Forums › Trading System Mentor Course Community › Performance Metrics & Brag Mat › High Frequency strategy on ASX

- This topic is empty.

-

AuthorPosts

-

March 24, 2016 at 9:34 pm #103450

SaidBitar

Participant50% margin

The reason of using margin is because drawdown is so small without margin and when margin is used it increases but still good

Another reason is for higher returns

Tstats are from single run the mcs are not far a bit higher dd

March 25, 2016 at 4:58 am #103408LeeDanello

ParticipantImpressive mertics. Thanks for sharing

March 25, 2016 at 1:36 pm #103452SaidBitar

ParticipantI totally agree

On paper things look good

And as Nick always says next 1000 tradesThree thing that are needed

1 discipline

2 time

3 more days like yesterdayApril 26, 2016 at 11:07 am #103409ScottMcNab

ParticipantReducing the number of positions to 10 would, I imagine, improve exposure but 10 positions at 10% is asking for trouble perhaps ?

April 26, 2016 at 11:09 am #103410ScottMcNab

ParticipantOr is it more a practical issue of liquidity with a large portfolio ?

April 26, 2016 at 9:57 pm #103411Nick Radge

Keymaster10 positions of 10% is fine but the issue is one of selection bias.

If you run the trade skipping MCS and the results are tight then no issues.

I just prefer a little more diversification.

April 27, 2016 at 9:09 am #103412ScottMcNab

ParticipantThanks Nick. My interest was sparked when I was re-reading the profit maximization module….was thinking another approach may be to have one of the systems with the position size ramped up…increased risk but increase return through exposure…but used as one of a number of systems

April 27, 2016 at 9:46 am #103635TrentRothall

ParticipantScott McNab wrote:Thanks Nick. My interest was sparked when I was re-reading the profit maximization module….was thinking another approach may be to have one of the systems with the position size ramped up…increased risk but increase return through exposure…but used as one of a number of systemsI have thought about something like 16 positions at 12% or 15 at 13%, when thinking about the topic you are talking about Scott. if MDD etc still suited

April 27, 2016 at 9:57 am #103636SaidBitar

ParticipantWhy you don’t run rolling windows on short term such as one day and check the number of trades that you have.

if you found out that most of the time you have between 10 to 15 trades then 20 will be a bit large for this market and may be it will be good idea to decrease the number of trades i.e. increasing the position size so you will have more returns. but if the percentage of days where you have 20 trades is good then better to stick with 20 trades.Or may be you can keep 20 trades and decrease the stretch a bit so you can be sure that you are filled on more orders.

April 27, 2016 at 10:06 am #103637SaidBitar

ParticipantAnother thing if you stay with 20 positions it makes you follow your system better. For example in the US market may be only two or three days per month i am holding 20 positions but everyday i put lots of orders and very few get filled. the reason i do not switch to a lower number of positions is that there are really bad trades out there, that will make you think that maybe i need to have some stops in my system or i should put exit based on time but when you see that the position is small and the loss is still OK than you will kick out these ideas and just do what the system is saying.

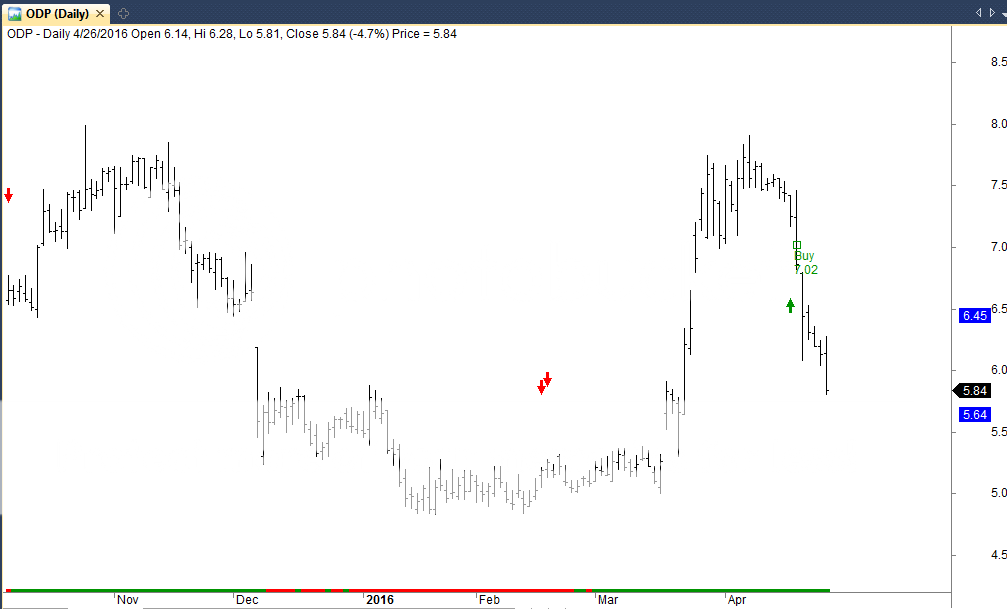

here is one bad one i am in at the moment.

everyday lower close and I do not feel that it is going to take a break soon

April 27, 2016 at 10:08 am #103638

April 27, 2016 at 10:08 am #103638TrentRothall

ParticipantWould you run rolling windows on the full test period? 2000-2016? i imagine that may take a while but might only need say 5 years?

April 27, 2016 at 10:13 am #103413ScottMcNab

ParticipantYeah…thats an interesting and I suspect very valid point Said that I hadn’t given enough thought to…having more positions may help prevent panic from taking hold and over-riding the system

April 27, 2016 at 10:22 am #103640SaidBitar

ParticipantScott McNab wrote:Yeah…thats an interesting and I suspect very valid point Said that I hadn’t given enough thought to…having more positions may help prevent panic from taking hold and over-riding the systemsometimes the market is not in mood and it decides to go down so you will have gap down you will get filled on your orders and continue down, had this day this month i do not remember exactly which day end of the day i was around 5% down with 20 positions so if i had 10 i will be may be 10% down or even more. what i want to say the day to day volatility will increase. So for me at this stage i prefer to play safe till my confidence in the system is boosted and some profits are sitting in the account then maybe then i will play with volatility.

April 27, 2016 at 10:24 am #103641TrentRothall

ParticipantI have a hard exit on the 7th day to avoid the constant drop, dosn’t affect any other metric just makes the ave loss and ave loss time smaller

April 27, 2016 at 10:25 am #103643TrentRothall

ParticipantSaid Bitar wrote:So for me at this stage i prefer to play safe till my confidence in the system is boosted and some profits are sitting in the account then maybe then i will play with volatility.That’s a good point

-

AuthorPosts

- You must be logged in to reply to this topic.