Forums › Trading System Mentor Course Community › AmiBroker Coding and AFL › Handy CBT code

- This topic is empty.

-

AuthorPosts

-

May 2, 2020 at 8:32 am #111384

GlenPeake

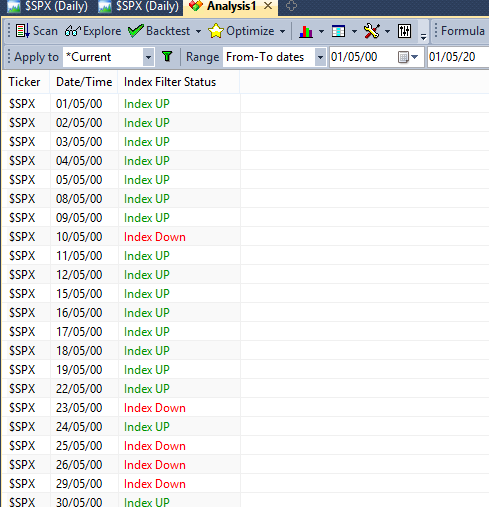

ParticipantAn Explore example below of checking whether the Index Filter is Up/Down using the “AddMultiTextColumn” option. I hadn’t used this option before.

Code:_SECTION_BEGIN (“Normal MA Index Filter”);

//=================================================================================

// SPX Index Filter

//=================================================================================IndexTog = ParamToggle(“Index Filter”,”Off|On”,1);

“”;

“Normal MA Index Filter”;

//IndexCode = ParamStr(“Index Symbol”,”$NDX”);

IndexCode = ParamStr(“Index Symbol”,”$SPX”);

//IndexCode = ParamStr(“Index Symbol”,”$DJI”);Index = Foreign(IndexCode,”C”);

IndMA = Param(“Index MA”,200,10,300,10);

IndFiltUp = Index > MA(Index,IndMA);

IndFiltDown = Index < MA(Index,IndMA); IndFilt = IIf(IndexTog,IndFiltUp,1); //================================================================================= _SECTION_END(); Filter = 1; IndexUP = IndFiltUp; IndexDOWN = IndFiltDown; TextList = "No signalnIndex UPnIndex DownnIndexUP and IndexDown"; TextSelector = 1 * IndexUP + 2 * IndexDown; AddMultiTextColumn(TextSelector,TextList, "Index Filter Status ", 1.0,IIf(TextSelector == IndexUP, colorGreen, colorRed)); // ------------------------------------------------------------------ // https://www.amibroker.com/guide/afl/addmultitextcolumn.html

// ------------------------------------------------------------------ May 2, 2020 at 8:50 am #111390

May 2, 2020 at 8:50 am #111390GlenPeake

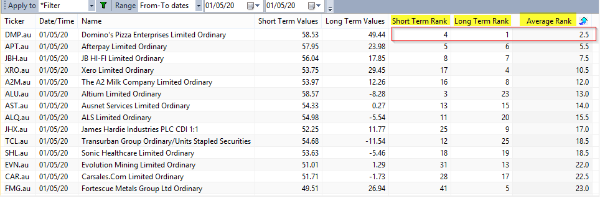

ParticipantUsing the StaticVAR option to merge Indicators of dissimilar values and RANK accordingly…

Handy if you want to build a Rotational system using multiple indicators with dissimilar values.

You can then manipulate how you want to calculate the rank….E.g. ‘Average’ rank shown below.

Code:// https://forum.amibroker.com/t/exploration-ranks/14285/2

//

// ———————————————————-

// choose WL in Analysis window

wlnum = GetOption( “FilterIncludeWatchlist” );

List = CategoryGetSymbols( categoryWatchlist, wlnum ) ;if( Status( “stocknum” ) == 0 )

{

StaticVarRemove( “ShortTermValues*” );

StaticVarRemove( “LongTermValues*” );for( n = 0; ( Symbol = StrExtract( List, n ) ) != “”; n++ )

{

SetForeign( symbol );ShortTermValues = RSI( 15 );

LongTermValues = ROC( C, 200 );RestorePriceArrays();

StaticVarSet( “ShortTermValues” + symbol, ShortTermValues );

StaticVarSet( “LongTermValues” + symbol, LongTermValues );

}StaticVarGenerateRanks( “rank”, “ShortTermValues”, 0, 1224 );

StaticVarGenerateRanks( “rank”, “LongTermValues”, 0, 1224 );

}symbol = Name();

svShortTermValues = StaticVarGet( “ShortTermValues” + symbol );

svLongTermValues = StaticVarGet( “LongTermValues” + symbol );ShortTermRank = StaticVarGet( “rankShortTermValues” + symbol );

LongTermRank = StaticVarGet( “rankLongTermValues” + symbol );// from here you can choose whatever manipulation of the two rankings you desire

// example below is to average the two rankings

AverageRank = ( ShortTermRank + LongTermRank ) / 2;// Exploration of calculations //

Filter = 1;

AddtextColumn(FullName(), “Name”);

AddColumn( svShortTermValues, “Short Term Values” );

AddColumn( svLongTermValues, “Long Term Values” );

AddColumn( ShortTermRank, “Short Term Rank”, 1.0 );

AddColumn( LongTermRank, “Long Term Rank”, 1.0 );

AddColumn( AverageRank, “Average Rank”, 1.1 );SetSortColumns( 8 );

May 2, 2020 at 2:56 pm #111391

May 2, 2020 at 2:56 pm #111391JulianCohen

ParticipantGlen I get an “error 701 Missing Buy/Sell variable assignments” when I use this with my rotational code.

Any idea what I’m doing wrong?

I’m placing it just before the line for SetBacktestMode(backtestRotational)May 2, 2020 at 11:55 pm #111393GlenPeake

ParticipantHi Julian,

I would put all this code above the rank criteria and then edit the Rank = accordingly as below, where AverageRank is the calculation output of the StaticVar code, with the 1000 – AverageRank bit so that it ranks from the biggest number to lowest number etc when running the ranking calc through the backtest etc etc…..

Code://=================================================================================

//Entry & Exit

//=================================================================================

Rank = 1000 – AverageRank; //Criteria for rotationLet me know if you want a full sample Rotational system code posted and I can throw one up if you still get stuck.

January 13, 2021 at 3:26 pm #111273Anonymous

InactiveDoes anyones’ Amibroker crash when trying to run most of these snippets of code? Seem to be having issues on my end

January 13, 2021 at 8:27 pm #112873Nick Radge

KeymasterWhat version are you running? Might be worth upgrading to latest version.

January 13, 2021 at 9:59 pm #112874Anonymous

InactiveUpgraded from 6.30.5 to 6.38.0 to no avail. My knowledge of this CBT is pretty limited, but did some tinkering though and the issue seemed to be with duplicating:

if (Status (“action”) == actionPortfolio )

Fixed – now I realize you cant just bolt on those snippets together, need to include them under the same if statement and also delete duplicate objects

June 24, 2021 at 10:14 am #111274ChrisThong

ParticipantHi All,

I found the following codes from Cesar’s Blog, which is relating to exploration of ~~~Equity for drawdown percentage and new equity high.

To explore, please select symbol “~~~Equity” and the date that you wanted to explore.

Code://=================================================================================

//Equity exploration parameters

//=================================================================================

Filter = True;

{

eq = C;

drPerc = -100*(eq/Highest(eq) – 1);

barSinNewHigh = BarsSince(drPerc == 0);

dd1 = IIf((barSinNewHigh == 0 AND Ref(barSinNewHigh,-1) != 0) OR (Status(“lastbarinrange”)), 1, 0);

dd1 = IIf(Status(“firstbarinrange”), 1, dd1);

dd2 = IIf(barSinNewHigh == 0 AND Ref(barSinNewHigh,-1) != 0 OR (Status(“lastbarinrange”)), HHV(drPerc, barSinNewHigh) , 0);

ddSort = Sort(dd2);

dn = DateNum();

barsToMdd = IIf(dd1 != 0, HighestSinceBars(Ref(dd1, -1) != 0, drPerc), 0);

}//=================================================================================

// Equity exploration code

//================================================================================={

AddColumn(C,”Equity”);

AddColumn(drPerc,”Draw Down Percent”);

AddColumn(barSinNewHigh,”barSinNewHigh”);

AddColumn(dd1,”dd1″);

AddColumn(dd2,”dd2″);

AddColumn(ddSort,”ddSort”);

AddColumn(barsToMdd,”barsToMdd”);

AddColumn(IIf(dd1==1, Ref(dn, -barsToMdd), 0), “DN MDD”);

AddColumn(BarIndex(), “Bar Index”, 1.0);

}Code: -

AuthorPosts

- You must be logged in to reply to this topic.