Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic has 380 replies, 2 voices, and was last updated 3 weeks, 6 days ago by

RichardKoziel.

-

AuthorPosts

-

March 2, 2020 at 10:03 am #108649

GlenPeake

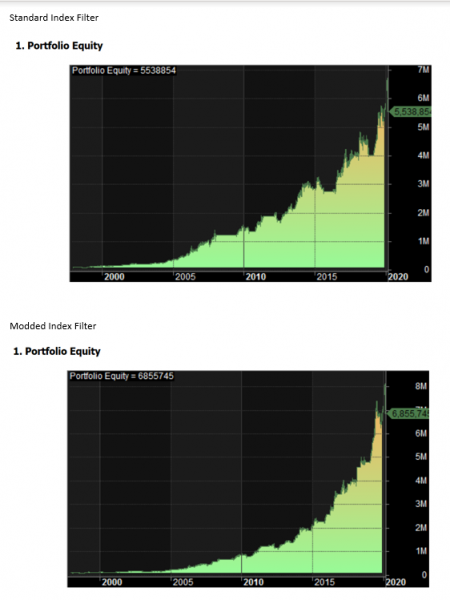

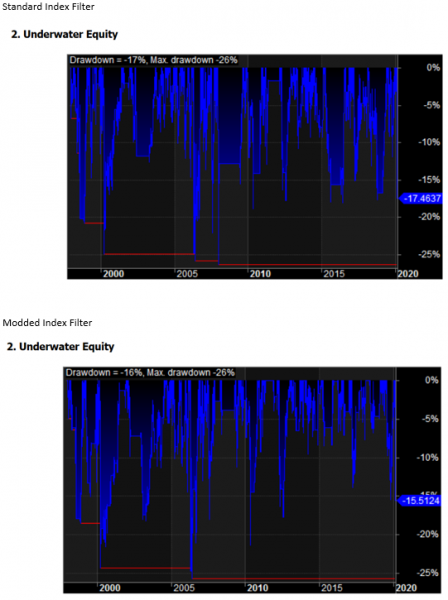

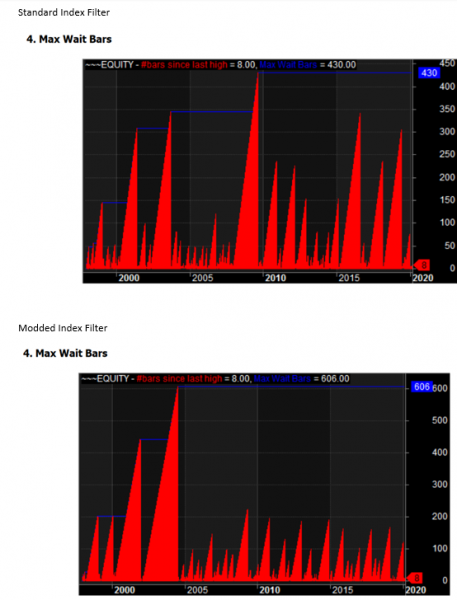

Participant1998- 2/3/2020 Comparison Standard vs Modded Index Filter

March 2, 2020 at 9:13 pm #111052

March 2, 2020 at 9:13 pm #111052Nick Radge

KeymasterJust a suggestion – rather than ‘attach’ the files, ‘insert’ them so they appear in the actual post.

March 2, 2020 at 10:03 pm #111053GlenPeake

ParticipantUpdated Nick.

I’ve left the original stats/charts files ‘attached’ so the reports can be opened for further reading etc.

Cheers

March 3, 2020 at 8:58 am #111055MichaelRodwell

MemberWhat’s the easiest way to insert files?

March 3, 2020 at 9:36 pm #111057Nick Radge

KeymasterUse the ‘insert’ function rather than the ‘attach’ function…

March 3, 2020 at 11:41 pm #111058Anonymous

InactiveI have found this usually works…

1. Go to Editor

2. Click ATTACHMENTS

3. Attach files.

4. Once files are attached, you will then have an INSERT button sitting below any of the attached files. Ensure your cursor is in the correct place within the message that you want to insert, then hit the INSERT button below the appropriate attachment.March 4, 2020 at 8:44 am #111059ScottMcNab

ParticipantNever seen rotational system with PF or Sharpe like this..or win rate…in a different league to mine…back to the drawing board for me..inspirational Glen

March 4, 2020 at 10:16 pm #111061GlenPeake

ParticipantCheers Scott.

I’ve been working my way through the trade list to confirm all is clean….. so far so good, so the figures look legit.

This system is essentially the same system as the rotational system I’ve been building for the NDX100. The main difference is the index filter…….

This index filter is based on Mike’s idea of the dual MA crossover on the index. I’m calling it the “Rodwell Regime Filter”

I had explored/tested the dual MA on the index in the NDX100 build, but didn’t see a benefit with it for my system (over the standard 200MA index filter).

When I cut the system over to the ASX100 to test robustness, initially the equity curve & DD was a bit ‘choppy’….. Nick suggested Mike’s approach, which I had already tried on the NDX100 & kind of disregarded it for the ASX100 build (I have no idea what Mike is using for his lookback periods etc), but I used his principal for the dual MA crossover and ‘searched’ for parameters that worked for my system…. and what you see in the reports is what come out

There were actually a few parameters, i.e. lookbacks (in the same ballpark) which appeared to work quite nicely (which is what you want from a robustness perspective).

So I guess the learning from my perspective is, just because I ‘tweak’ didn’t work on a system in one market, doesn’t mean the same tweak won’t work on the same system in another market.

Interestingly, using the “Rodwell Regime Filter” on the ASX100, if I were trading the system live ‘today’…. the index filter would still be UP/Green status, which means I’d still be invested in the market during this month of MARCH. On the flip side, I would’ve been out of the market at the end of September 2018 and would’ve been in ‘cash’ at the start of OCT during the OCT 2018 downturn. Probably a bit ‘recency bias’, looking back at these time periods, but it’s a process of getting an understanding/feel of how this index filter operates etc.

Cheers

March 5, 2020 at 2:06 am #111063MichaelRodwell

MemberLOL… might be a bit of a stretch taking naming rights for a MA cross over (but I’ll have it!)

A little bit of a white knuckle ride at the moment while a lot of momentum systems are switched off… may be this bounce will continue.

Re: your recency bias, yeah, my system skipped a lot of the carnage other experience back in Sept/ Oct but it relies on a bounce happening so it could get caught out. If the market chops around here for a while my MA’s will tighten right up and be sensitive to a downward movement (ie, switch the system off sooner rather than later).

In this image:

1. V shape sell off is no dramas

Then the market chops around and my MA’s tighten up

2. a few down days and its out…

March 5, 2020 at 2:42 am #111064GlenPeake

ParticipantI was seeing similar observations to yourself Mike in terms of the ‘flow’ of how the Filter operates. I like how it’s just ‘a little bit different’ to the standard 200MA filter….. but offers a different flow i.e. index filter UP/DOWN status etc.

(I also performed a quick test against my ASX WTT system with the “Rodwell Regime Filter”, so far nothing stands out…. but, I’ll take another look at some different settings as it’s a weekly system etc).

March 9, 2020 at 8:33 am #108650GlenPeake

ParticipantThought I’d list some of the resources I’ve used for my Rotational build(s), so that I and/or others can refer to it in the future….

I’ve also made a couple of ‘tweaks’ to my current ASX100 Rotation Build…..

* I’ve removed the indicator check on the stock for the ASX100 build. This indicator check worked/works very nicely on the NDX100 Rotation build…. but it was making very little difference on the ASX100 build (still active on the NDX100 build).

* In light of recent weeks….. I’ve added an Index ‘Kill Switch’ Filter… e.g. if the Index (XAO.au) drops X% over the past Y days, then the Index filter turns from GREEN to RED and we exit all positions @ the end of the month. Testing so far shows it doesn’t activate all that often (outside of the current Index Filter) but in times like we are seeing at the moment…. any rapid drops in the INDEX will see us exit if the Normal Index Filter lags at the end of the month. So in effect, I have the Dual MA Index Filter and the “Kill Switch” Index Filter working along side each other…. The “Kill Switch” Index Filter, provides a little more in the “comfort factor” stakes…

– Said’s Ranking with ROC/ATR combined.

https://edu.thechartist.com.au/Forum/trading-system-idea-s/262-said-s-ranking-method.html#4124– Multiple Momo ROC Combinations

– Low Vola MOMO

https://alvarezquanttrading.com/blog/low-volatility-stocks-20-cagr-portfolio/– Rotation Readers Ideas

https://alvarezquanttrading.com/blog/sp500-monthly-rotation-readers-ideas/– GTAA

https://forum.amibroker.com/t/gtaa-timing-model-rotational-strategy/4090– Technical Ranks

https://alvarezquanttrading.com/blog/stockcharts-technical-rank-sctr-rotation-strategy/– Nick’s MOMO Video….. It is a must view:

https://www.tradelongterm.com/relative-momentum-video/– Momo Weighting.

– 200MA Distance Code

Code://https://forum.amibroker.com/t/indicator-distance-between-ma-200-and-price/17608/2

//

// Distance from MA 200 Day

ma200 = MA(Close, 200);distancia = (Close-ma200)/Close * 100;

cero = IIf(Close >= ma200, colorGreen, colorRed);

Plot( distancia, “Distance From 200DAY MA”, cero, styleHistogram | styleThick, Null, Null, 0, 1, 5 );

Example of the 200MA Distance

March 9, 2020 at 8:51 am #111083

March 9, 2020 at 8:51 am #111083ScottMcNab

ParticipantGlen Peake wrote:* I’ve removed the indicator check on the stock for the ASX100 build. This indicator check worked/works very nicely on the NDX100 Rotation build…. but it was making very little difference on the ASX100 build (still active on the NDX100 build).2c worth

I have tended to leave these in …. my rotational systems, even when tested over longer time frames, do not have a huge number of trades…and if it has proven beneficial for one data set while not harming the other then I find it hard to conclude that it may not become useful in future years…March 9, 2020 at 10:52 am #111084GlenPeake

ParticipantScott McNab wrote:Glen Peake wrote:* I’ve removed the indicator check on the stock for the ASX100 build. This indicator check worked/works very nicely on the NDX100 Rotation build…. but it was making very little difference on the ASX100 build (still active on the NDX100 build).2c worth

I have tended to leave these in …. my rotational systems, even when tested over longer time frames, do not have a huge number of trades…and if it has proven beneficial for one data set while not harming the other then I find it hard to conclude that it may not become useful in future years…hhhhhmmm you might have a point there Scott… your 2c worth, warrants further review… as it does seem to weed out some of the stocks losing their MOMO… it may not make a huge difference in terms of ‘large’ chunks as on the NDX100….. but it’s the ‘one percenter’s (1%er’s) that can make a slight difference.

Thanks for the nudge….

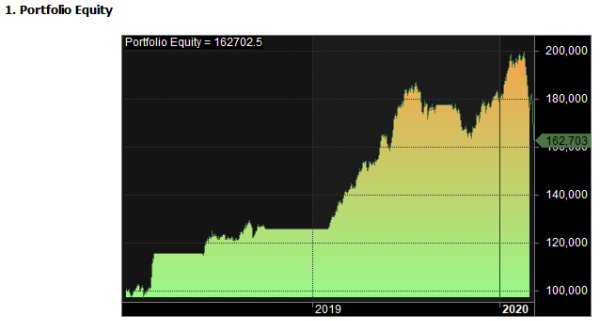

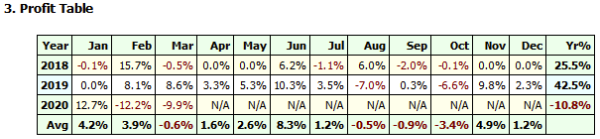

With Stock Filter:

Without Stock Filter:

March 9, 2020 at 10:54 am #111086

March 9, 2020 at 10:54 am #111086GlenPeake

ParticipantLet’s face it…. I’ll probably have at least a few months more of testing, before the INDEX Filter goes green again anyway

March 16, 2020 at 5:51 am #111087

March 16, 2020 at 5:51 am #111087GlenPeake

ParticipantCurrent status:

Thus far I’ve taken every BUY / SELL signal and have made no discretionary trades or tried to ‘pre-empt’ any future SELL orders and jumped ship early…. since all this started around 24/2/20.

The Weekend Trend Trader system is currently just 10% invested. Due to the extreme swiftness of the moves in the market…. trading weekly has, under these conditions meant my trialing stops have often been tagged at the start of the week and prices have continued lower etc…. This is where the Growth Portfolio has performed quite nicely in comparison, being a daily system.

Surprising, I’m still in profit since launching the WTT in Jan 2019…..barely… approx. -25% drawdown…. I guess I’m looking at it this way, I’ve been ‘playing with house money’ during recent times…. so we’ll chalk it up as ‘more experience’ and more ‘unseen data’ that can be used for further backtesting down the path.

In terms of my MR systems…. they’ve been holding up well…. ‘relatively’ speaking….. down a single digit % points so far this month for both….. but, it’s been an EXTREME ride…. I traded through the GFC period…. albeit, like a ‘rudderless yacht’…. but this market is a completely different beast.

In this current environment, when maintaining good health and keeping your immune system ‘UP’ is critical and in the interest of maintaining good health/well being & lower stress levels….. I’m taking some of the risk out of my 2x MR systems and will reduce the position sizing and will trade them @ 25% position sizing to what I’ve been trading @ thus far and will re-evaluate @ the end of month. Keep in my mind that, I’m not using leverage, just a cash account.

In other news, my employer this week is enforcing mandatory Work From Home (WFH)….. until at least April and will adjust accordingly to the events currently occurring.

Any and all thoughts/comments? All welcome

-

AuthorPosts

- You must be logged in to reply to this topic.