Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic has 380 replies, 2 voices, and was last updated 3 weeks, 4 days ago by

RichardKoziel.

-

AuthorPosts

-

March 30, 2019 at 3:54 am #108628

GlenPeake

ParticipantMarch 2019 Stats

US MOC – 2.48%

US MRV #1 – 4.24%

ASX WTT +4.69%The ASX WTT is now 95% invested, I’m holding approx. 6 gold stocks and a couple of iron ore stocks, plus other randoms etc, but GOLD is definitely the dominant holding in the portfolio atm.

I would say at least 50% of my holdings in my ASX WTT are stocks that the Growth Portfolio has also triggered BUY signals for, the timings for the BUY signals might be slightly different, but considering both are trend following systems, probably no surprises that there is some correlation of signals….which is nice.

Biggest gainer for the ASX WTT portfolio was MGX which added +18.28% for the month.

Biggest loser for the ASX WTT portfolio was IFM which dropped -15.41% for the month. (Entered the position on 15/3)

My MRV #2 system, backtested returns for March of +3.14%, I plan on going live with this system next week.

For April, I want to take another look at my MOC system and try to improve the returns. Trading it with NO MARGIN is….mediocre at best……around 11% CAR over the last 10 years.

Glen

May 1, 2019 at 9:07 am #109886GlenPeake

ParticipantAPRIL 2019 Stats

US MOC -5.84%

US MR #1 +0.69%

US MR #2 -0.01%

ASX WTT +5.93%Since going live with my ‘tweaked WTT’ code at the start of this year, my ASX WTT portfolio is now up 15.74% (YTD). The overall market is obviously favourable.

However when you consider the volatility of the market(s) during the last quarter of 2018, as a systematic trader, we follow our systems/signals and pull the trigger…… as a discretionary trader, could they continue to pull the trigger into 2019 with the volatility of OCT/NOV/DEC 2018 behind them….? If I was a discretionary trader, I’m not sure I could have continued to pull the trigger into 2019 and therefore would’ve missed the boat over the past 4 months.

The ASX WTT is now 100% invested. Some volatility crept into some of the GOLD stocks I’m holding, but all good, I’ll continue to hold until the system says to sell.

The ‘Rock Star’ performer of the month for the ASX WTT portfolio was Z1P.au which added 44.12% for the month, the stock has gone parabolic over recent days/weeks.

The lag performer of the month (or as I now like to refer to them ‘best candidate for Mean Reversion trades’

) was AMI.au which retreated 19.46% for the month, previously in recent months this was one of my better performing holdings.

) was AMI.au which retreated 19.46% for the month, previously in recent months this was one of my better performing holdings.As discussed on Monday’s monthly mentor call, not having access to margin, I’m finding I run into margin issues when needing to sell MR positions and replace those positions with new BUY orders on the same day….. I’ve got some ideas around this, but will post further details/explanation over the coming days.

.May 2, 2019 at 11:14 pm #108629GlenPeake

ParticipantUPDATE: Running my Mean Reversion systems without margin and the margin issue I occasionally run into.

So just to outline my current situation, I’ll use the following basic example.

Let’s say I have $500 allocated for a MR system. The system will NOT have access to margin via IB and hold a maximum of 5 positions. Each position will be allocated 20% of the account, so $100 per position etc.

Let’s say I don’t have any open positions, I’ll place 5 BUY orders and lets say all 5 orders get fills on a Monday… I hold the positions overnight etc…

Then I get 2 SELL signals for the following trading session, (my system will SELL on the next day’s OPEN), I’ll place my 2 SELL orders which then means I can place 2 new BUY orders.

As I’m placing my orders outside of market hours (typically 20:00 Sydney time), as my 2 SELL orders haven’t yet been filled as the US market won’t open until 23:30 (Sydney time), when I then try to place my 2 new BUY orders, the IB system won’t allow me to place the 2 new BUY orders as all my cash is still fully in use/allocated to the 5 holdings and this would create a margin issue (IB doesn’t factor into the equation that I have 2 SELL orders in the system and the cash from the sale of these 2 positions would then go towards my 2 new BUY orders)… I would need an additional $200 in my account to allow the 2 new BUY orders to be placed outside of market hours etc.

So, this creates a situation where I want to maximise the use of the cash I have allocated to a system and not miss new BUY signals etc.

Current options:

1) Sit up until 23:30 each night and wait until my SELL orders get filled and then place my new BUY orders. (This is not really a great option for the long term…).

2) Automate it…..!!!!

Find a piece of software that allows for a MACRO to be created/recorded and can then be scheduled/automated to run. I.e. create a MACRO that will open the SMARTAPI (if necessary) and then Import/Send my MR orders to market after my SELL orders have be filled/executed i.e. schedule this task to run @ 23:31 Sydney time (09:31 New York time), that way all my SELL orders have already been filled on OPEN and my cash is available again. This could work Ok and I’ll start investigating.3) Put a request in for the SMARTAPI for a an option button along the lines of “SEND ORDERS AT A SPECIFIC TIME”…. i.e. instead of using the existing SEND button in the SMARTAPI, if I could Import my orders, but instead of SENDING my orders immediately, I could instead send at a custom time of my choosing etc. I.e. I could send the orders @ 23:31 (Sydney time) after my SELL orders have been filled etc. Probably the ideal option, but not sure how viable this option is atm, especially if this is a feature that only 1 person (me) would find useful etc.

Nick, your thoughts on option 3?

Let me know if you can think of any other ideas.

Thanks

GlenMay 2, 2019 at 11:59 pm #109951Stephen James

MemberGlen

If you can’t find an option as you have described you can use this setting to test MR systems as the cash account will allow.

SetOption(“SettlementDelay”,1);

Note the value is a day, not bar. More here for running a detailed log report:-

May 3, 2019 at 12:24 am #109952GlenPeake

ParticipantThanks Craig, I’ll keep that open as another option…. It would appear AmiBroker has an option for almost everything.

May 3, 2019 at 6:48 am #109953

May 3, 2019 at 6:48 am #109953Nick Radge

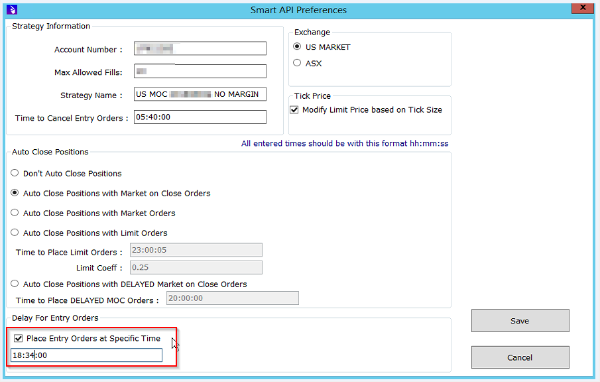

KeymasterQuote:Put a request in for the SMARTAPI for a an option button along the lines of “SEND ORDERS AT A SPECIFIC TIME”…. i.e. instead of using the existing SEND button in the SMARTAPI, if I could Import my orders, but instead of SENDING my orders immediately, I could instead send at a custom time of my choosing etc. I.e. I could send the orders @ 23:31 (Sydney time) after my SELL orders have been filled etc.I have spoken with the developer and he will add this feature in over the weekend.

May 3, 2019 at 7:49 am #109955GlenPeake

ParticipantNick Radge wrote:Quote:Put a request in for the SMARTAPI for a an option button along the lines of “SEND ORDERS AT A SPECIFIC TIME”…. i.e. instead of using the existing SEND button in the SMARTAPI, if I could Import my orders, but instead of SENDING my orders immediately, I could instead send at a custom time of my choosing etc. I.e. I could send the orders @ 23:31 (Sydney time) after my SELL orders have been filled etc.I have spoken with the developer and he will add this feature in over the weekend.

That’s awesome!!! Thanks very much Nick!!

May 3, 2019 at 8:24 am #109956Nick Radge

KeymasterWe’re here to please.

May 4, 2019 at 5:41 am #109957GlenPeake

ParticipantNick Radge wrote:We’re here to please.One pleased Mentor Student / Long Term Chartist subscriber here Nick

May 4, 2019 at 7:04 am #109967

May 4, 2019 at 7:04 am #109967Nick Radge

KeymasterThis new update has been made and will be sent through within the hour.

The API has two options; either you send the orders directly or the orders will be placed when the set time will be reached.

So the process is the same Import the trades ànd Send Orders.

If anyone has time can you please do a test over the weekend.

May 4, 2019 at 8:51 am #108630GlenPeake

ParticipantTested the “Place Entry Orders at Specific Time” option.

Looks good….!!!

FYR: The option can be enabled under the Smart API Preferences

Thanks again Nick!

May 5, 2019 at 12:33 pm #109970

May 5, 2019 at 12:33 pm #109970Anonymous

InactiveHi Glen, When you have a minute, I’m just interested to know how or why you are using this change to the API? Thanks!

May 6, 2019 at 1:30 am #109982JulianCohen

ParticipantDustin it is because he is running an account in Australia and they have stopped his margin. So if he wants to use all the funds in his account to run an MR system, then he can’t place a buy order for a new stock and a sell order for an old stock, as the system doesn’t recognise the sell orders will create cash that he will be using in order to buy. It just sees him trying to buy with funds that it doesn’t think he has available.

Therefore he needs the API to place the buy orders at 1 minute after the market opens, by which time his sell orders have been processed and the system sees that he has cash with which to potentially buy new stocks.

May 6, 2019 at 2:29 am #109991GlenPeake

ParticipantHi Dustin,

Exactly what Julian has outlined…..

Couldn’t have said it better myself Julian!!! Cheers.

May 6, 2019 at 8:16 am #109992ScottMcNab

Participant10:10 (AEST) for ASX ?

-

AuthorPosts

- You must be logged in to reply to this topic.