Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic has 380 replies, 2 voices, and was last updated 3 weeks, 4 days ago by

RichardKoziel.

-

AuthorPosts

-

August 9, 2019 at 10:16 am #110296

GlenPeake

ParticipantAMD…..That’s a sweet gap up!!!…Nice

I need to get back into the design of a monthly rotational system…. It’s on the to do list

It’s been a topsy turvy start to the month, a few of the mean reversion trades took their time to revert, but didn’t quite revert enough to turn a profit….

Oddly enough, my ASX WTT portfolio actually turned a profit of around 3% this week… which is super solid good going considering the XAO dropped 300 points through Monday / Tuesday. Credit to the GOLD stocks and ISX.au in the WTT portfolio which performed strongly this week. We’ll see how the rest of the month pans out.

August 31, 2019 at 6:30 am #108638GlenPeake

ParticipantAUGUST 2019 Stats

ASX WTT +4.34%

(The system is now up 32.72% year to date).US MR#1 +5.1%

US MR#2 -2.3%A solid month, especially when you factor in all of the volatility.

The Index filter on the WTT system switched off, so no new BUY signals for a little while and the stops have been tightened. The WTT system is currently 55% invested. As a result of the Index filter going into the RED a few sells this month, 3 of my GOLD stocks (RMS, RSG & SLR) generated SELL signals, which leaves 2 other Gold positions still being held, AQG & PRU.

ISX broke out and was the best WTT holding with a gain of +30.77% for the month.

NEA was the lagger and had a dip of -23.44% for the month and is within a whisker of the trailing stop.

The CVNA trade in MR#1 during August, made the month for me. My Index filter also went into the red for a few days during the month.

I’ve decided to turn off my MOC system, I’ll redirect the MOC funds in to the 2x MR systems and start researching a rotational system(s). I believe (testing to prove this), that I can make my cash work harder with less effort with a rotational system vs the ‘unleveraged’ MOC System. Having a monthly rotational system also means I’ll be diversifying system strategies i.e. 2x momentum systems and 2x mean reversion strategies.

Backtesting my MOC for August would’ve netted a -0.27% loss.

Glen

August 31, 2019 at 8:12 am #110333TrentRothall

ParticipantWTT is flying! Well done on that!

August 31, 2019 at 4:25 pm #110334TimothyStrickland

ParticipantNice results on the WTT!

October 1, 2019 at 10:34 am #108639GlenPeake

ParticipantSEPTEMBER 2019 Stats

ASX WTT +1.38%

(The system is now up 34.57% year to date).US MR#1 -1.17%

US MR#2 -4.17%New equity high’s for me intra month :woohoo: (albeit briefly)…. I haven’t seen these high’s since pre-GFC days, so it’s been a long, tough grind back into the black…. next 1000 trades

The index filter on the WTT system flicked back into the green, which resulted in 10 new positions being added to the portfolio, along with 3 Sells, I’m now 90% invested.

ISX.au, I’ve seen a few “familiar” tweets with the quote “Ride ’em UP not Down”

in reference to stocks that go up via the stairs and down via the escalator (window/fireman’s pole etc etc). ISX.au turned into a bit of a wild ride, but finally closed the position out with a 90% profit…. followed my system signals to perfection, so regardless of the % gain/loss, it was a successful trade.

in reference to stocks that go up via the stairs and down via the escalator (window/fireman’s pole etc etc). ISX.au turned into a bit of a wild ride, but finally closed the position out with a 90% profit…. followed my system signals to perfection, so regardless of the % gain/loss, it was a successful trade.Z1P.au broke out of a 5 month consolidation and added a tidy +26.67% for the month, the position is now up +183.54%.

The 2 US MR systems have been flat/negative for most of the year since going live, however, the ASX WTT has been hitch hiking/motoring along down the trend following highway nicely….so a thumbs up for diversification!!! :cheer:

All in all, things are moving along nicely.

October 1, 2019 at 8:47 pm #110442MichaelRodwell

MemberF-ing smashing it with that WTT. Nice work!

October 1, 2019 at 10:35 pm #110443GlenPeake

ParticipantCheers Mike. Thanks.

You never know when ‘Mr Market’ is going to be looking at you favourably, we just need to make sure to follow the process and keep pulling the trigger.

Who knows what the next 3 months will be like…… this time last year the market started going into hypo-volatility mode, so anything is possible.

October 2, 2019 at 6:34 am #110445TrentRothall

Participantnice Glen!

November 1, 2019 at 8:30 am #108640GlenPeake

ParticipantOCTOBER 2019 Stats

ASX WTT -1.91%

(The system is now up 32.06% year to date).

US MR#1 -9.76%

US MR#2 -0.70%Currently 100% invested with the WTT system.

The better performers where AQG.au and IFM.au which put on approx. 14% each for the month, on the flip side however Z1P.au triggered a SELL this week and will therefore be sold on Monday’s open (a bit of a wild ride for Z1P.au this month). Z1P.au has been a strong performer in the portfolio and will bank approx. 131% profit on Monday once sold.

The MR#1 system took a hit this month…. It seems I managed to take positions in stocks which announced poor earnings and these positions continued to drop further after triggering….tough to recover from when that happens….. Oh well, no dramas reset for November

November 30, 2019 at 3:41 am #110519GlenPeake

ParticipantNOVEMBER 2019 Stats

ASX WTT +2.39%

(The system is now up 35.30% year to date….. can we crack the 40% for the year???)

US MR#1 +0.76%

US MR#2 +3.20%Currently 95% invested with the WTT system.

The strong performers this month were CAT.au & PAR.au, up 24% and 26% respectively. AQG also gets a mention and has been moving along nicely in the portfolio all year, up a tidy +161%.

I had 4 stocks which were down -10% or more this month, with WAF.au being the biggest loser, down -23% for the month, which also tagged the trailing stop during the week and will be sold on the next open.

December 4, 2019 at 6:08 am #110622TrentRothall

ParticipantHi Glen in regards to your WTT does the system only buy after the initial breakout of the previous high (if all other conditions are met) or can it buy in the following weeks if initially the conditions are not met but they are after the price keeps rising? If that makes sense…

December 4, 2019 at 6:54 am #108641GlenPeake

ParticipantHey Trent,

Short answer is, BUY if the previous bar high (plus 1 tick) is breached in the following 1 week (the order will only live for 1 week).

Example of a triggered position.

So for my Z1P.au trade during the year, the entry trigger price was $1.63, Previous high was $1.625 (plus 1 tick, which was half a cent making $1.63).In the following week of trade, we traded above $1.625, so we entered the position.

Example of a stock where we don’t get on board.WSA.au on 13/9 triggered a buy setup. The high that week was $3.38…. therefore our entry/order/trigger will be $3.38 plus 1 tick = $3.39.

Price action never went above $3.38 in the following week, so our order is canceled after the market closes on 20/9.

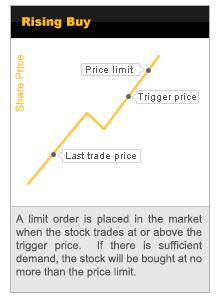

I use a ‘conditional’ order on another trading platform (not IB), to place my BUY orders. In the Commsec world it’s referred to as a ‘Rising Buy’

Hopefully I’ve explained it clearly enough… Let me know if have any other questions.

Cheers

January 1, 2020 at 1:31 am #110665GlenPeake

ParticipantDecember 2019 Stats

ASX WTT –0.99%

(No Santa Claus rally to finish the year off on an ‘uptick’……)The WTT system finished the year up 33.98%…

US MR#1 +5.19%

US MR#2 +1.20%Had you of offered me a gain for the year of circa 20% 12 months ago, I would’ve signed up for it…… so to bag almost 34% is especially nice. :cheer:

The WTT system is currently 70% invested.

Big Thanks to our mentors Nick & Craig for putting the Mentor Course together and delivering what is stated in the curriculum.

All the best for 2020!!

January 1, 2020 at 1:53 am #110714

January 1, 2020 at 1:53 am #110714Nick Radge

KeymasterNice one Glen. All the best for 2020.

February 1, 2020 at 2:19 am #108642GlenPeake

ParticipantJanuary 2020 Stats

ASX WTT -0.20%

US MR#1 +2.74%

US MR#2 -7.49%The WTT is currently 100% invested, but Monday’s open will see 3 positions unloaded.

The top performer in the WTT portfolio this month was MSB.au which put on 30.67% for the month.

The lag stock of the month was one of the stronger holding’s AQG.au, which gave back 16% for the month and will be sold on Monday’s open, currently sitting on an open profit of 121%.

The WTT portfolio hit new equity high’s intra month, but gave back a bit/all in the last week of January. It was a similar story for the 2 US MR systems.

During January I’ve been researching/testing a rotational system(s). Looking at NASDAQ 100, but also having a look at a rotational for the XAO. Still a work in progress atm.

-

AuthorPosts

- You must be logged in to reply to this topic.