Forums › Trading System Mentor Course Community › Performance Metrics & Brag Mat › High Frequency strategy on ASX

- This topic is empty.

-

AuthorPosts

-

March 22, 2016 at 8:00 am #101462

Nick Radge

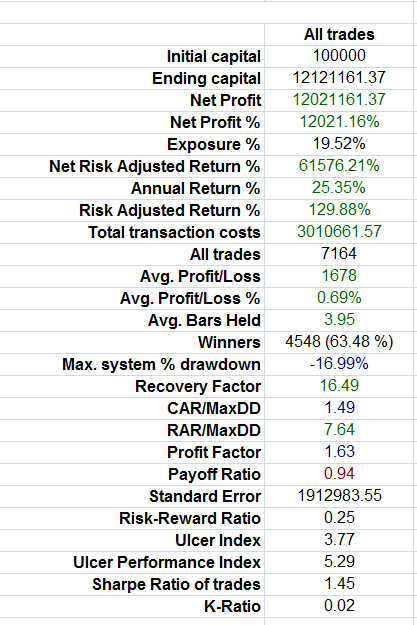

KeymasterHere’s my HFT strategy traded on the ASX,

March 22, 2016 at 8:07 am #103398

March 22, 2016 at 8:07 am #103398Nick Radge

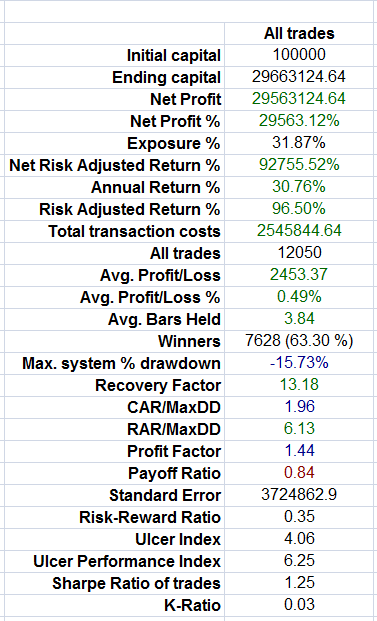

KeymasterAnd for those that haven’t seen it, here’s the same system, same parameters traded on the S&P 500

March 22, 2016 at 9:43 am #103399

March 22, 2016 at 9:43 am #103399ScottMcNab

ParticipantEye opener….trade frequency seems so important…for SP500 the same system has lower payoff ratio for same win rate and through compounding makes almost 3 times as much net….which reinforces thought that I should stick to US market. Does the greater avg. proft/loss fo SP500 simply reflect a greater inherent volatility in the US market that the system is then able to capture?

Thanks for posting NickMarch 22, 2016 at 11:09 am #103415SaidBitar

ParticipantDoesn’t this make you wonder why to invest in Trend following strategies when mean reversion are more profitable with lower DD. Don’t understand me wrong 75% of my trading capital in trend following and momentum but still from time to time i wonder about this.

March 22, 2016 at 1:50 pm #103400LeeDanello

ParticipantWhat time period is the back test over.

March 22, 2016 at 8:19 pm #103401Nick Radge

KeymasterTest is back to 1995

Quote:Does the greater avg. proft/loss fo SP500 simply reflect a greater inherent volatility in the US marketNo. It’s a function of the compounding is all. To measure like for like you’d need to switch the compounding off. Can do that later and post…

March 23, 2016 at 9:24 am #103402ScottMcNab

ParticipantLooking at the effects of increased trade frequency and compounding going from ASX to SP500 (and then still with only 32% exposure) makes me think it may be even better on SP1500…but I’m sure there is a reason you have elected not to do this Nick…I’m asking as I have been using the SP1500 to test my systems as it gives me the best results…does the selection of SP500 rather than SP1500 relate to one of your other posts about not being a fan of using positionscore and therefore using a smaller universe of stocks?…or is there another reason ?

Many thanks

ScottMarch 23, 2016 at 10:34 am #103420LeeDanello

ParticipantScott, 12000 trades over 20 years averages out at 600 trades a year or 50 trades a month. That’s quite a bit of trading.

March 23, 2016 at 12:26 pm #103422SaidBitar

Participantmoccha wrote:That’s quite a bit of trading.This is why it is High Frequency

here is the reason

NO Compounding is involved

if you check the post from Nick on the system performance on ASX

the edge of the system is 0.49%

this means each position taken will return 0.49% of the position as profit ( this is regardless of winning or losing because some times you will lose and other times you will win higher than this but as average it is 0.49%)

since the system has 10 trades and each trade is 10% of the portfolio this means that the edge of the system is 0.049% on portfolio levelso if you have 1000 trades your profit will be 49%

if you have 15000 trades then the profit will be 735% of the initial equity.again this is non compounding if you want to check compounding the calculations will become a bit more complex since you need to account for the equity growth that will affect the position size.

but as you can see the higher the number of trades the higher the returns

March 23, 2016 at 8:58 pm #103403Nick Radge

KeymasterThe strategy works perfectly well on the S&P 1500 but I would need to increase number of positions to tighten selection bias. Will test

March 23, 2016 at 9:56 pm #103404Nick Radge

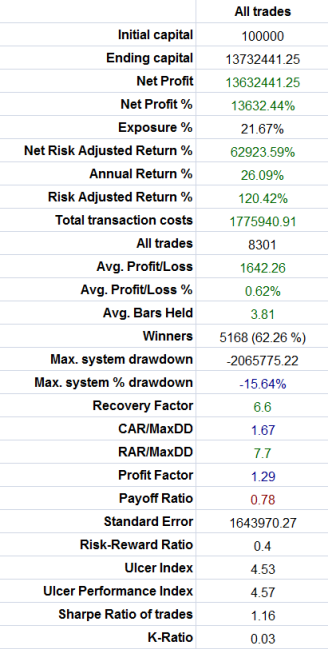

KeymasterSo this is the S&P 1500 excluding the S&P 500. I added a volume filter here to weed out illiquid stocks and remained with the standard 20 positions.

Shows the systems robustness… March 23, 2016 at 10:02 pm #103405

March 23, 2016 at 10:02 pm #103405Nick Radge

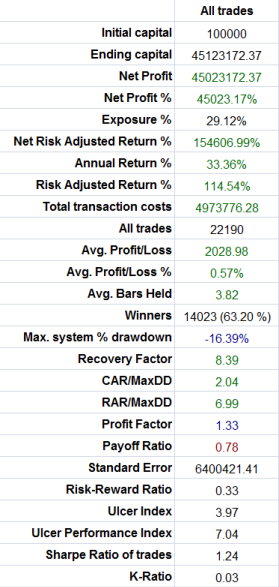

KeymasterAnd here is the complete S&P 1500 using 40 positions @ 5% equity

March 23, 2016 at 11:52 pm #103406

March 23, 2016 at 11:52 pm #103406ScottMcNab

ParticipantMany thanks for testing and posting Nick…seems that extra number of positions used to address selection bias has resulted in similar exposure to SP500…robust across all

March 24, 2016 at 11:32 am #103443SaidBitar

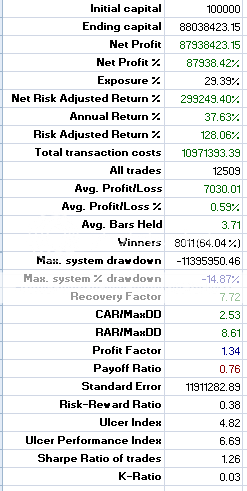

Participanthere are the performance of the MRV system that i trade at the moment

the universe is Russell 1000 and the duration from 1/1/1995 till 21/3/2016 March 24, 2016 at 9:27 pm #103407

March 24, 2016 at 9:27 pm #103407ScottMcNab

ParticipantImpressive Said…another system with car/maxDD above 2…I’m happy if I get mine above 1. MRV systems seem to give better stats than the trend following systems from my limited exposure….is this system traded on margin ?

Thanks for posting

Scott -

AuthorPosts

- You must be logged in to reply to this topic.