Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic has 380 replies, 2 voices, and was last updated 3 weeks, 4 days ago by

RichardKoziel.

-

AuthorPosts

-

January 1, 2019 at 3:45 am #108619

GlenPeake

ParticipantDecember 2018 Stats

US MOC: +7.76%

***NOTE:

Margin was removed by IB halfway through the month (account migrated to IB AUS) and it took a few working days to sort out a couple of post migration items, as a result I missed a couple of trading days. Surprisingly the trading days I missed would’ve been negative down days for the system.First half of the month traded with MARGIN (upto 14/12), second half of the month traded with NO MARGIN.

(Backtested Returns for the entire month for both MARGIN/NO MARGIN system: For comparison)

Complete month NO MARGIN +6.29%

Complete month with MARGIN -2.67%February 1, 2019 at 7:02 am #108620GlenPeake

ParticipantJanuary 2019 Stats

US MOC +0,85%

February 3, 2019 at 10:22 pm #109591GlenPeake

ParticipantJust a quick update.

I’ve going live with my ‘tweaked’ version of the Weekend Trend Trader (WTT) on the ASX today.

I have 4 ‘new’ orders/signals pending.

I’m using the Selection Bias Code.

In addition to the 4 ‘new’ orders/signals, I need to place a couple of additional orders for existing positions, so that way my ‘live’ positions held, will align with the backtested positions held etc. i.e. Zero Selection Bias.

February 23, 2019 at 4:17 am #108621GlenPeake

ParticipantUpdate on current status.

ASX Weekend Trend Trader is ticking along nicely…. currently 65% invested….

As I’ve been trading Nick’s turnkey WTT code for for a while, I held existing WTT positions when starting up my ‘tweaked’ version of the WTT code. So I’m still holding a few of the ‘old’ WTT code positions that don’t appear in the ‘open position’ version of my tweaked WTT code…. so a little bit of a transition still talking place in that regard…I was already holding some of the open/existing positions that showed up in my tweaked WTT code, so no action required in that regard, but to keep holding…easy peasy….

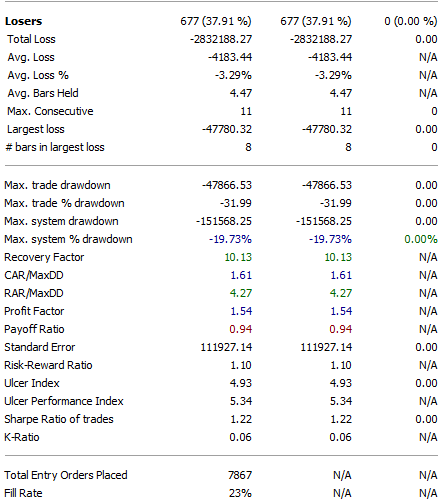

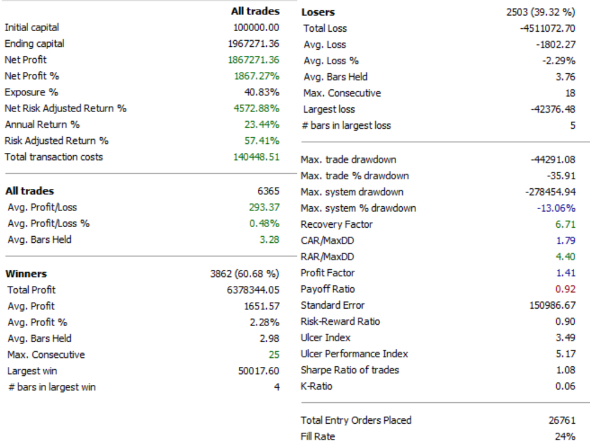

MOC….update…. hhmm pretty quiet…. with the restriction around margin by IB now and having to trade without margin…. the backtest stats aren’t setting off fireworks… CAGR 11% DD -6%… using 10 positions @ 10%.

On the back of the MOC status and in a bid to diversify…. I’ve been testing a Mean Reversion swing system (no margin)…. Still a work in progress, but stats look encouraging.

February 23, 2019 at 7:31 am #109689

February 23, 2019 at 7:31 am #109689Nick Radge

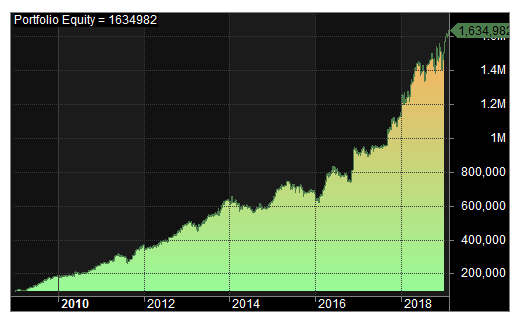

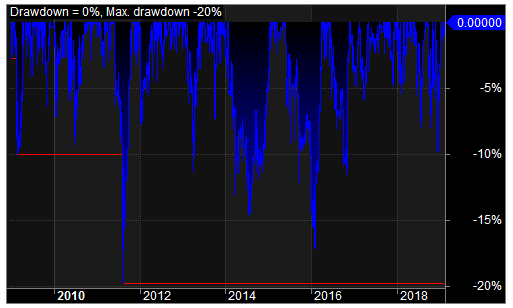

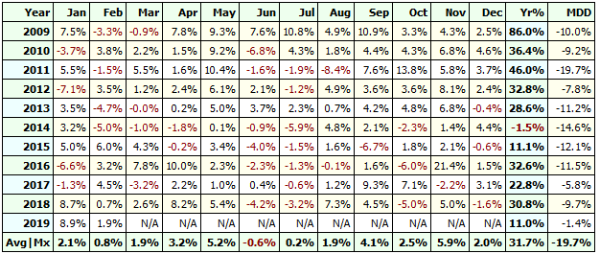

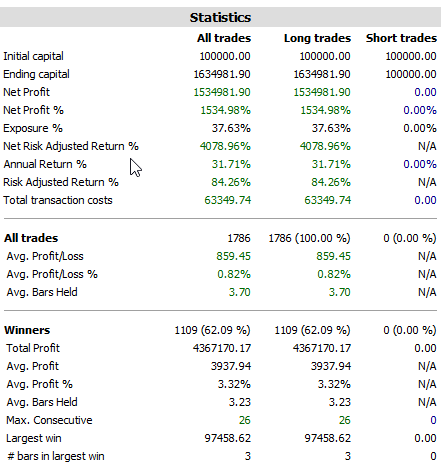

KeymasterWow. Those stats look mighty impressive for no margin!

Here’s my HFT using 10 positions at 10%.

February 23, 2019 at 11:06 am #109692

February 23, 2019 at 11:06 am #109692GlenPeake

ParticipantCheers Nick.

Nice to know I’m in the right ballpark…numbers wise.

Not having access to margin for the shorter term systems is a bummer, but gotta roll with the punches.

February 23, 2019 at 1:10 pm #109690LEONARDZIR

ParticipantGlen,

Those are great numbers. It looks like you tested trading through Dec 2018-Jan2019. Are you not using an index filter?February 23, 2019 at 9:33 pm #109694GlenPeake

ParticipantLen Zir wrote:Glen,

Those are great numbers. It looks like you tested trading through Dec 2018-Jan2019. Are you not using an index filter?Hi Len,

Yes, I use an index filter…. however it’s not based on the standard 200MA…it’s based on trend strength…. i.e. ADX. I find it helps keep you out of the market when things are quiet and gets you in when volatility picks up/strength. Increases CAR and reduces DD.

Test it out on your MOC/MR systems and see if it improves things….

///////////////

_SECTION_BEGIN (“ADX Index Indicator Filter”);

//=================================================================================

// Index Filter 4

//=================================================================================

IndexIndTog4 = ParamToggle(“ADX Index Indicator Filter”,”Off|On”,1);

SetForeign( “$SPX” );

IndADXPeriod4 = Param(“Index ADX Indicator Period”,5,1,300,1);

IndADX4 = Param(“Index ADX Indicator Filter”,25,5,80,5);

ForeignADX = ADX(IndADXPeriod4);

IndexIndFilterTrig4 = ForeignADX > IndADX4;

IndexADXInd4On = IIf(IndexIndTog4,IndexIndFilterTrig4,1);

RestorePriceArrays();

_SECTION_END();

///////////////////////////////////////////////////////

IndicatorGroupFilters = IndexADXInd4On;////////////////////////////////////////////////////////////

February 23, 2019 at 9:59 pm #109691ScottMcNab

ParticipantWhat market Glen ? If it is R1000 or SPX then might be worth testing on R2000 as well? I run MRV systems on RUI and RUT separately (same code) as a way of dealing with the different liquidity between the stocks in each index..have 2/3 of US MRV funds allocated to RUI and 1/3 to RUT …..but RUT is still trading same amount as my ASX MRV and has had fewer partial fills than ASX system (although has been minimal in both really)

February 23, 2019 at 11:57 pm #109697LEONARDZIR

ParticipantGlen

Very interesting. Kind of you to share.February 24, 2019 at 1:56 am #109699GlenPeake

ParticipantHi Scott, this is against R1000…. yet to check out the other universe’s.

February 24, 2019 at 2:09 am #109700GlenPeake

ParticipantHi Len, No probs…. this was the article that got me thinking about ADX Index Filters etc…..

https://cmtassociation.org/wp-content/uploads/2015/11/0107-geisdorf.pdf

February 24, 2019 at 5:52 pm #109701LEONARDZIR

ParticipantGlen,

Ran my MR strategy from 2007 to present on R1000 using the ADX filter. CAR went from 34.97% with 25.4% drawdown with SPX index filter to 48.58% but with a 39.7% drawdown. I don’t think I could stomach a 40% drawdown.

Will play around with some different entry criteria.February 24, 2019 at 9:49 pm #109708GlenPeake

ParticipantThanks for the follow up Len…

I guess after running the backtest and seeing 48.58% CAR the eyes would’ve popped out a bit, but scrolling down and seeing DD @ -39.7% churns the stomach a bit….

Yep, play around with the 2 PARAM options to see if there is a sweet spot for you specific system etc

February 24, 2019 at 10:25 pm #109709ScottMcNab

ParticipantLen Zir wrote:Glen,

Ran my MR strategy from 2007 to present on R1000 using the ADX filter. CAR went from 34.97% with 25.4% drawdown with SPX index filter to 48.58% but with a 39.7% drawdown. I don’t think I could stomach a 40% drawdown.

Will play around with some different entry criteria.Another possible solution to try Len is to vary PS

eg

remove IndexPass from buy conditions and change (assuming 20@10%):SetPositionSize(IIf(Ref(IndexPass,-1),10,5),spsPercentOfEquity);

-

AuthorPosts

- You must be logged in to reply to this topic.