Home › Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic is empty.

-

AuthorPosts

-

October 1, 2020 at 2:13 am #112111

GlenPeake

ParticipantSEPTEMBER 2020 Stats

ASX WTT -3.70% (Up +18.75% since go live in JAN 2019…. Excluding dividends & interest)

US MR#1 +6.87%

US MR#2 +11.47%Monthly Rotational Systems

ASX100 ROTN: -5.70% (+5.76 since go live in AUG 2020) (Index Filter RED for OCTOBER)

NDX100 ROTN: -1.30%This month highlights the benefit of trading a suite of systems. My MOMO systems were all in the RED, while my Mean Reversion systems went GREEN.

The Weekend Trend Trader had a heap of sells this month and is now just 25% invested…. I’m considering splitting out some of these funds (maybe a 80% / 20% split) and allocate the 20% into a Weekly Small Caps system, similar to what Nick does with the Growth Portfolio (mid-caps) and WTT (small-caps).

For me, this means I’ll have the ASX100 covered with my monthly rotational system, mid-cap/XAO stocks covered in my current WTT and then the new weekly system will cover the small caps that are not included in the XAO….

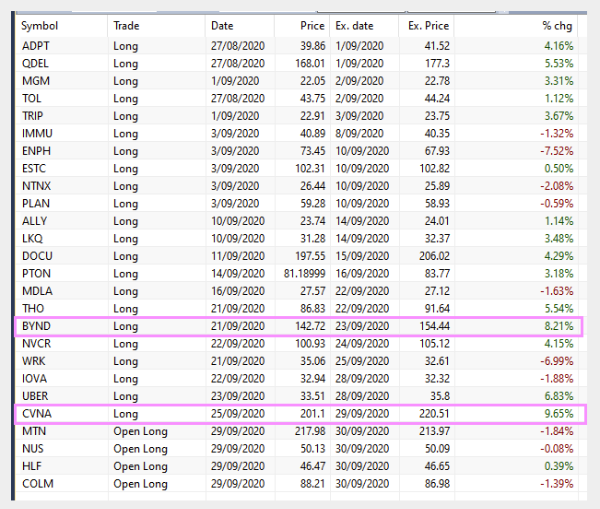

Trades for the month in MR#1

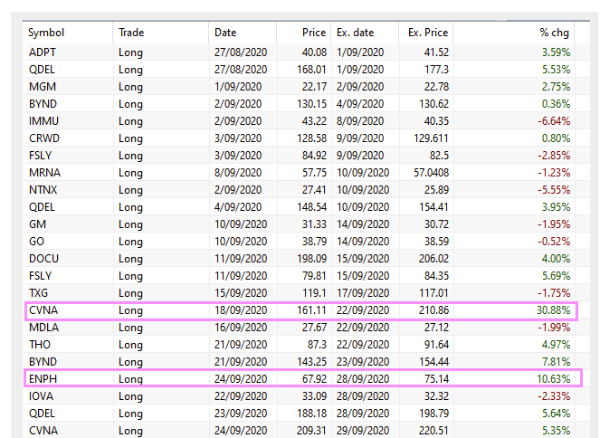

Trades for the month in MR#2

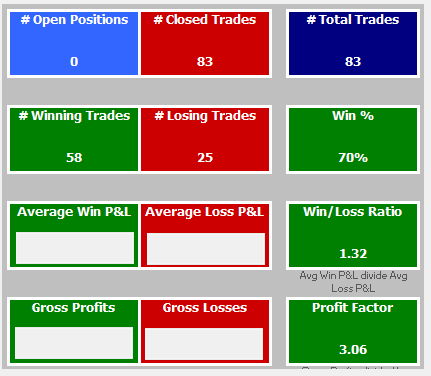

Performance Stats of MR#1 since mid-MAY 2020

Performance Stats of MR#2 since mid-MAY 2020

October 1, 2020 at 5:23 am #112219

October 1, 2020 at 5:23 am #112219ScottMcNab

Participantamazing stats on MR (again)

October 1, 2020 at 5:38 am #112226GlenPeake

ParticipantThanks Scott!!

We’ll see how they hold up over the next month or 2, with the US Election taking place and the ‘expected additional VOLA’ etc….

October 9, 2020 at 8:14 am #112227GlenPeake

ParticipantThe Index Filter on my ASX WTT system went green during the week…. as a result 9 new BUY orders for Monday’s OPEN….. Monday lunchtime would be a great time for the ASX to break out (i.e. break upwards) of the 4 month sideways consolidation

I’ll go from 10% invested to 55% invested.

October 9, 2020 at 8:34 am #112287TrentRothall

ParticipantShit, i just looked at mine. i’ll go from 0 –> 100% in dog stocks, that isn’t going to be ideal (my brain says). eg my top rank is AAR

October 9, 2020 at 10:26 am #112288GlenPeake

ParticipantYep… sounds like it’s ‘Full Gas’ for your WTT Trent…..

AAR is only up 100000% since last week lol…. I’m guessing PLL might also be in your list?

October 13, 2020 at 6:25 am #112290TrentRothall

ParticipantYeah, PLL is, not a good day today for me lol.

October 13, 2020 at 6:49 am #112336GlenPeake

Participantre: PLL…. I thought it might be….(it’s also listed in the US…. so the OZ price tends to track the US price etc)

The WTT needs a bit of time for the big Diesel Trend Engine to get things moving along…. but once it does… well, just look at the returns Nick has achieved this year since he launched his version….

…..Even my returns last year were more than acceptable… sure a fair bit of give back with COVID etc….. but still positive currently approx. +20% (better then money in the bank etc) and still in the game and still pulling the trigger.

…..Even my returns last year were more than acceptable… sure a fair bit of give back with COVID etc….. but still positive currently approx. +20% (better then money in the bank etc) and still in the game and still pulling the trigger.Good Luck with it!!!

#Next1000Trades

October 16, 2020 at 7:40 am #112337GlenPeake

Participant9 new BUY signals in the ASX WTT for Monday, which will take it to 100% invested….

October 31, 2020 at 6:27 am #112340

October 31, 2020 at 6:27 am #112340GlenPeake

ParticipantOCTOBER 2020 Stats

ASX WTT -4.10% (Up +14.08% since go live in JAN 2019…. Excluding dividends & interest)

US MR#1 -2.34%

US MR#2 +2.57%Monthly Rotational Systems

ASX100 ROTN: +0.20% (Index Filter Down for OCT… Went to cash at start of OCT on an uptick day… Index Filter GREEN for NOV)NDX100 ROTN: -5.80% (Index Filter RED for NOV)

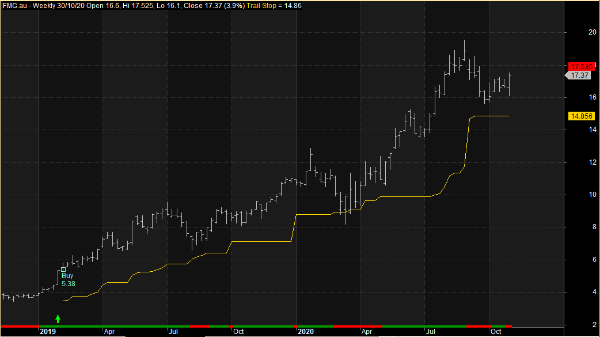

The WTT quickly went to 100% invested during the month and will be ‘quickly’ selling off 12 positions on Monday’s open. On a positive note, the WTT porfolio is still holding FMG.au

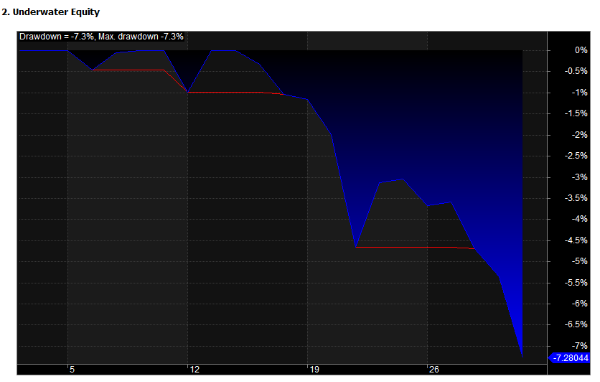

All systems were in the GREEN up until about a week ago… The MR Systems were on track for another solid month up until that point. I got stuck in a few trades which refused to revert and eventually hit the STALE BAR exit instead.

The NDX100 RTN had recovered and was out of drawdown, but ran into some hurdles/VOLA in the last few days.

MR#1 Trades

MR#2 Trades

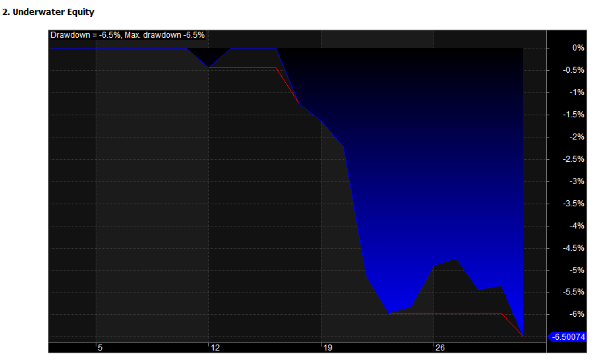

MR#1 Monthly DD

MR#2 Monthly DD

WTT Riding FMG.AU

November 9, 2020 at 2:35 pm #112404

November 9, 2020 at 2:35 pm #112404Anonymous

Inactive“Data Dog” DDOG is one of my favorite company names and symbols.

November 14, 2020 at 5:21 am #112445GlenPeake

ParticipantIt’s been 6 months since I ‘tweaked’ my Mean Reversion systems, so this week I spent some time reviewing them to see if there was a need to recalibrate/tweak/tune the systems at all, for the last 6 months of data. No changes at this stage to either system…. I’ll review them again in another 6 months or so.

The performance over the last 6 months of live (out of sample) data has been really good…. it’s fair to say that the MR systems have been in SYNC with the market.

November 14, 2020 at 6:45 am #112469ScottMcNab

ParticipantRemember hearing “someone” on a podcast recommending optimizing short term systems every weekend (using last 3-4 weeks of data I think) to stay in sync !! Ever tested that Glen ?

November 14, 2020 at 7:39 am #112470GlenPeake

ParticipantWow… every week… I can’t say that I’ve gone down that path…

I recall Nick suggesting every 6 months on approx. 3-5 years of data for the short term systems and every 12 months for the long term systems….

When I first launched the MR systems, I left it too long for a review ( >12 months) and was kicking myself when I saw the “possible ” returns had I reviewed sooner etc

November 15, 2020 at 10:39 pm #112471GlenPeake

ParticipantSeveral more buy orders in the ASX WTT today and I’m be back to 100% invested again….

Buying back a few of the stocks that got sold off the other week…… a little bit of whipsaw around.

-

AuthorPosts

- You must be logged in to reply to this topic.