Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Group Collaboration System Ideas

- This topic is empty.

-

AuthorPosts

-

May 18, 2016 at 10:13 am #104034

SaidBitar

Memberanother thing you can run this strategy on S&P500 with this condition the average volume is 5M the results will not be much different

May 18, 2016 at 10:21 am #104030LeeDanello

ParticipantSaid Bitar wrote:Maurice Petterlin wrote:I definitely can’t keep up with Said. Way to quick for me. I’m on the slow burn.Oops sorry

Any how this group work I believe it has added value for all of us, I have some more ideas but I will wait for others to catch up or suggest some ideas

Don’t be sorry keep them coming. As Darryl Kerrigan from The Castle would say, “you can be the ideas man”

May 18, 2016 at 10:22 am #104035LeeDanello

ParticipantSaid Bitar wrote:another thing you can run this strategy on S&P500 with this condition the average volume is 5M the results will not be much differentWhat’s the main difference between the S&P and the Russell stocks?

May 18, 2016 at 10:24 am #104036May 18, 2016 at 10:46 am #103735TrentRothall

ParticipantIs this about where we are at guys? Am i on track.

May 18, 2016 at 11:08 am #104037LeeDanello

ParticipantTrent Rothall wrote:Is this about where we are at guys? Am i on track.That’s about what I’m getting after sorting some glitches

May 18, 2016 at 11:09 am #103736

May 18, 2016 at 11:09 am #103736TrentRothall

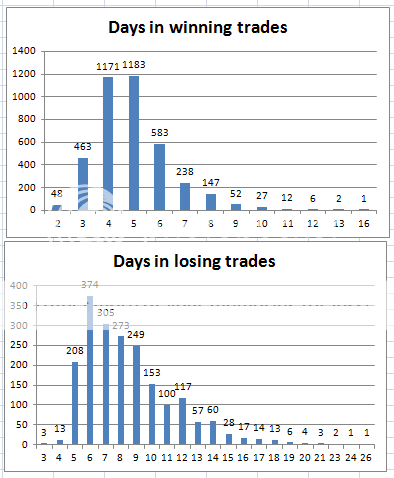

ParticipantOne improvement for comfort levels too i think is a ‘fail safe exit’. The ave win time is about 5 dys but ave loss time is about 9. Some can go much longer (see graph) If we set an exit at max 9-12 days wherever tests best it will help limit some large losses, plus trades longer than 10 days produce few winners. A trade off is one DD looks to last a bit longer. Nick pointed this out to me once before

This exits on the 9th day at open

May 18, 2016 at 7:48 pm #104038SaidBitar

Memberyes it decreases DD a bit, I tested with 8 days

this is why

May 21, 2016 at 7:55 am #104040

May 21, 2016 at 7:55 am #104040JulianCohen

ParticipantThis might be a little bit too much for me at the moment coding wise, but you guys might want to play around with this idea:

http://blog.alphaarchitect.com/2016/05/18/return-seasonalities-are-everywhere/#gs.LozC_Oo

May 21, 2016 at 11:58 am #103737Anonymous

InactiveThanks for this guys, it has been very valuable.

I did the coding (with a little use of cheat sheet from the posts, but mostly on my own and used to check, thanks :cheer: )

My results are quite different and it seems it could be from the price filter as my results include a lot of stocks with min price below $5.

I have the price filter condition in my buysetup and it is on. I tried eliminating the obvious things that could be wrong.I have used OpenInt as my price field and also tried Close (not correct but I tried it). When using close it eliminates stocks below $4? The max at $100 is fine.

Any ideas.

May 21, 2016 at 12:30 pm #103738Anonymous

InactiveMy post above can be ignored, the actual price at the time was above $5…after checking the OpinInt field in the data window. The price in the results is the adjusted price.

May 22, 2016 at 1:50 am #104042LeeDanello

ParticipantJulian Cohen wrote:This might be a little bit too much for me at the moment coding wise, but you guys might want to play around with this idea:http://blog.alphaarchitect.com/2016/05/18/return-seasonalities-are-everywhere/#gs.LozC_Oo

I wonder why these guys need to come up with complex mathematical equations to explain simple concepts?

So after trying to wade thru all the Greek symbols in the formulas, in plain English does the system say to compute the the one month ROC of all stocks in the index and buy the top 20. Next month sell those in the portfolio that are the weakest and replace with the strongest? So this a rotational system. If it’s so, it sounds similar to Clenow’s system. I’m probably completely wrong but I find it difficult reading stuff like this.

Can you provide a plain English set of rules for mathematical illiterates like myself?

May 22, 2016 at 7:28 am #104043JulianCohen

ParticipantI also had problems wading through the maths, in fact I didn’t ha ha. But I read it as they compared the ROC for January over the last 20 years, then Feb for the last 20 years then March etc etc…to give a kind of correlation matrix for each month over the last 20 years. They are then saying you can see a pattern that some months are bullish and some are bearish. That’s my reading of it but I’m open to corrections

May 22, 2016 at 10:31 am #104044LeeDanello

ParticipantSo only good for companies that have been around for 20 years?

I always thought it was better to invest in the smaller cap stocks to get bang for your buck

May 22, 2016 at 9:09 pm #104045Anonymous

Inactivesome modifications that seem to give small improvements. basically added ADX( 8 ) > 30 (from a previous post of Said’s) and few other changes to entry and bollinger stddev:

Code://=========================================================

// Paramaters

//=========================================================

// moving averages

longMALength = Param(“Long MA length”,100,50,200,10);

shortMALength = Param(“Short MA length”,5,50,200,10);

longMA = MA(C, longMALength);

shortMA = MA(C, shortMALength);// ATR and ADX setup

atrMultiplier = Param(“ATR multiplier”,1,0.5,2,0.1);

atrBuyLength = Param(“Buylimit ATR length”,10,5,30,1);

adxPeriod = Param(“ADX period”,8,8,30,2);

adxMin = Param(“ADX Min”, 30,20,60,5);// setup for bollinger bands

bolliPeriod = Param(“Bollinger Period”,5,5,100,5);

topBandStd = Param(“B-Band top”,2,1.0,3,0.2);

botBandStd = Param(“B-Band bot”,1,1.0,3,0.2);

bolliTop = BBandTop(C,bolliPeriod,topBandStd);

bolliBot = BBandBot(C,bolliPeriod,botBandStd);

bolliWidthMin = Param(“Bollinger width min”,3,1,7,1);

bolliWidth = ((bolliTop – bolliBot)/bolliBot)*100;//=========================================================

// Entry and Exit signals

//=========================================================

cond1 = C > longMA;

cond2 = L < bolliBot; cond3 = bolliWidth > bolliWidthMin;

cond4 = optionalFilter AND HDBFilter AND volFilter AND gapFilter;

cond5 = ADX(adxPeriod) > adxMin;

buySetup = cond1 AND cond2 AND cond3 AND cond4 AND cond5;

buyLimit = C – atrMultiplier*ATR(atrBuyLength);backtest dates:

01/01/2000 – 01/01/2016

-

AuthorPosts

- You must be logged in to reply to this topic.