Forums › Trading System Mentor Course Community › Running Your Trading Business › Hedging My US MOMO Exposure

- This topic is empty.

-

AuthorPosts

-

December 4, 2020 at 3:51 am #102075

GlenPeake

ParticipantI just want to double check that I’m not cocking this up.

(Probably a similar setup to a few of us here:)

Summary:

– Interactive Brokers Cash Account, with Base currency as $AUD.

– I’ve bought US Stocks for my US NDX MOMO Rotational system

– I want to Mitigate/Hedge against a rising Aussie Dollar (AUD) for the stocks I hold in my US MOMO portfolio(I’ve never traded a futures contract before and I just want to make sure that this is correct etc.)

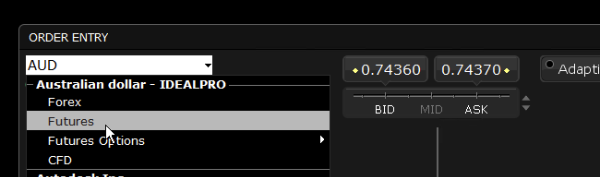

Select AUD-> Futures

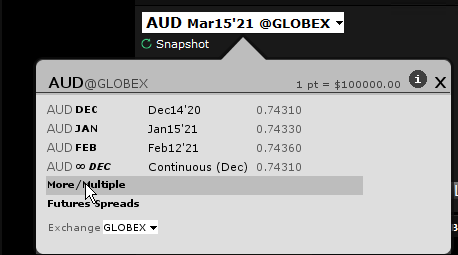

Expand to select another month e.g. MARCH:

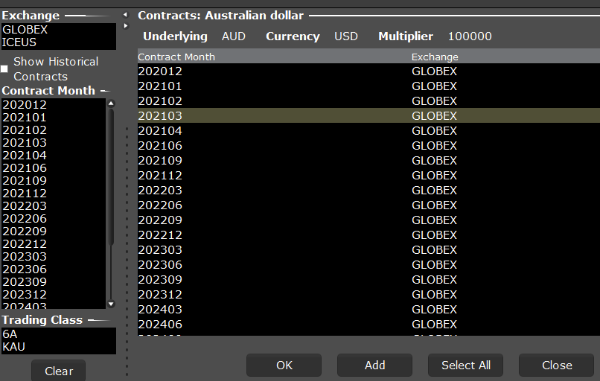

Select 1 contract: e.g.

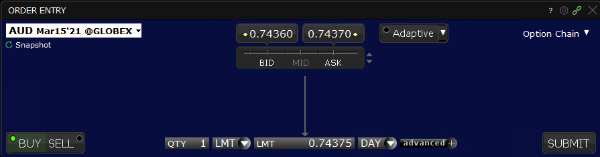

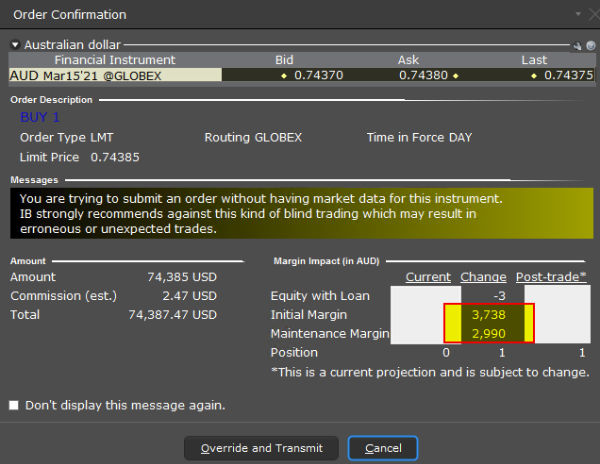

Review of Order:

I’m hedging e.g. 1x Contract which means I’m hedged for approx. $74385 (USD)

Some questions:

– Hedging with Futures is the appropriate way? The steps I’ve shown above are on the right track etc?

– In terms of how far ahead to hedge… i.e. I selected the March contract… approx 3-4 months. Is this a reasonable time frame? What do others do e.g. 2-3 months??? Shorter/Longer time frame?

– The 2 figures in the last image

3738 (Initial Margin)

2990 (Maintenance Margin)These 2 figures equals 6728. Cost of the hedge? What happens to this amount when I sell the 1x Contract e.g. do I retain some/all of this amount 6728. e.g.

In March if AUD is lower/flat/higher:0.70 LOWER (I will lose some/all of the 6728)?

0.74385 FLAT/UNCHANGED (I will retain some/all of the 6728)?

0.80 HIGHER (I will gain some $$ plus the 6728)?– If it is a March contract, I assume that means, the END of March? (Double checking).

Just looking for confirmation before I do anything and BUY the wrong thing etc.

December 4, 2020 at 4:24 am #112617Nick Radge

KeymasterI’ll call you Glen

December 4, 2020 at 4:39 am #112619GlenPeake

ParticipantThanks for the call Nick.

For those also in a similar situation….. what I posted above is correct for my situation…. the initial margin of $6728 will be returned to me plus or minus whatever the $AUD has done in that time etc….

Cheers

December 4, 2020 at 6:17 am #112620JulianCohen

ParticipantDon’t forget futures expire on third Wednesday of each quarter, in other words you need to close the position in March 2021, if you still have it, and open a new position in June 2021, ideally on or around 15th March 2021.

I normally have a reminder in my calendar for any futures ‘rolls’ as they are called; when you roll the position out to the next liquid contract.

December 4, 2020 at 6:32 am #112621ScottMcNab

ParticipantHI Glen..can I just check that it is only the initial margin ($3738) that is paid ? I think the maintenance margin is the level at which you have to add more funds if the position moves against you (so don’t have to add the maintenance to the initial to make it as high as 6728)…been long time since looked at this…can someone confirm or correct this please

December 4, 2020 at 6:52 am #112623GlenPeake

ParticipantThanks for the tip Julian.

@Scott…. not sure about how much is required…atm… be nice if it’s just the Initial part.

I need to transfer some more funds to IB to put the Hedge on to cover both 3738 (Initial Margin) and 2990 (Maintenance Margin), just in case both are required etc…. I’ll let you know once I’ve made the transaction if it’s Initial only or Initial + Maintenance (if no-one else responds in the meantime etc).

December 4, 2020 at 8:27 am #112624

December 4, 2020 at 8:27 am #112624TrentRothall

ParticipantSo with a cash account you can do this Glen? I thought i couldn’t i better check again! Thanks

December 4, 2020 at 9:19 am #112625GlenPeake

Participant@Trent

My account is activated for Futures trading. You may need to go through a Futures activation questionaire if your account is not enabled for it.I activated mine when I first setup the IB account.

It might also be dependent on how you setup your IB account i.e. PTY LTD or Personal account etc as to whether Future’s trading can be enabled or not… (not 100% sure on this point, but keep it in mind if you cannot enable it etc)

April 5, 2021 at 9:00 pm #112622#REF!McGrath

ParticipantIs there a general guide as to when to roll over eg 1 month before expiry or just keep an eye on volume?

April 5, 2021 at 9:33 pm #113182Nick Radge

KeymasterI roll when Open Interest moves to the next contract. Currently June…

January 27, 2023 at 12:41 am #112618KateMoloney

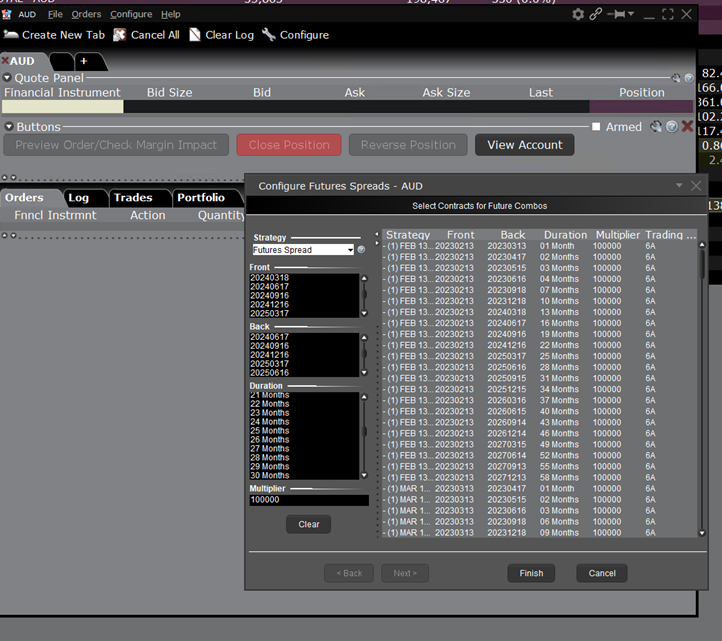

ParticipantWhat are the steps to rollover a futures contract?

Mine don’t need rolling until April, but trying to get my head around it and type up an SOP of some sort.

IB gave the following info;

https://www.interactivebrokers.com/lib/cstools/faq/#/content/36996766Use the SpreadTrader tool to roll a future in TWS:

- Right click on a Future position

- Select SpreadTrader

- When the Spread Trader window opens, select Futures Spreads

- Towards the bottom half of the page, look in the left column and find the month you want to roll to.

To roll a long future position:

- Click on the displayed Ask for the contract you wish to buy, and the Spread Trader will set up an order to buy that contract and sell (to close) your long open future position

- Select your desired order parameters and Transmit once finished.

Where I get stuck is point 2 (in red).

Here are what my windows look like;

Then I click on the contract I want (in theory) and the following window shows up, there is no transmit button.

Have asked IB for help, but curious if some smart cookie on here has it figured out

January 27, 2023 at 6:32 am #115393

January 27, 2023 at 6:32 am #115393Nick Radge

KeymasterGive me a call sometime Kate. I’ll go through it with you.

January 30, 2023 at 5:48 am #115394KateMoloney

ParticipantThanks to Nick for taking the time to discuss futures.

I wrote up an SOP but can’t upload it here for some reason.

Main learnings were to buy futures on the quarterly contracts March, June, September or December … as they are the main contracts with most volume.

My understanding is Limit orders are best for contracts other than the spot month, even if it takes a day or so to fill. Otherwise market orders for futures contracts are ok due to the higher volume.

Instead of rolling over contracts, I will be diarizing the first week of the expiry month and then selling the future contract I hold and buying another one for the next quarter. Its essentially similar/same as rolling over the contract (to my understanding).

January 30, 2023 at 5:50 am #115395KateMoloney

ParticipantAlso, I asked IB about continuous futures contracts.

This was their response…

Initial Description: Continous futures contracts

Response from IBCS at 25-Jan-2023While it is possible to add the Continuous future to a watch-list and trade the Continuous future, please remember that when you trade the continuous future you are trading the Lead month, and this future contract will still expire. As such you will need to roll your future position to the next lead month if you wish to extend the length of the position.

Generally speaking the Continuous future contract is used to have a seamless historical chart of the future.

In order to check the margin requirements of the product you may simply follow the below steps:

1. Log in to TWS.

2. Add contract to watch-list

3. Right click on contract >Financial instrument info> Description.

4. Under Margin Information page you can see the margin requirements for the product.Also, there is a tool called “Preview Order / Check Margin” in TWS that offers the ability to review the projected cost, commission and margin impact of an order prior to its transmission.

Preview Order / Check Margin: https://ibkr.info/article/644

Regards,

Darren S.

IBKR Client Services

-

AuthorPosts

- You must be logged in to reply to this topic.