Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Group Collaboration System Ideas

- This topic is empty.

-

AuthorPosts

-

May 18, 2016 at 7:16 am #104024

Stephen James

MemberOpenInt contains the unadjusted close price for stocks Julian. See Module 11 > Price Filters.

May 18, 2016 at 7:18 am #104025Stephen James

MemberApologies – misread your question Julian – but the answer is still in the course content with examples.

May 18, 2016 at 7:39 am #103730StephaneFima

ParticipantThe answer Craig gave me was the following: “Use OpenInt when backtesting if you have a price filter in play as that will give you the close price at the time of the buy signal, which may have been different to the current chart due to splits or other corporate actions“

May 18, 2016 at 7:39 am #104026JulianCohen

ParticipantI’ll go back and look it up. Thanks Craig

May 18, 2016 at 7:44 am #103731StephaneFima

ParticipantSaid,

In this system there is one rule which is BB width is greater than 5%. What is the interpretation of this?

As far as I understand BBands, if b% (i.e. the width) widens, it means that volatility increase and vice versa.

So, does the rule above implies that we want a minimum level of volatility to trade?May 18, 2016 at 7:54 am #104027SaidBitar

MemberJust to have some volatility because if there is no volatility then the price will be sideways and profits can’t be generated

You can play with it and you will see the effect

May 18, 2016 at 7:56 am #104028SaidBitar

MemberAnother idea is instead of close bellow the bb bottom use the low is bellow the bb from memory it gave more trades and better results but dd were more than what I like

May 18, 2016 at 8:01 am #103732StephaneFima

ParticipantThanks Said.

Did you already trade this system?May 18, 2016 at 8:12 am #104029SaidBitar

MemberNo

The reason is that there are many systems but not enough cash for all May 18, 2016 at 8:31 am #104022

May 18, 2016 at 8:31 am #104022SaidBitar

MemberMaurice Petterlin wrote:I definitely can’t keep up with Said. Way to quick for me. I’m on the slow burn.Oops sorry

Any how this group work I believe it has added value for all of us, I have some more ideas but I will wait for others to catch up or suggest some ideas

May 18, 2016 at 8:31 am #103733StephaneFima

Participant😆 😆

May 18, 2016 at 8:56 am #104031TrentRothall

ParticipantWow that escalated quickly, go away for the day and there is 45 new posts! after a quick gloss over i think we are all close?

Maybe to make sure everyone has the same results ensure this setting is set to 0 for testing purposes?

May 18, 2016 at 9:22 am #103734StephaneFima

ParticipantAll,

Playing around with the model, I see a potential problem with it:

– If we start with a 100K portfolio and a position size of 5% of the equity, we end up with positions in excess of 500K, which I think would be difficult to fill

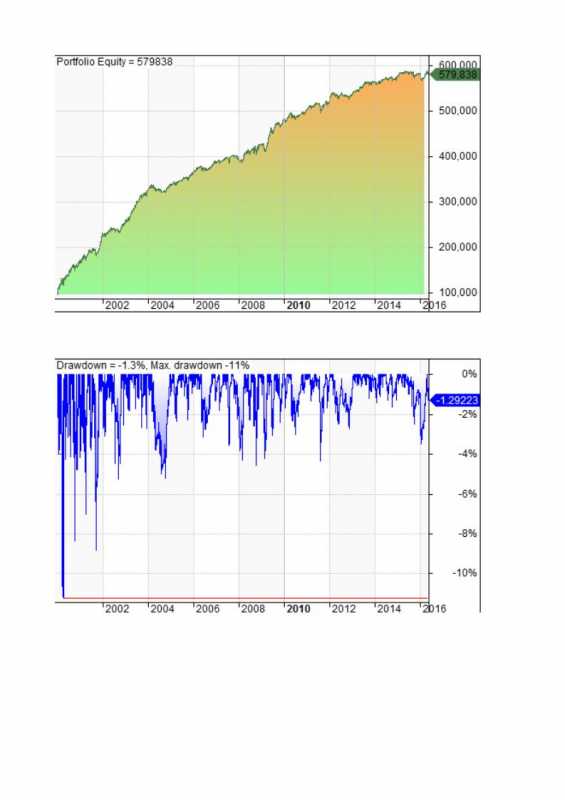

– However, if we start with a 100K portfolio but a fixed $5000 position size, obviously CAGR significantly decrease to around 11% (which is acceptable) and the DD is also signficantly reduced. Below are the graphs with these parameters.

What do you think?

May 18, 2016 at 9:33 am #104032

May 18, 2016 at 9:33 am #104032TrentRothall

ParticipantI don’t really see that as a issue or problem, if you end up with 500k positions you have done something right! In real life i dont think you would trade this system with $20m

for testing purposes i think it’s important to keep all things equal ie 5% positions, thats why i mentioned the setting above. Make sense? But once you’re happy with a system you could use that position size

That’s my opinion

May 18, 2016 at 10:04 am #104033SaidBitar

MemberI agree with Trent on this, because i can not imagine anyone can trade a system for 16 years without taking any profits out of it. Ideally you will be taking money out of the system to invest in new ideas. Another thing there are some ideas that can be traded on very liquid stocks that can handle this position size.

My opinion for now no need to worry about this, and as Nick said in the last conf call this problem can be dealt with when it occurs.

-

AuthorPosts

- You must be logged in to reply to this topic.