Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic has 380 replies, 2 voices, and was last updated 3 weeks, 4 days ago by

RichardKoziel.

-

AuthorPosts

-

May 6, 2019 at 8:27 am #109995

GlenPeake

ParticipantI would say so Scott…

Unless you were selling a stock in the Group 1 10:00:00 am +/- 15 secs 0-9 and A-B, e.g. ANZ, BHP, then you could modify to suit on a case by case basis. Otherwise, 10:10 would be the default ‘safe’ time to allow any sells to complete etc.

https://www.asx.com.au/about/trading-hours.htm

Opening Phase

Opening takes place at 10:00 am Sydney time and lasts for about 10 minutes. ASX Trade calculates opening prices during this phase. Securities open in five groups, according to the starting letter of their ASX code:

Group 1 10:00:00 am +/- 15 secs 0-9 and A-B, e.g. ANZ, BHP

Group 2 10:02:15 am +/- 15 secs C-F, e.g. CPU, FXJ

Group 3 10:04:30 am +/- 15 secs G-M, e.g. GPT

Group 4 10:06:45 am +/- 15 secs N-R, e.g. QAN

Group 5 10:09:00 am +/- 15 secs S-Z, e.g. TLSThe time is randomly generated by ASX Trade and occurs up to 15 seconds on either side of the times given above, e.g. group 1 may open at any time between 9:59:45 am and 10:00:15 am.

May 7, 2019 at 10:55 am #109996#REF!McGrath

ParticipantHi Glen

Thanks for the suggestion for the added feature of the API. This will also help me with a similar situation I have been facing with my US momentum system as I have a cash account.

Can I ask how did you test that the orders were placed as expected. (sorry I’m new to API’s)

May 7, 2019 at 11:30 am #108631GlenPeake

ParticipantHi Gavin,

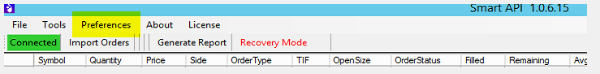

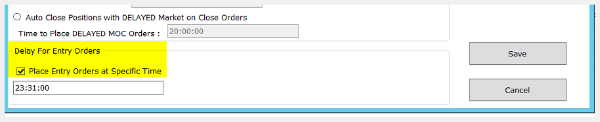

Essentially I opened the Smart API like normal (this was outside of market hours) @ around 18:30 (Sydney time)….. I went into the Preferences of the Smart API and down the bottom, TICK “Place Entry Orders at Specific Time”, enter the appropriate time e.g. 23:31 and click SAVE.

Then IMPORT your orders like normal.

Then hit SEND and the API should hold your orders until the time you specified and then SEND @ the designated time.

May 7, 2019 at 10:24 pm #110001

May 7, 2019 at 10:24 pm #110001Nick Radge

KeymasterJust ensure that TWS is not timed to shut down between the time you place the orders and the market open.

I set my TWS shutdown to 8am AEST. That allows me to do my morning reconciliation. I then place my new orders later that day.

So for you Gavin, you need to ensure TWS isn’t set to shutdown to after 23:31:00

May 13, 2019 at 8:09 am #108632GlenPeake

ParticipantJust a follow up on the “Place Entry Orders at Specific Time” feature.

I’ve been using this option regularly since the change was added to the API. Everything is going smoothly and my orders are being sent at the specified time of 23:31.

Very beneficial and gets around those cash account limitation situations as quoted earlier.

Big Thumbs Up on this feature being added so quickly!!!

Thanks NickMay 21, 2019 at 8:42 pm #110011

Thanks NickMay 21, 2019 at 8:42 pm #110011#REF!McGrath

ParticipantHi Glen/Nick

When I used the API last night as a test I got the following error message “Error ID: 6 Error Code: 354 Error Message: You are trying to submit an order without having market data for this instrument.IB strongly recommends against this kind of blind trading which may result in erroneous or unexpected trades.Restriction is specified in Precautionary Settings of Global Configuration/Presets.” Is this just a warning message not an error?

After I send the order from the API & I go into TWS in the API tab the order is sitting there but with the blue Transmit button (do I need to hit transmit in TWS – I thought the orders were placed automatically?)

After 23.31 has passed the order is still sitting in TWS. The API is connected to TWS & TWS is not shutdown. Not sure why the order is not executing maybe I’ve missed something in the settings.

Any ideas?

May 21, 2019 at 8:53 pm #110033Nick Radge

KeymasterOpen TWS – Configure > API > Precautions > and tick “Bypass Order Precautions for API Orders” > Apply

May 22, 2019 at 8:54 pm #110034#REF!McGrath

Participantthanks that worked. got a fill last night.

June 1, 2019 at 6:21 am #108633GlenPeake

ParticipantMAY 2019 Stats

US MOC +2.19%

US MR #1 -9.88%

US MR #2 -6.64%

ASX WTT -0.58%My first negative month this year for the WTT,nothing goes up in a straight line, so I was wondering when I was going to have a RED month for the WTT. Pre-Election performance the WTT was tracking +4% for the month, then Post-Election performance, turned negative.

I had 1 SELL for the WTT in the month, AMI.au, which was quickly replaced with ISX.au. So I’m again 100% invested.

The biggest positive mover for the month was RMS.au, which added 20.21%.

While TNE.au was the weakest link, dropping 22.94%

(Pleasantly) Surprised with the MOC performance this month…..

As has been discussed around the forum already, a few MR systems took some hits this month. My MR’s were not immune and also took some punches and low blows, namely QCOM, UBNT, HAIN, MPWR and overnight STZ decided to join the biggest loser party 😆

Cheers

GlenJune 29, 2019 at 5:33 am #108634GlenPeake

ParticipantJUNE 2019 Stats

US MOC -0.62%

US MR #1 +0.81%

US MR #2 +5.48%

ASX WTT +2.60%The WTT portfolio was somewhat quiet for the month, a bit of ebb and flow, but was helped along this month with the surge in the GOLD price, with SLR.au being the standout for the month adding 36.25%.

At the other end of the train, was RMS.au which got left behind pulling back 29.66% for the month. The RMS.au chart looked oh so pretty last month with the breakout through 0.90 and heading upwards towards $1….. but wasn’t to be.

Come 10am on Monday the WTT will be 85% invested, with another SELL order hitting the market for the month. I have a ‘Stale Exit’ option configured whereby if I’m holding a stock for ‘X’ number of bars/weeks and the current price is less than the Entry price, it gets the flick…. Kind of like a false breakout check/protection. I give the position enough time/wiggle room to get going in the right direction (UP), if it goes the other way, the clock is ticking and it’s sold so that capital can be reallocated to other stocks that are trending in the right direction. I had 3 such SELLs this month.

Glen

June 29, 2019 at 5:51 am #110155Nick Radge

KeymasterNice work Glen.

August 1, 2019 at 10:24 am #108635GlenPeake

ParticipantJULY 2019 Stats

US MOC -1.15%

US MR#1 -4.4%

US MR#2 +0.96%

ASX WTT +5.67%US systems took a hit late in the month (as others have also commented) which spoiled the GREEN party.

The ASX WTT keeps on trucking along nicely… currently up 26.96% year to date, which is really refreshing, bit of a change to the last few years (decade) etc.

The standout performing this month, was last month’s lucky loser RMS.au which put in a solid effort up 28.22% for the month.

While MGX.au continues it’s correction. Looking at the chart here, it looks like it’s retreated in a A-B-C pattern down into the 50-61.8% region, so perhaps a bounce from this area is due.

I’m considering replacing my MOC with a rotational system. Access to margin being the Achilles heal for performance with the MOC. Something to look into anyway.

Glen

August 1, 2019 at 10:34 am #108636GlenPeake

ParticipantMGX Chart

A-B-C correction down highlighted by the white lines.

August 9, 2019 at 7:49 am #108637

August 9, 2019 at 7:49 am #108637GlenPeake

ParticipantNice to catch 1 of these trades that goes the other way for a change. 😆 :woohoo:

(This is from MR system #1…. Position will be closed on the OPEN, tonight).

CVNA

August 9, 2019 at 9:35 am #110295

August 9, 2019 at 9:35 am #110295MichaelRodwell

MemberThat’s a beautiful thing.

I caught $AMD in my monthly momentum system which popped 15% yesterday.

-

AuthorPosts

- You must be logged in to reply to this topic.