Home › Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic is empty.

-

AuthorPosts

-

January 1, 2021 at 1:26 am #112748

TimothyStrickland

MemberGreat results Glen!

I feel you on the need more systems not enough funds dilemma. After this great year I just had, I plan to diversify a little bit more. The problem is I am also going to be tight on time finishing up my CS degree next year full time while working full time, so I may just have to hold off until the following year.

When did you create that NDX Rotn system?

January 1, 2021 at 3:23 am #112751GlenPeake

ParticipantTim Strickland wrote:Great results Glen!When did you create that NDX Rotn system?

Thanks Tim.

I was about to launch it in March 2020 then COVID hit and then launched it Post COVID…. My Index Filter was ultra conservative for the Post COVID V shaped bounce, so I’ve missed out there. I’ve since loosened up the Index Filter.

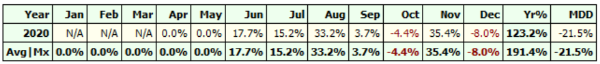

Backtest Stats Post COVID (Current Index Filter)

Backtest Stats 2020 (Current Index Filter)

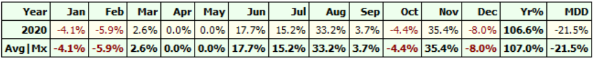

Backtest Stats Post COVID i.e. as traded Live (Old/Conservative Index Filter)

January 1, 2021 at 3:53 am #112749

January 1, 2021 at 3:53 am #112749JulianCohen

ParticipantYes I’m great at breaking software. Mainly because I don’t know what I’m doing most of the time

January 1, 2021 at 7:55 am #112750

January 1, 2021 at 7:55 am #112750ScottMcNab

ParticipantAmazing MRV results Glen.. congratulations

January 1, 2021 at 8:22 am #112764GlenPeake

ParticipantThanks Scott!!!

I would not be trading any sort of MRV strategy if it weren’t for Nick and everyone on the forum showing what is out there in terms of other strategies and possibilities. (I’m a trend follower by heart / nature…. so the MRV strategy kind of goes against the grain for me (at first), but once you dig a little deeper….. it makes a lot of sense).

Hopefully 2021 will be a good year on the markets for all

January 1, 2021 at 4:09 pm #112769

January 1, 2021 at 4:09 pm #112769TimothyStrickland

MemberI noticed sort of the same thing with my systems. I have a very loose index filter on mine so my drawdowns are larger but of course you can see the potential upside I got this year. It is tough to figure out how much drawdown you can handle until you are actually in the middle of one.

January 30, 2021 at 2:38 am #112779GlenPeake

ParticipantJANUARY 2021 Stats

ASX

WTT -0.36% (Since Go Live in JAN 2019: +29.81%)

ASX100 RTN -3.90% (My System)

ASX100 RTN -3.29% (TheChartist System)US

MR#1 +4.4%

MR#2 +9.9%

MR#3 +10.6% (**New System: Live Beta Test Trading with small position size).

NDX100 RTN +12.0%The WTT was on track for around +7% increase this month, but the price action over the last week put an end to that run good. 6 Sell orders lined up for Monday’s open. I haven’t had to make any trades in this system since 30/11/2020 and have been 100% invested since then.

I’m trading Nick’s/The Chartist’s ASX100 Monthly Momo RTN system along side my own ASX100 RTN system now.

Added a 3rd Mean Reversion system to the suite of systems this month. I’ll continue trading with small size and monitor its progress.

Again, this month highlights the benefit of diversification of systems, both longer & shorter timeframe and over differing markets. The ASX momo systems WTT/ASX100, fizzled out in the final few days of the month, while the US MR systems ticked along nicely and had already banked a chunk of the gains prior to the recent VOLA kicking in. Pleased to get something positive out of my NDX100 RTN system this month as well.

I’ve made solid progress with RealTest, I have both the ASX100/NDX100 rotational systems coded up and backtests look solid. I have 2 of my Mean Reversion systems coded up and need to do the 3rd system (a couple of specific/non-default options related to Bollinger Bands in my system that I need to research/double check in RT).

February 27, 2021 at 3:00 am #112939GlenPeake

ParticipantFEBRUARY 2021 Stats

ASX

WTT +3.16% (Since Go Live in JAN 2019: +33.91%)

ASX100 RTN -1.00%

US

MR#1 +5.3%

MR#2 +6.1%

MR#3 +7.3%MR#4 (**New System: Go Live Beta Test Trading with small position size during March).

NDX100 RTN -5.3%

It seems the current theme of 2021 is build up positive returns in the first 3 weeks of the month and then give it back in the final week of the month. Both of the ASX/NDX Rotational systems were up approx. +9% each for the month, but then fizzled out in the final week.

The WTT system will be 65% invested on Monday, with 5 new SELL orders hitting the Monday market OPEN.

Launching an additional Mean Reversion system for March. I’ve been testing/developing this system in RealTest and will run/manage the system using RealTest i.e. day to day orders etc I’ll also double check Amibroker charts for the system signals etc

March 20, 2021 at 8:37 am #113042GlenPeake

ParticipantI’ve been busy backtesting a new system over the past few weeks….

A monthly rotational for the Russell 1000. Still very much a work in progress.

I’m testing/developing in RealTest…. and have run approx. 7500 backtests….

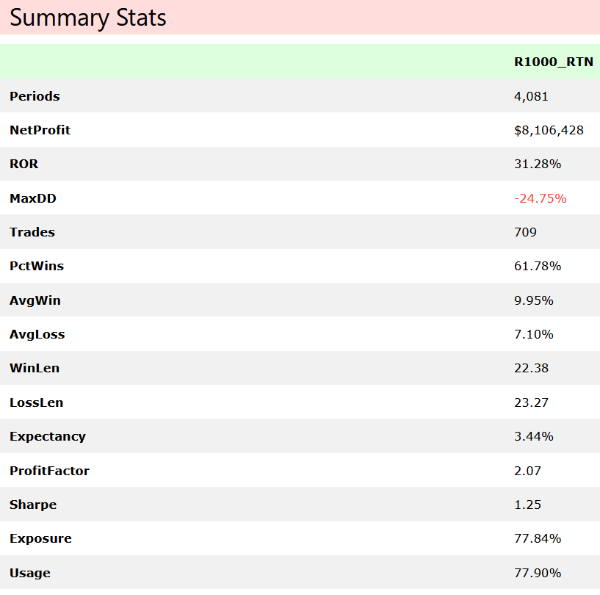

To be fair, I’ve struggled to find a combination of parameters that I’m happy with thus far…… A large % of the backtests have come back with CAR around 10% – 20% with MDD in the 30% – 50% range…. so not so great.

Lately I’ve found some better combinations of parameters….. and as I’ve already got a NDX rotation, I’ve excluded those stocks from this system…. which makes sense to me…. no point double up and adds diversification etc…..

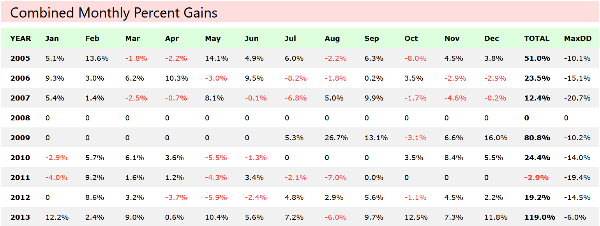

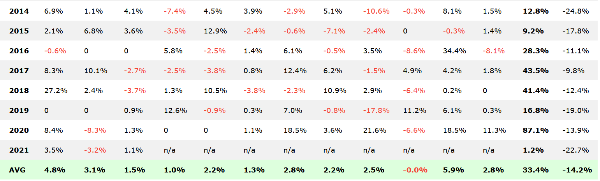

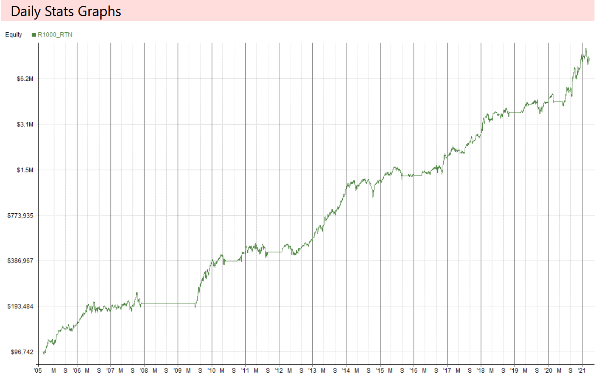

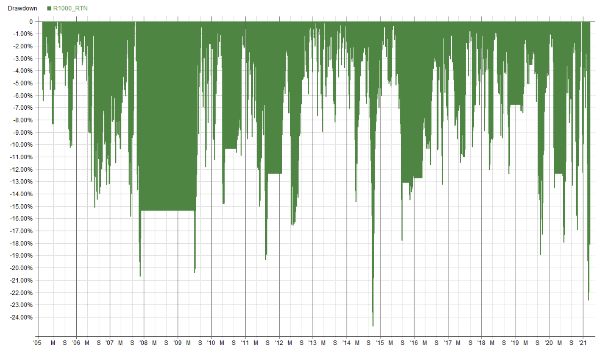

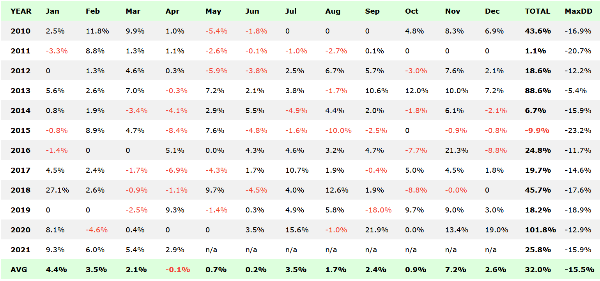

Stats thus far:

March 20, 2021 at 10:27 am #113107

March 20, 2021 at 10:27 am #113107JulianCohen

Participant61% wins is pretty good for a rotation system

March 20, 2021 at 4:53 pm #113108TaranveerSingh

Memberamazing results. do you think you could explain a bit about how you avoided curve fitting (without giving away the rules ofcourse)?

March 21, 2021 at 2:23 am #113111GlenPeake

ParticipantTaranveer Singh wrote:amazing results. do you think you could explain a bit about how you avoided curve fitting (without giving away the rules of course)?I’ve used my NDX Rotational system as a base to build this system.

I’m using ROC for the ranking using a combination of Short-term/Medium-term/Long-term values and a Dual Moving average for the individual Stock selection and your standard Regime Index Filter. So only a few moving parts, which should equal Robustness.

The parameters I’m using atm, other parameters close to these values (should) also work.

The current system, looks to enter stocks with strong momo, but are in a potential consolidation phase. The thinking here is kind of like a Momo Mean Reversion system…i.e. ride the bounce then get out.

I’d like to test a 2nd entry condition which looks to capture breakouts and stays in the trade until Momo fades away….. and maybe include that within the one system and have both sets of entry criteria working together to generate signals. I’ll see how this looks/turns out.

I feel I still have a lot of testing to go, before I get to something I’m happy with.

April 1, 2021 at 4:31 am #113114GlenPeake

ParticipantMARCH 2021 Stats

ASX

WTT -1.7% (Since Go Live in JAN 2019: +31.55%)

ASX100 RTN -6.4%US

MR#1 -0.9%

MR#2 +2.8%

MR#3 +0.5%

MR#4 -3.0% (**New System: Go Live Beta Test Trading with small position size during March).NDX100 RTN -12.6%

A really choppy month. Launched a 4th MRV system. This system was developed/tested in RealTest. I’m also using RealTest to manage the day to day orders for this system etc.

All MRV systems went into drawdown of between -8% & -11% during March, before bouncing back and recovering (some/most) of the DD.

The WTT system is currently 45% invested. Held up OK during the month.

The NDX100 RTN system…….went into approx. -30% DD….. #Next1000Trades

In terms of a Total account return, this is the first negative return month I’ve had in over 6 months. Down -0.67% for the month. Another TICK for diversification.

I’m continuing to research/test a Rotational system for the R1000…..

May 1, 2021 at 7:49 am #113158GlenPeake

ParticipantAPRIL 2021 Stats

ASX

WTT +4.1% (Since Go Live in JAN 2019: +36.9%)

ASX100 RTN +0.2% (Index Filter DOWN for April… UP for May)US

MR#1 -1.4%

MR#2 +2.4%

MR#3 +3.5%

MR#4 -0.6%NDX100 RTN +9.2%

R1000 RTN +2.9% (**New System: Beta Test Trading)

Added a monthly rotational system for the RUI to the suite of systems… for a total of 8 systems now

May 1, 2021 at 8:23 am #113235

May 1, 2021 at 8:23 am #113235Howard Lask

ParticipantCongratulations on the RUI system Glen.

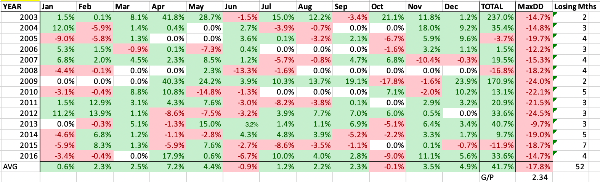

I have spent much of April in RealTest trying to develop an RUI rotation system, based on my NDX rotation system with weighted ROC for ranking, dual stock MA plus index filter and cannot get close to something I am happy with. Best I could come up with had significant losing years and unacceptable drawdowns:

You’ve shown it’s possible so looks like I will need to keep plugging away!

-

AuthorPosts

- You must be logged in to reply to this topic.