Home › Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic is empty.

-

AuthorPosts

-

May 1, 2021 at 8:49 am #113236

JulianCohen

ParticipantWhat do you mean by a weighted ROC Howard? Are you using an EMA of the ROC?

May 1, 2021 at 9:10 am #113237Howard Lask

ParticipantJulian, I am using a blended ROC calc combining a short term ROC with 70% weighting and longer term ROC with 30% weighting as the ranking mechanism

May 1, 2021 at 9:52 am #113239GlenPeake

ParticipantYeah… I found it tricky to get something I was happy with on the RUI as well… some 20,000 plus backtests in RealTest etc

Mine is a combo of short term/long term ROC (not weighted)… and dual MA on the stock….

The system kind of morphed into Momo Mean Reversion system… so average hold times are short i.e. about a month.

May 1, 2021 at 10:23 am #113240Howard Lask

ParticipantThanks Glen. Thankfully RT is fast, 20,000 tests in AB is not really viable.

A quick follow up clarification question if that’s ok … are you using the stock dual MA as a component of the ranking criteria or as an entry filter?

May 1, 2021 at 8:26 pm #113241GlenPeake

ParticipantDual MA as a stock entry filter.

May 2, 2021 at 7:17 am #113242JulianCohen

ParticipantThanks for the weighted ROC Howard…makes a big difference…not that I haven’t seen it before of course as it’s in the examples in RT, but sometimes someone says something that makes things click in a different way.

Sorry for hijacking the thread Glen

May 2, 2021 at 3:39 pm #113247

May 2, 2021 at 3:39 pm #113247Howard Lask

ParticipantGlad it helped Julian – I found it made a marked improvement to my rotational systems

May 31, 2021 at 8:06 am #113251GlenPeake

ParticipantMAY 2021 Stats

ASX

WTT +1.2% (Since Go Live in JAN 2019: +38.49%)

ASX100 RTN -4.6%

US

MR#1 -3.8%

MR#2 -5.8%

MR#3 -0.5%

MR#4 +13.4%NDX100 RTN -3.1%

R1000 RTN -4.6%

Total Account: -0.72%.

Best Mean Reversion trade came from MR#4 with a 33% winner in $MOXC…$MOXC

July 1, 2021 at 3:52 am #113333GlenPeake

ParticipantJUNE 2021

ASX

WTT +0.8% (Since Go Live in JAN 2019: +39.59%)

ASX100 RTN +6.7%US

MR#1 +3.9%

MR#2 +5.0%

MR#3 +5.7%

MR#4 -4.3%

NDX100 RTN +10.1%R1000 RTN +0.1% (Green is Green

)

)Total Account: 3.3%

I bit of chop in the WTT for June. I went from reaching new equity highs for the WTT earlier in the month, then within 3 sessions went into a snap -6% drawdown mid-month, then recovered towards the end of the month, to finish approx. 2% from those new equity highs….

Some nice Mean Reversion trades were also executed during the month (for 3 of the MR systems anyway), hoping this continues.

.

July 31, 2021 at 3:30 am #113509GlenPeake

ParticipantJULY 2021

ASX

WTT +2.77% (Since Go Live in JAN 2019: +43.45%)

ASX100 RTN +9.5%US

MR#1 -4.7%

MR#2 -15.9%

MR#3 -18.3.%

MR#4 +5.2%NDX100 RTN +15.0%

R1000 RTN -0.5%Total Account: +1.41%

Took a bit of a haircut in the MR systems this month. A combination of low Win % and getting stuck in positions that struggled to revert…. the DD is within system specs so no dramas there.

The fact that the total account still managed a positive return for the month, just highlights/reinforces the benefits of a diversified suite systems.

A sample of some of the MR trades below:

The best MR trade of the month was from the MR#4 system in $NAOV

August 31, 2021 at 11:10 pm #113645

August 31, 2021 at 11:10 pm #113645GlenPeake

ParticipantAUGUST 2021

ASX

WTT +2.8% (Since Go Live in JAN 2019: +47.48%)

ASX100 RTN -6.25%

US

MR#1 -0.69%

MR#2 -1.52%

MR#3 -4.94%

MR#4 -3.35%MR#5 +10.9% (Paper traded during AUGUST, will Beta Test Trade during SEPT) MR5 was developed in RealTest and I’ll run/generate orders from RealTest,

NDX100 RTN +4.67%

R1000 RTN +19.35%Total Account: +2.15%

The month closed out with new equity highs. Kind of a choppy month, $MRNA bolted early then retraced in the NDX100 system.

$FMG and other Iron Ore positions tanked a bit in the WTT portfolio, but other positions like $ASM, $DUB held up OK. New equity highs for the WTT portfolio.

The R1000 RTN system was the star system this month and kicked on nicely, mainly due to ($UPST)

I’m going to run all of my MR systems out of RealTest from SEPT onwards. Ease of management of systems out of the one APP, RealTest automatically keeps track of account balance(s) & therefore adjusts position sizing accordingly and auto generating CSV order file(s) means one less manual step and less chance of mistakes.

September 5, 2021 at 9:50 am #113774GlenPeake

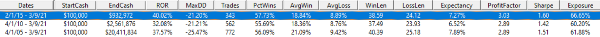

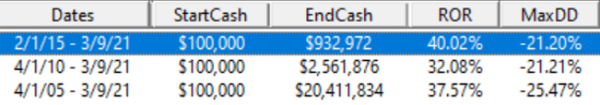

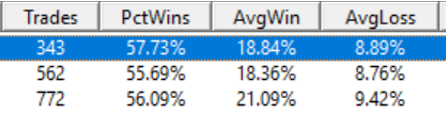

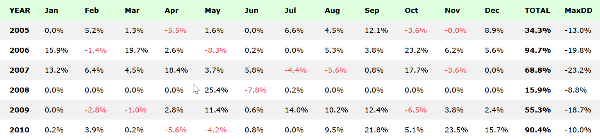

ParticipantStarted developing a new system this weekend…… only early days atm and this is not the final version, but so far it’s looking OK.

It’s a monthly rotational system for ASX Small Ordinaries universe (XSO).

I started using my NDX100 Monthly RTN system as a template for the XSO.

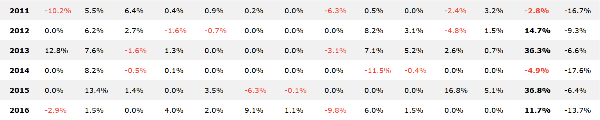

Below are the stats for

2015-2021

2010-2021

2005-2021

(Zoomed IN)

Monthly Stats Breakdown:

September 5, 2021 at 9:58 am #113844

September 5, 2021 at 9:58 am #113844GlenPeake

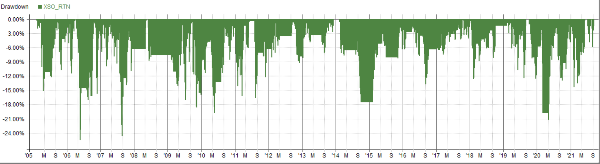

ParticipantDrawdown graph:

September 5, 2021 at 11:39 am #113845

September 5, 2021 at 11:39 am #113845JulianCohen

ParticipantI was trying to get XSO to work the other day and I can’t get any trades.

I added XSO to the constitute.csv file and RT shows it when I type inXSO….What are you using for the main set of data? Do you have a dynamic watch list of all ASX stocks set up?

September 5, 2021 at 11:59 am #113846GlenPeake

ParticipantYep….. I hit the same hurdle yesterday and then emailed Marsten. He experienced similar…. he then emailed Richard @ Norgate to get clarity (no reply from Richard as yet)…

It looks like the constituents for XSO is not fully functional in Norgate atm…… (guessing)

In the interim I did this…

“The S&P/ASX Small Ordinaries index is used as an institutional benchmark for small-cap Australian equity portfolios.

The index is designed to measure companies included in the S&P/ASX 300, but not in the S&P/ASX 100.”So I’ve modified the Import section and imported the ASX300 with the $XKO & $XTO constituents and then edited the canhold to exclude the ASX100 members as follows:

IncludeList: .S&P ASX 300 Current & Past

Constituency: $XKO, $XTO // ASX300 & ASX100canhold: InXKO and not(InXTO) and factor > 0

The below code is Marsten’s NDX Rotate Example script modified for the XSO.I ran a SCAN to generate the CURRENT symbols that it produces and it matches the CURRENT Small Ords XSO Listing of stocks etc…..

(Still need to check the historic part, but believe it looks correct etc)… Let me know if you spot something that doesn’t look quite right.

Code:

Code://///////////////////////////////////////////

// NDX Rotate

// shows one way to implement this popular momentum-based concept

// requires Norgate data to avoid suvivorship biasImport: // assumes Platinum subscription level

DataSource: Norgate

//IncludeList: .S&P ASX Small Ordinaries Current & Past

IncludeList: .S&P ASX 300 Current & Past

IncludeList: $XAO.au // import $SPX symbol if want to use for Index Filter

//Constituency: $XSO

Constituency: $XKO, $XTO

ExcludeList: Examplesexclude.txt

StartDate: 1/1/2000

EndDate: Latest

SaveAs: XSORTN.rtdTestSettings:

DataFile: XSORTN.rtd

StartDate: Earliest

EndDate: Latest

BarSize: Daily

//HolidayList: Examplesholidays.txt // only needed for generating tomorrow’s orders

AccountSize: 100000Data:

// uptrend: c > Avg(C,200)

// bullmkt: Extern($SPY, uptrend)

factor: 0.4 * PctChg(C,63) + 0.2 * PctChg(C,126) + 0.2 * PctChg(C,189) + 0.2 * PctChg(C,252) // IBD RS factor// canhold: InXSO and factor > 0 //

canhold: InXKO and not(InXTO) and factor > 0 //

// canhold: factor > 0 //posrank: #rank canhold * factor

Parameters:

positions: 5

worstrank: 5Strategy: ASX_XSO_RTN

Side: Long

Quantity: 100 / positions

QtyType: Percent

MaxPositions: positions

EntrySetup: EndOfMonth and canhold and posrank <= positions EntryScore: factor ExitRule: EndOfMonth and (posrank > worstrank or not canhold)/////////////////////////////////////

-

AuthorPosts

- You must be logged in to reply to this topic.