 200, it should have placed the stop much lower, rather than taking the stop from the 130 buy. A buy at 130 never occurred in the backtest, the 200 buy is the only time that symbol was traded in that backtest. Hope that kind of makes sense?

Trent try a bit earlier in this thread, I posted it as an attachment.

-

AuthorPosts

- You must be logged in to reply to this topic.