Home › Forums › Trading System Mentor Course Community › AmiBroker Coding and AFL › Grrr…Idea’s Needed

- This topic is empty.

-

AuthorPosts

-

October 17, 2020 at 8:06 am #102057

Nick Radge

KeymasterSo I’ve got two great short side MOC systems that are very different, but even so there is too many duplicate entries.

I’ve tried many variants of ranking, different universes across the two but still can’t find a balance.

Looking for some inspiration…

October 17, 2020 at 9:14 am #112343GlenPeake

ParticipantCould you merge/code the 2 systems into 1 system/AFL code, that way when you rank the setups, no duplicates?

October 17, 2020 at 9:07 pm #112346Nick Radge

KeymasterYes – I thought of that during the night. Thanks – I’ll give it a crack.

October 17, 2020 at 9:56 pm #112344ScottMcNab

ParticipantMy MOC short merges two systems into one but I did that because I had to in order to reach a cagr that made it worth the effort to trade..if I had two great systems it would be good to keep them separate if possible. One way (which probably wont work

) would be to pick a variable and make it a condition in system 1 for the variable to be above X and the same condition in system 2 needs to be below X

) would be to pick a variable and make it a condition in system 1 for the variable to be above X and the same condition in system 2 needs to be below X

eg

above/below MA

rstrength

HV

recent HV/ past HV

HV/ Index HV

Close

ROC

Ideally it wont impact cagr much but will just allow a neat division of trades (yeah..I don’t really believe it either, even as I type it, but sometimes things test out differently)When that fails, another test that may be worth trying is making one system a MRV with very short stale exit (2 or 3 days) ? It would reduce trade replication somewhat and add a bit of diversification at the cost of slightly higher maxDD

October 17, 2020 at 11:17 pm #112347Nick Radge

KeymasterThanks Scott. I did give that a brief go yesterday but thinking more about it there is scope to adjust other parameters.

October 18, 2020 at 1:24 am #112348TrentRothall

ParticipantSome thing that might be out of left field and might not work but separating them by price. ie one trades C < 75 the other > 75

October 18, 2020 at 3:14 am #112349Nick Radge

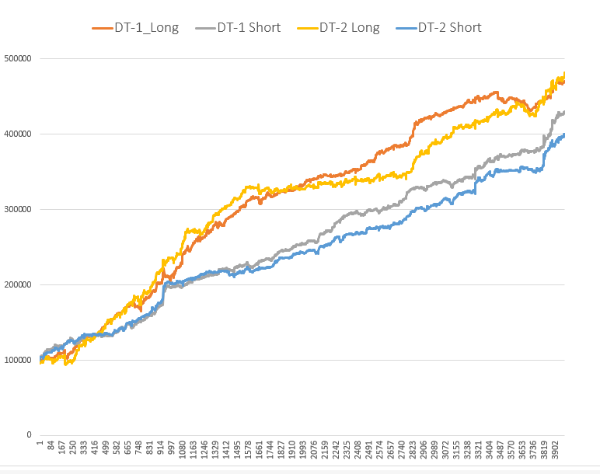

Keymaster2 long short systems combined equity growth each allocated $100,000.

CAGR 52%

maxDD: -14.5%Long side clearly the better performers mainly due to a wider stretch on the short side.

October 18, 2020 at 4:06 am #112350

October 18, 2020 at 4:06 am #112350TrentRothall

ParticipantNice, looking good! 40 positions each?

October 18, 2020 at 4:45 am #112351Nick Radge

KeymasterDT-1 Long is only 20 positions.

October 18, 2020 at 5:17 am #112352Nick Radge

KeymasterWell, just did more checking of ranking and too many double ups back last few years.

Might just combine signals instead.

October 18, 2020 at 7:41 am #112353Nick Radge

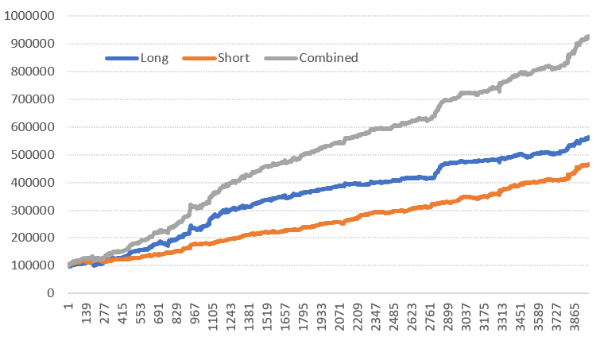

KeymasterSo here’s the system performance using dual signals. The long signals are the exact opposite of the shorts.

Non-compounded CAGR of 15.2% with maxDD of 16%

October 18, 2020 at 10:26 pm #112354

October 18, 2020 at 10:26 pm #112354ScottMcNab

ParticipantNick Radge wrote:The long signals are the exact opposite of the shorts.Very interesting…what was the thinking behind testing that idea Nick ? Seems logical for a trend following futures (commodity/currency ) system but I had not thought to try it on stocks….obviously works

October 19, 2020 at 12:09 am #112355TerryDunne

ParticipantHi Nick,

Nice results! Looks fantastic and really supports the idea of the benefits of diversification.

In real life, would you be concerned that some of the best shorts can’t be traded because the stock was unavailable to borrow? I can’t remember who, but one of the group had exactly that happen last week – a big winning short that wasn’t filled due to unavailability?

Or the example you often give of being legally prevented from shorting during the GFC?

To me, this also complicates the reliability/usefulness of back testing results.

The other concern I have with shorting is that when you are long, price can only go to zero, so if you have a $10k position you lose $10K. But when you’re short, price could go to $1,000.000,000,000. I know that this is impossible but take a few zeros off and it seems to me that the likelihood moves from impossible to improbable.

Imagine shorting a stock with a high RSI (or whatever your measure of choice) that stretches higher the next day so your limit is hit. Of course, the reason the RSI is high and the stretch has been met is that people are buying. In this particular instance, there is good reason why people are buying as the company you’ve just shorted announces a cure for epilepsy/Covid19/cancer/erectile disfunction. I would expect that the $100k/$200k I could lose in one day would cause me permanent erectile disfunction.

I understand that this might be paranoia, but just because I’m paranoid doesn’t make me wrong.

I’m really interested in opinions on this, both from those who are shorting and those who aren’t…

Kind regards,

Terry

October 19, 2020 at 1:40 am #112357Anonymous

InactiveThe way I prevent the duplication is simply run two universe in the two systems with a specific exclusion of the other. I run both my long and short on both RUI and RUT separately (so a total of four running systems) however when I build, test and also run the systems in real time I specifically exclude the larger cap index from the smaller cap index via the filter.

So for the RUI systems I just run the filter as Include RUI and Exclude anything of the small handful of things on my exclude list (like different class of shares for same symbol etc.).

Then for RUT systems I use Include RUT and Exclude RUI + SPX + NDX + Exclude List. I have made an Exclude list which bundles all these together. This ensures in the RUT system I do only get symbols that live in the RUT only and not those that may also appear in the RUI, SPX, NDX etc.

In live trade I never get any duplicate signals across the two universes.

October 19, 2020 at 3:11 am #112356Nick Radge

KeymasterQuote:Very interesting…what was the thinking behind testing that idea Nick ? Seems logical for a trend following futures (commodity/currency ) system but I had not thought to try it on stocks….obviously worksWell, one assumes that a robust strategy should, in theory, work in both directions. I have done the same for 4 of my systems and they all stand up nicely.

-

AuthorPosts

- You must be logged in to reply to this topic.