Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic has 380 replies, 2 voices, and was last updated 3 weeks, 6 days ago by

RichardKoziel.

-

AuthorPosts

-

February 24, 2019 at 11:04 pm #109715

LEONARDZIR

ParticipantGlen, Scott,

Thank you.

Scott will give your suggestions a try.February 28, 2019 at 9:29 am #108622GlenPeake

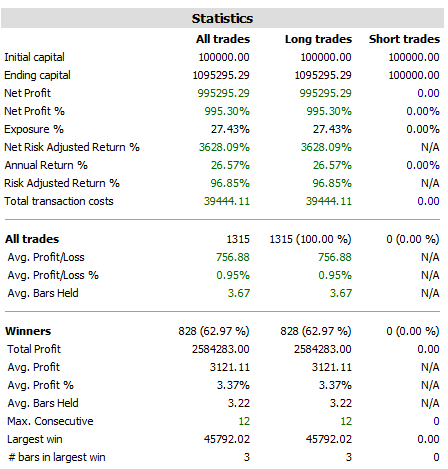

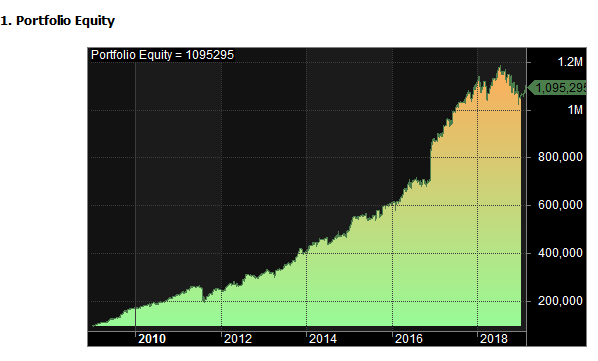

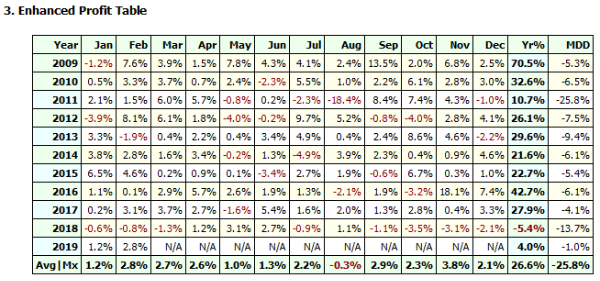

ParticipantAnother update on the MR/Swing system I posted about last week.

I went live with the system yesterday. I ended up using 5 positions @ 20%. So no margin.

I caught my first trade with it overnight!!! 😆

I’ll be using small position sizes for the next month, to triple check everything…. but from my previous backtests/explorations, stress tests and checks everything looked good.

Now that I’m running 2 API’s, I also want to make sure I put the correct trades into the correct API screen… So I’ll be allowing myself a few weeks to adjust to running 2x API’s and getting my ;send order’ routine together etc.

I’ve also being putting together another MR/Swing system (no margin)….. I haven’t spent too much time on it yet, so it still needs some work, but what I tried was to JUST change the entry technique(completely different entry technique) from the above system (MR system #1) and leave everything else the same…. so same MA filters, SellSetup, index filter…. no other changes apart from the entry.

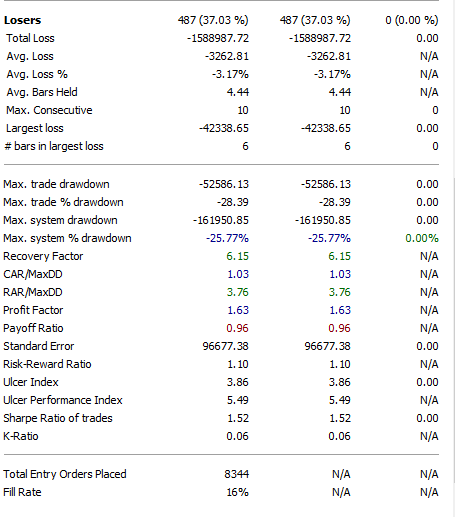

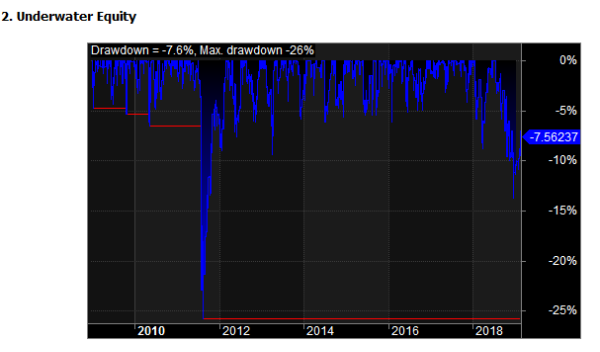

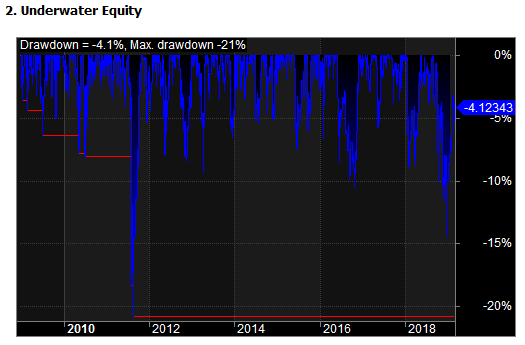

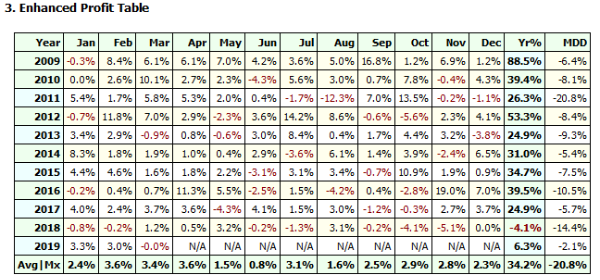

At first glance, what appeals to me about this system is the DD (for the most post) is less then -10%, with only 2 years where DD went beyond -10%. Sure DD is more then MR system #1, but I liked how consistent it ‘generally’ looked.

During the year 2014 this system (MR system #2) had a winning year, while MR system #1, had a losing year…..

Similarly in 2018, MR system #1 was a winning year, while MR system #2 had a losing year…..

So some nice diversification between the 2 systems.

So still some work to do…. but looks appealing.

March 1, 2019 at 7:25 am #108623

March 1, 2019 at 7:25 am #108623GlenPeake

ParticipantFebruary 2019 Stats

US MOC -0.40%

ASX WTT +2.54%Happy that the WTT is now up and running, went live with it at a time when the market started to pick up and the BUY signals started to pop up as well…..

I went live this week with a Mean Reversion system on the R1000, so next month I’ll be reporting on 3 systems! Diversification feels good!!! :cheer:

Nice to see a bit more green in the February stats posts from the other members. Well done!!

March 1, 2019 at 7:36 am #109734Nick Radge

KeymasterGreat result for the WTT Glen.

March 10, 2019 at 4:42 am #108624GlenPeake

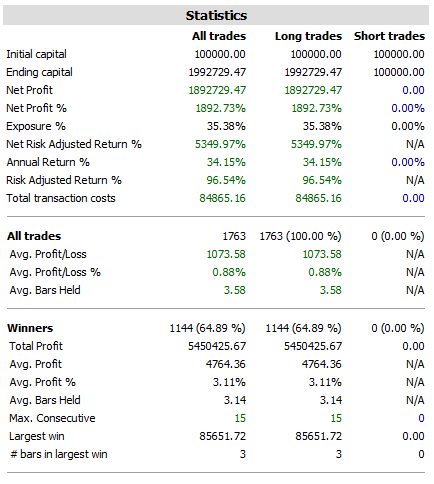

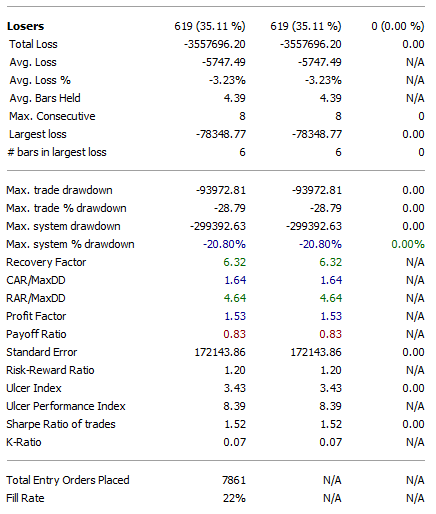

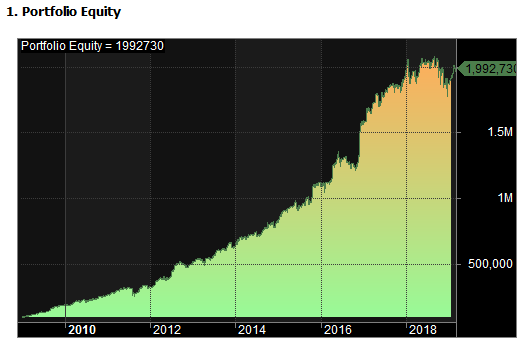

ParticipantUpdate on the progress development for MR System #2….again NO MARGIN being used.

March 10, 2019 at 5:07 am #109790

March 10, 2019 at 5:07 am #109790JulianCohen

ParticipantWith no leverage that is a really good result I’d say!

March 10, 2019 at 2:58 pm #108625LEONARDZIR

ParticipantGlen,

Agree those are outstanding results. I incorporated your adx filter with my MR system and it produced a very significant boost to my back tested results. Will see how it goes with real-time trading.

Thanks again for sharing,March 10, 2019 at 8:35 pm #109791SaidBitar

Participantvery nice results for no margin

March 11, 2019 at 4:13 am #108626JulianCohen

ParticipantNot sure if anyone has tried it, but I got a nicer result with my systems by adding Glen’s ADX idea to the existing MA(c,200) Index Filter.

March 11, 2019 at 4:29 am #109797Nick Radge

KeymasterUsing both? On which systems?

My short term MR systems don’t use an index filter.

March 11, 2019 at 5:00 am #109799JulianCohen

ParticipantI should have said my MR system. I haven’t tested it on the long term stuff yet.

My MR does use an Index Filter (my MOCs don’t)

“Index Filter”;

IndexTog = ParamToggle(“Index Filter”,”On|Off”,0);

SetForeign( “$SPX” );IndMA = Param(“Index Filter MA”,200,50,200,25);

IndexFilterUp = ADX(5) > 30 AND C > MA(C,IndMA);

IndexUp = IIf(IndexTog,1,IndexFilterUp);RestorePriceArrays();

March 11, 2019 at 7:12 am #109798GlenPeake

ParticipantJulian Cohen wrote:Not sure if anyone has tried it, but I got a nicer result with my systems by adding Glen’s ADX idea to the existing MA(c,200) Index Filter.Sweet.. Julian.

What about when you only use the ADX Index Filter only? I.e. turn off your “IndMA” Index Filter and only run the ADX Index Filter?

For my MOC/MR I run the ADX Index filter only…(no other Index Filter).

In terms of the longer term systems, I haven’t tested it…but, not sure if it would be beneficial.

I wanted to come up with some sort of filter that would get me into the market when volatility picked (either UP or DOWN) and be on sidelines on those days when the market was quiet… Just avoiding those days when the market was quiet, seemed to help the shorter term systems. I.e. it kept me on sidelines for a couple of days last week.

To provide an idea of just how many days you are on sidelines I.e. approx. 347 days out of the past 2562 trading days (calculated back to 1/1/2009) the ADX Index filter would have kept you on the sidelines i.e. no new trades placed on these days…

Also to clarify…. I do not use the ADX Index Filter as a ‘kill switch” to exit any existing open trades…I only use it as an entry mechanism i.e. for a multi day MR system….just let existing open positions close themselves out using whatever Sell Setup conditions configured.

I’d be keen to hear feedback if others have tested it and have seen a benefit or not….Hope it helps.

Cheers

March 11, 2019 at 7:15 am #109794GlenPeake

ParticipantLen Zir wrote:. I incorporated your adx filter with my MR system and it produced a very significant boost to my back tested results. Will see how it goes with real-time trading.

Thanks again for sharing,Awesome Len!! Thanks for the feedback!!! :cheer:

March 11, 2019 at 7:23 am #108627GlenPeake

ParticipantMR System #2 Comments:

For me MR system #2…. my results I posted CAR 34% and DD 20…. was a bit of an outlier…

Most of the other variations I’ve been testing/focusing in on were around 28%-32% CAR with around 24%-26% DD… which are still good going…

So the system that resulted in 34% CAR and 20% DD, was probably a result of too much optimization of the RANK & STRETCH…

So I’ll look to reel that back in to where most of the other variation backtests results were landing i.e. 28%-32% CAR with around 24%-26% DD, which should offer more flexibility for the future.

Thanks all for the feedback….

Cheers

GlenMarch 11, 2019 at 7:37 am #109802JulianCohen

ParticipantGlen Peake wrote:Julian Cohen wrote:Not sure if anyone has tried it, but I got a nicer result with my systems by adding Glen’s ADX idea to the existing MA(c,200) Index Filter.Sweet.. Julian.

What about when you only use the ADX Index Filter only? I.e. turn off your “IndMA” Index Filter and only run the ADX Index Filter?

Cheers

For me the ADX filter on it’s own didn’t improve things.

I just experimented with the Sector Filter on my MR though and that made a difference!

-

AuthorPosts

- You must be logged in to reply to this topic.