Home › Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic is empty.

-

AuthorPosts

-

November 15, 2020 at 11:36 pm #112472

JulianCohen

ParticipantIt does seem to be a bit of a whipsaw period. That’s one of the cons of momentum trading….I doubt if there’s anything you can do about it, it’s just part of the process.

November 16, 2020 at 5:24 am #112473TrentRothall

ParticipantNo sells for me last week, i was up about 5% was a pretty volatile week in the small caps! Crawling out of my start DD

November 16, 2020 at 5:38 am #112474GlenPeake

ParticipantUp 5% is good going Trent… Nice!!!

@Julian…. yep, agreed…. Just got to follow the process.

November 30, 2020 at 11:28 pm #112475GlenPeake

ParticipantNOVEMBER 2020 Stats

ASX WTT +7.78%

US MR#1 +39.7% :woohoo:

US MR#2 +18.1%Monthly Rotational Systems

ASX100 ROTN: -3.58%NDX100 ROTN: +0.9 (Index Filter Down for NOV… Went to cash at start of NOV on an uptick day… Index Filter GREEN for DEC)

MR#1 went into Beast Mode this month. Just looking through the historical backtests, this month is the biggest monthly percentage return ever…. During the month the system would enter positions on a ‘soft’ negative day, then there would be positive news with either the US election/COVID vaccine and the positions just ran the following session(s)…. this repeated a few times….. The system was sitting on 41.4% return for the month until last nights session…. so a little bit of give back.

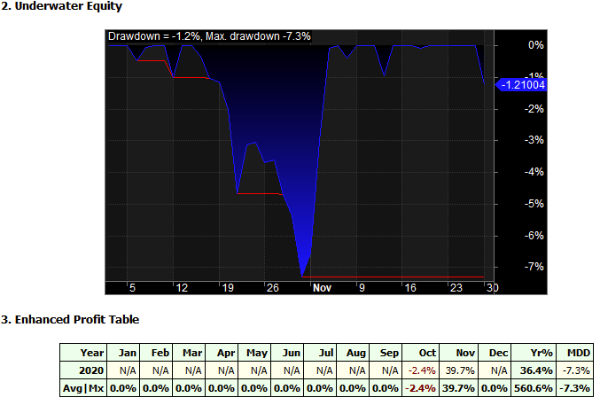

MR#1 Stats

MR#1 Drawdown

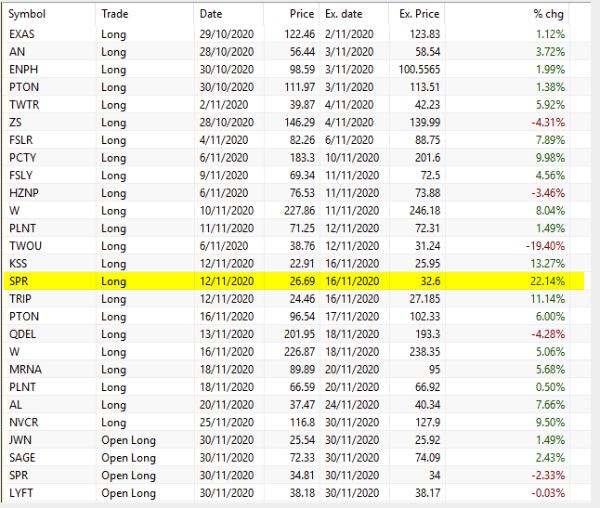

MR#2 would’ve returned 22.5% for the month, but I missed my fill in SPR, my entry was the LOW of the day which didn’t get filled…. Naturally SPR would’ve gone on to be the best trade for the month…:sick: But, we can’t control that….

MR#2 Stats

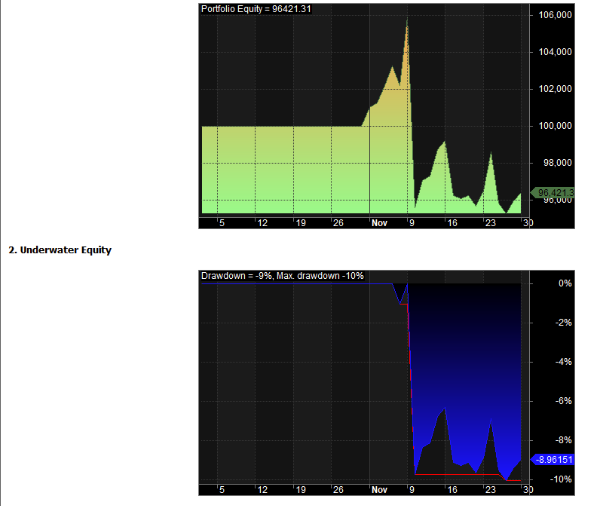

The ASX100 RTN started the month off strongly, then went into drawdown on the COVID Vaccine announcement…. A little bit of rotation for December coming up.

ASX100 RTN DD

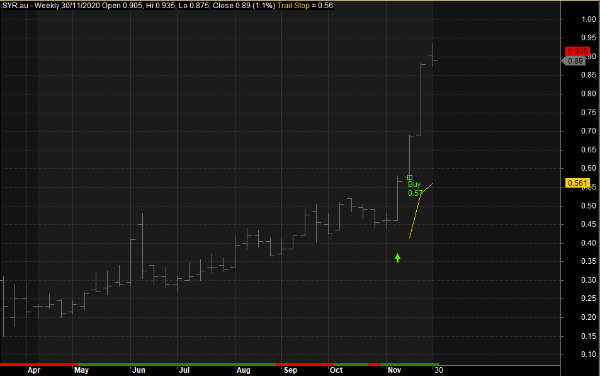

The WTT keeps on keeping on…. SYR.au is a recent addition and has kicked on nicely.. and FMG.au continues to trend nicely. The WTT is 100% invested.

November 30, 2020 at 11:39 pm #112550

November 30, 2020 at 11:39 pm #112550TrentRothall

ParticipantBoom, nice Glen. You have been smashing it too! How’s the win % on MR1!! Nice

November 30, 2020 at 11:53 pm #112552GlenPeake

ParticipantThanks Trent!

With all the talk about how NOV was going to be a VOLATILE month, I didn’t expect that kind of result… I guess I/we, kind of give up trying to predict what might happen and just follow the systems.

December 1, 2020 at 12:23 am #112554TrentRothall

ParticipantGetting a big month close to system release like that will really help with compounding that account too hey! Nice.

December 1, 2020 at 12:24 am #112555Nick Radge

KeymasterYowza! Great work Glen.

December 1, 2020 at 1:15 am #112557TimothyStrickland

MemberWow, I have never seen a MR system get such good results, that is awesome Glen

December 1, 2020 at 1:53 am #112563GlenPeake

ParticipantTim Strickland wrote:Wow, I have never seen a MR system get such good results….Neither have I…… Mind you, I’ve also never seen Monthly Rotational results (like someone on this forum…let’s not mention his name

) of +50% +60% +70% until now either…… :whistle:

) of +50% +60% +70% until now either…… :whistle:lolz

December 4, 2020 at 4:38 pm #112567Anonymous

InactiveI had to ask Nick who LeTour Trader was on twitter, didn’t know who was giving me compliments. Looks like you are still “in sync” with the market!

January 1, 2021 at 12:16 am #112628GlenPeake

ParticipantDECEMBER 2020 Stats

ASX WTT +4.82%

(Since Go Live in JAN 2019: +30.28%)US MR#1 +8.2% (Approx +75% since mid-May 2020)

US MR#2 +2.0% (Approx +78% since mid-May 2020)

Monthly Rotational Systems

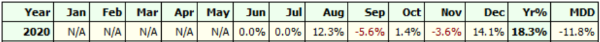

ASX100 ROTN: +14.1% (Since Go Live in June 2020: +18.3%, MDD -11.8%)NDX100 ROTN: -3.5%

For 2020, I went live with 2 new Rotational Systems. I tweaked my 2 Mean Reversion Systems, which have performed consistently well post COVID. I plan to start Live Beta Trading/Testing a 3rd Mean Reversion System. Should be OK to go in January.

The WTT is almost out of its COVID drawdown, with FMG.au being the stand out position atm, +300%…I’m also holding FMG.au in the ASX100 Rotational. The Mean Reversion systems have outperformed during the last 6 months and as a result, I finish the year at new equity highs…. (I didn’t think that we be the case during March/April after hitting new equity highs in February).

I’m thinking I will probably split some of my ASX100 RTN funds and trade Nick’s/Chartist ASX100 Momo as well. The STOCK signals are almost identical atm (thus far, e.g. the Rotation for January is identical

) but we differ in Index Filter on/off from time to time. So my plan atm is a 50%/50% split…. Provides another layer of diversification.

) but we differ in Index Filter on/off from time to time. So my plan atm is a 50%/50% split…. Provides another layer of diversification.A backtest comparison for 2020: Nick’s ASX Momo system returned 59% vs Mine 10%.

ASX100 Stats since GO LIVE in June 2020

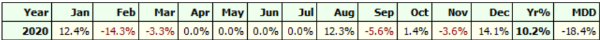

ASX100 Stats for 2020

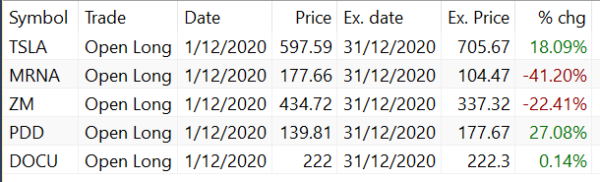

Took a bit of a haircut within the NDX100 system this month with MRNA, while every man and his dog was shorting MRNA @ $178 on the 1/12/20, my NDX100 system was buying it

Plans for the future (later in 2021 and beyond)….

– Allocate more funds to my current Live rotational systems. (A bit light-on, on additional funds atm, so a bit of time required here).

– Diversify further by allocating funds to Nicks US MOMO systems. The message I keep reminding myself is “Secular Bull Market”, Nick has mentioned this countless times and I need a bit more exposure in the US MOMO space. (Again, a bit light-on, on additional funds atm…. A common theme developing here. Once you start going down the diversification Rabbit Hole, a case of ‘so many systems – not enough funds’ ).

).

– Continue to research more Mean Reversion systems….

– Get my teeth into RealTest…. just working my way through the examples scripts atm.January 1, 2021 at 12:29 am #112744Nick Radge

KeymasterGreat work Glen.

January 1, 2021 at 12:53 am #112745JulianCohen

ParticipantIf you need any help with RT just reach out Glen…I’m no expert but I’ve discovered a few things along the way

January 1, 2021 at 1:13 am #112747GlenPeake

ParticipantThanks Julian…! Will do.

I’ve been looking over the RT forums and it appears that you’re Marten’s Chief RT Bug Discoverer

Can’t get over the speed of RT vs Amibroker… super slick.

-

AuthorPosts

- You must be logged in to reply to this topic.