Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic has 380 replies, 2 voices, and was last updated 3 weeks, 6 days ago by

RichardKoziel.

-

AuthorPosts

-

February 21, 2020 at 9:35 am #108643

GlenPeake

ParticipantIntra month update:

Firstly, it was great to put a few faces to names in Sydney on Tuesday @ the lunch Nick put on, cheers Nick for orgainising!!

I’ve been back into the coding/research these last few weeks, trying to work on a monthly Rotational System, targeting the NASDAQ 100, that will also work on the ASX.

I’ve tried quite a few different bits and pieces from the simple to the more, ‘not so simple’, then back to simple. Sometimes you get an idea that is like an itch that needs to be scratched, so you have to test it out etc.

A sampling of some of the things I’ve been testing:

* Index/Regime Filter variations

– Using some of the Norgate indicators as a Filter e.g. “#DJI%MA200” (which shows the percent of stocks above there 200 Day MA), and other Breadth indicators.

– Adding up the number of days the Index Filter has been RED in a range of days for the month

– Using various indicators, both in isolation and combination, e.g. ADX, PDI MACD etc as Index filters.* Combing ranks via the use of StaticVarGenerateRanks()

Details here:

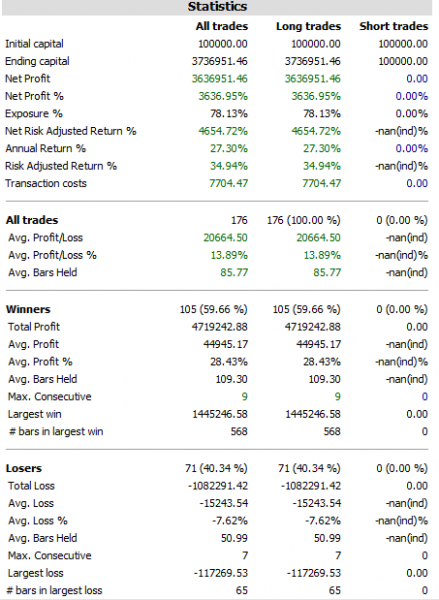

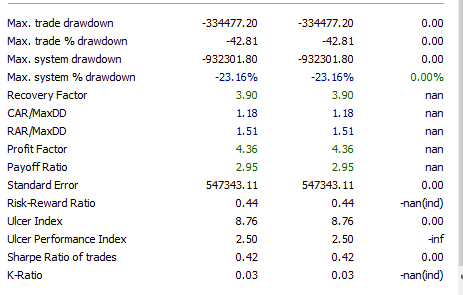

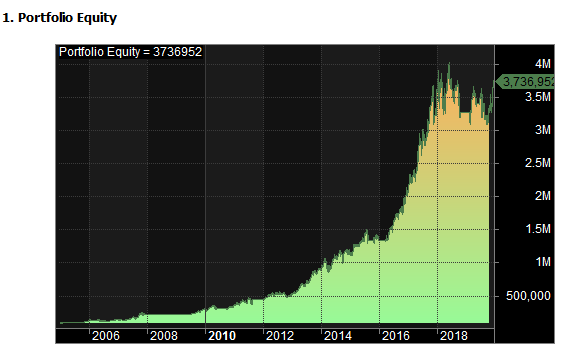

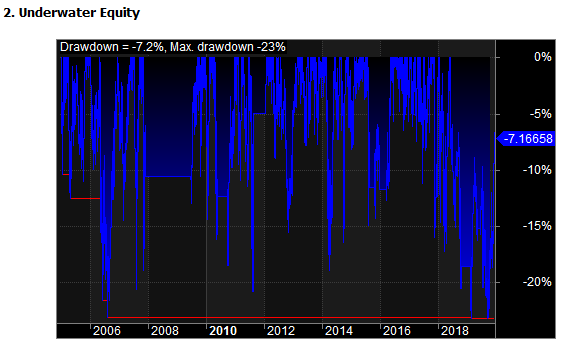

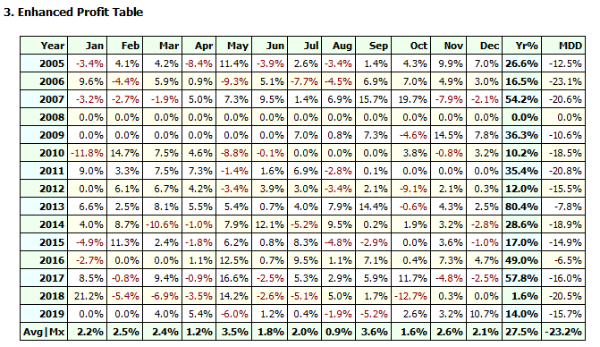

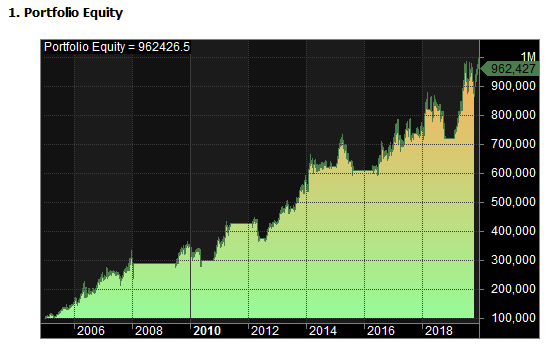

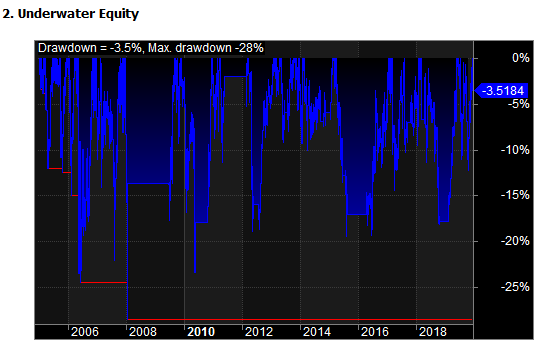

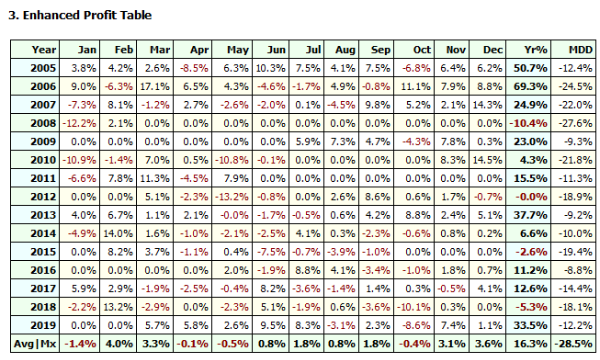

https://forum.amibroker.com/t/positionscore-using-combined-ranks/576/5So far, my stats for 1/1/2005 – 1/1/2020 on the NASDAQ 100 are

CAR: 27%

MDD: -23%Still a work in progress……

System is made up of a:

– Simple MA index filter

– Short/Long term ROC

– Stock MA filterSo only a few moving parts.

February 21, 2020 at 9:39 am #108644

February 21, 2020 at 9:39 am #108644GlenPeake

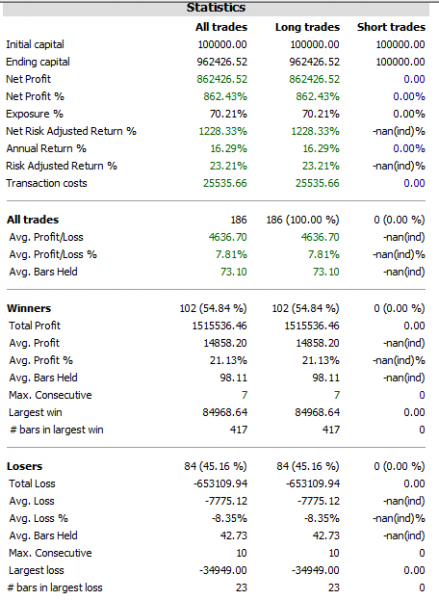

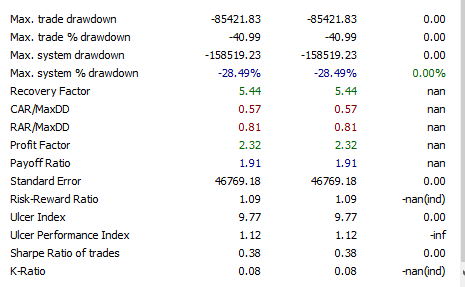

ParticipantNASDAQ100 Rotational Backtest reports continued.

February 21, 2020 at 9:41 am #108645

February 21, 2020 at 9:41 am #108645GlenPeake

ParticipantFor a Robustness comparison, here is the same system, with no changes except changing the index filter code over to the XAO.au, against the ASX100

February 21, 2020 at 9:43 am #110966

February 21, 2020 at 9:43 am #110966GlenPeake

ParticipantASX100 Rotational Backtest reports continued.

February 22, 2020 at 5:51 am #110967

February 22, 2020 at 5:51 am #110967Nick Radge

KeymasterGlen – did you add dividends into the ASX backtest?

February 22, 2020 at 7:46 am #110968GlenPeake

ParticipantHey Nick,

Nah, all backtests are excluding dividends….

February 22, 2020 at 11:06 pm #110969Nick Radge

KeymasterSo I would add the dividends in for the ASX. Half the index return in Australia is dividend driven, so you should see a decent bump in performance.

February 23, 2020 at 12:40 am #110965ScottMcNab

ParticipantNDX Profit Factor and Payoff ratio exceptional as is avg profit/loss %…very nice

February 23, 2020 at 4:59 am #110970GlenPeake

ParticipantNick Radge wrote:So I would add the dividends in for the ASX. Half the index return in Australia is dividend driven, so you should see a decent bump in performance.With dividends, adds approx 2.5% to CAR, CAR goes to 18.61% (up from 16.29%. While DD improves by approx 1%. Which adds up over the years……. what’s that saying….. “compounding, the 8th wonder of the world”.

Cheers

February 23, 2020 at 5:11 am #110971GlenPeake

ParticipantScott McNab wrote:NDX Profit Factor and Payoff ratio exceptional as is avg profit/loss %…very niceCheers Scott…

I still need to check the trades and make sure all is OK and doing what it’s suppose to and there’s no gremlins lurking around.

February 29, 2020 at 3:53 am #109265GlenPeake

ParticipantFebruary 2020 Stats

ASX WTT -11.57%US MR#1 +3.41%

US MR#2 -1.44%Last week the WTT system was up approx 3% for the month of FEB and @ new equity highs and sitting at 38.4% return since go live in JAN 2019.

One week later, @ 19.85% return since go live.The WTT is operating within parameters, i.e. drawdown is @ approx -15% from equity highs last week.

7 Sells to place for Monday’s open and will be 60% invested once they’ve been sold off. (Spring cleaning is several months early this year).

Top performers for the month: not much

Worse performers for the month: all stocks not mentioned above

…… There were several stocks down in the -30% range for the month….. but the one that takes the cake is PAR.au…. down approx -47% for the month.

…… There were several stocks down in the -30% range for the month….. but the one that takes the cake is PAR.au…. down approx -47% for the month.Both of the MR Systems were tracking to return in the 5-10% positive range for the month, but not to be. Amazed that MR#1 stayed in the green.

Development of the monthly rotational systems continues……

February 29, 2020 at 4:20 am #111031GlenPeake

ParticipantAlso, just to add that without the Mentoring Course, who knows where my head would be at when the market goes into these sorts of ‘downturns’….. so there’s comfort in following the process and sticking to it…… instead of going around and around in circles via the Beginners Cycle. :silly:

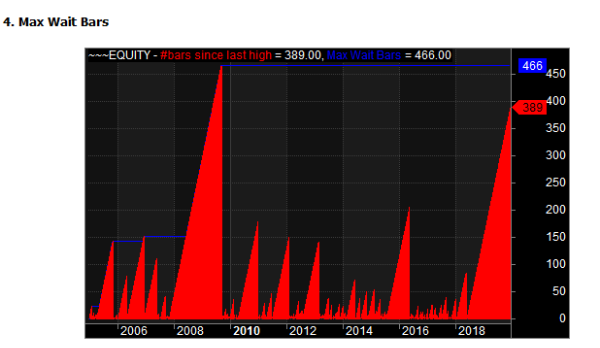

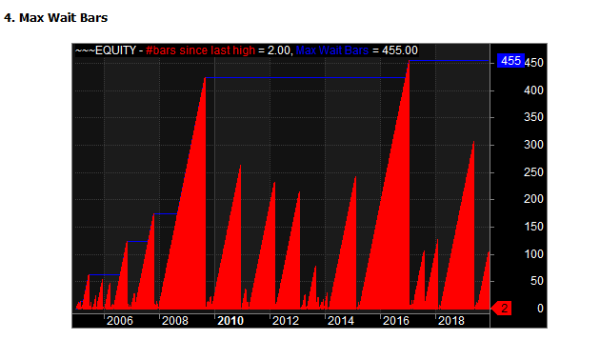

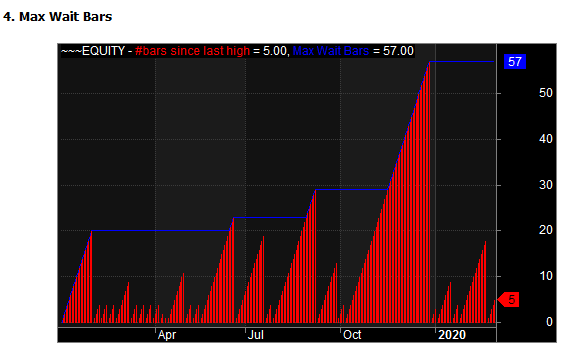

Just wanted to show a chart of the WTT system Max Wait Days to new equity highs…. Currently sitting @ 5 days…..

This is from 1/1/2019 to 28/2/2020

March 2, 2020 at 9:58 am #108646

March 2, 2020 at 9:58 am #108646GlenPeake

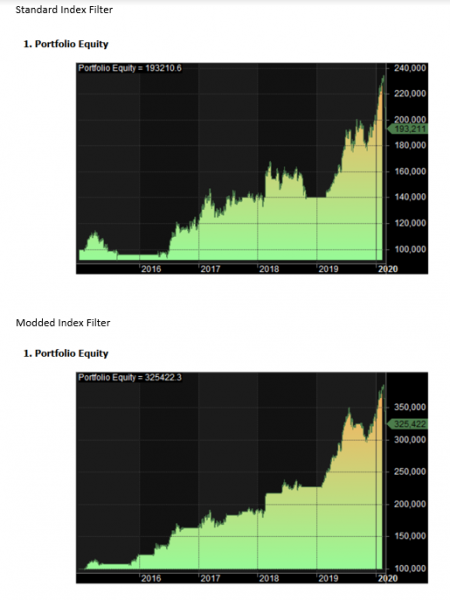

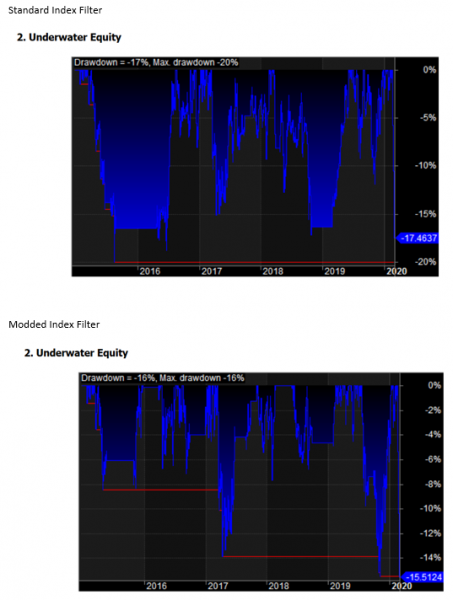

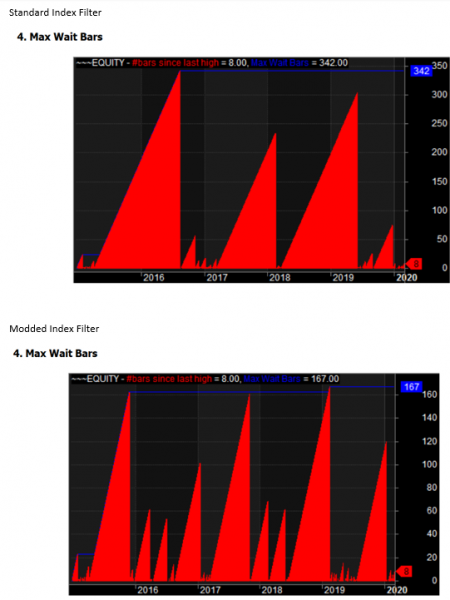

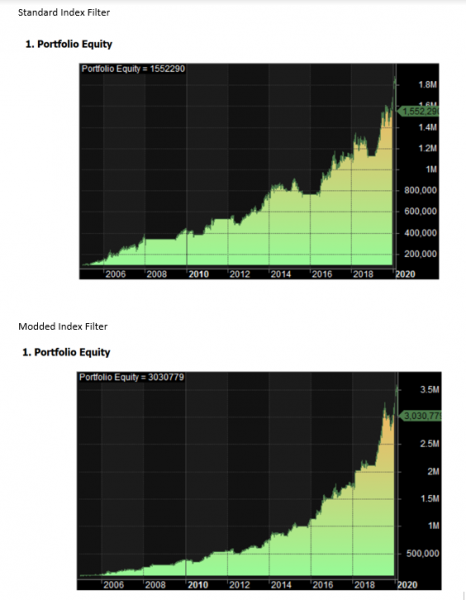

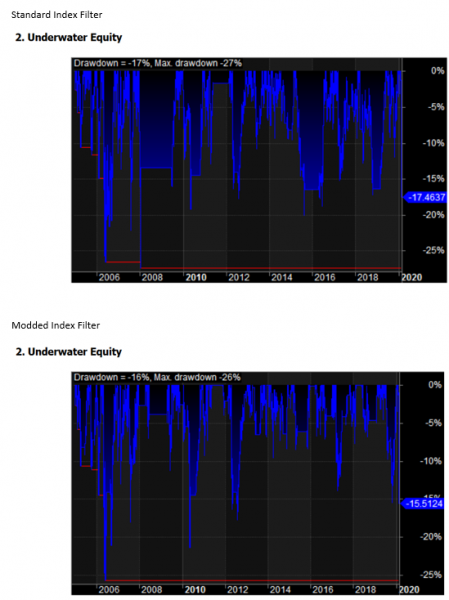

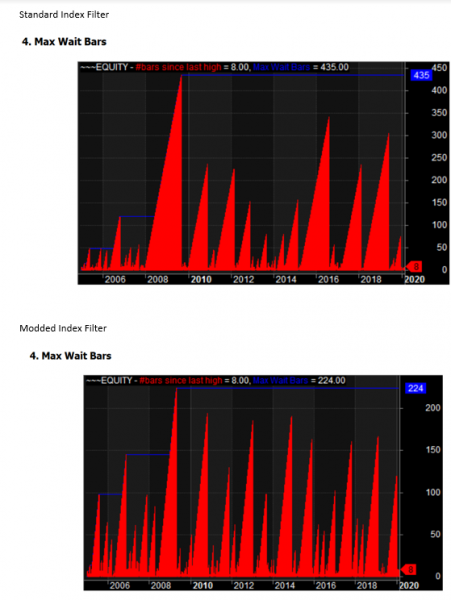

ParticipantASX100 Monthly Rotational Update:

Index Filter Mod

Courtesy of Mike’s Index Filter idea around the MA Crossover on the Index… Cheers Mike….

I’ve made a change on the index filter for the ASX100 Monthly Rotational Build.

I’ve seen improvements in consistency around drawdown, lowered exposure and MAX wait days stats e.g. over the past 15 years the MAX wait days was just 224 days.

In the next few posts I’ll post Backtest reports compare to the previous standard MA Index filter vs The ‘Modded’ Index Filter

1998 – 2/3/2020

2005 – 2/3/2020

2015 – 2/3/2020Still developing and testing, but the ‘Rodwell Modded’

Index Filter is looking like the way forward atm.

Index Filter is looking like the way forward atm.The below reports are run on the ASX100 with dividends.

March 2, 2020 at 10:01 am #108647GlenPeake

Participant2015 – 2/3/2020 Comparison Standard vs Modded Index Filter

March 2, 2020 at 10:02 am #108648

March 2, 2020 at 10:02 am #108648GlenPeake

Participant2005 – 2/3/2020 Comparison Standard vs Modded Index Filter

-

AuthorPosts

- You must be logged in to reply to this topic.