Home › Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic is empty.

-

AuthorPosts

-

July 6, 2020 at 10:48 pm #111817

OmarAouane

ParticipantActually I was hearing an opposite story about robinhood traders. The mainstream story is to call them dumb money. We are all dumb money in the market at one point of time. But it seems a good chunk of them are engineers at google and other tech firms or associates/graduates at investment banks. Whatever…

July 7, 2020 at 1:51 am #108654GlenPeake

ParticipantASX Small Cap Build/Development Update.

A couple of progress backtest updates. Volume/Turnover makes quite difference depending on what you select in terms of what you can realistically trade in terms of liquidity. I’m yet to review every trade etc, but there’s some fairly thin liquidity on some of the stocks. But it’s certainly a sector on fire atm….

I’ve included a post-COVID backtest that made me almost puke etc… lol

I’ve divided into 2 sets of backtests…. 1 with normal volume filter (which catches some of the low liquidity stocks)…. and 1 with double the volume filter, to weed out some of the lower liquidity stocks…. as mentioned need to review some of the stocks to see what is a realistic ‘sweet spot’.

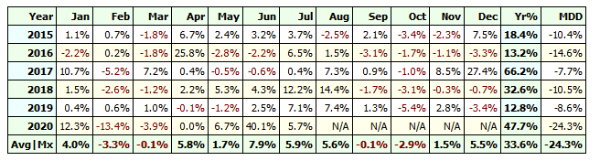

5 Year Lower Volume Filter (i.e. this will catch some of the lower liquidity stocks)

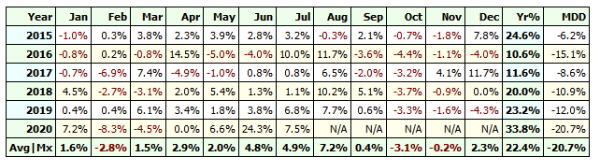

5 Year Volume Filter ‘Doubled’ (i.e. this will weed out some of the lower liquidity stocks)

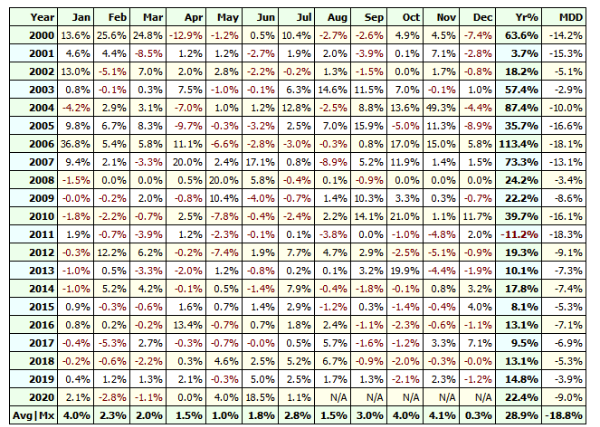

20 Year Lower Volume Filter

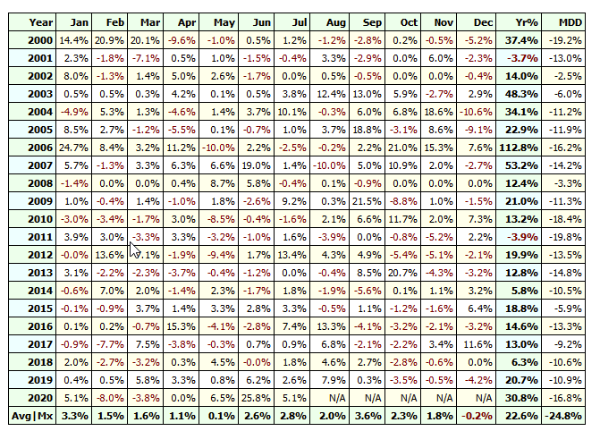

20 Year Volume Filter ‘Doubled’

The next 2 are backtests for this year only (using the lower Volume filter).

Start date 1/1/2020

Start date 1/4/2020 (Post COVID crash :sick: )

Still a work in progress…. my thinking here is, possibly allocating a smaller amount of capital to the system, reasoning:

1. Lower liquidity on some of the stocks

2. Higher volatility with the small caps they can really bounce/whipsaw around a lot…

3. Not enough free capital atm to allocate to the system…. :blush: … so the system will be on the bench for the time being, until sufficient funds can be allocated etc….. I suspect this last point is common for a few of us lolz, So many systems, not enough $ to diversify etc lolSystem is a weekly system. I kind of struggled to make a Daily system work to my liking and the weekly just seemed to fire up nicely.

July 30, 2020 at 6:01 am #111826GlenPeake

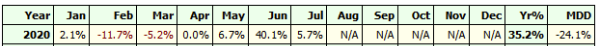

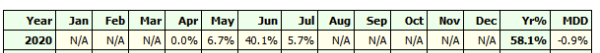

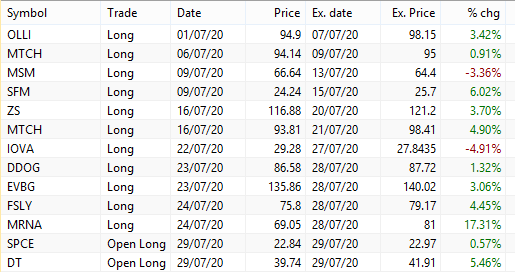

ParticipantMean Reversion performance for July 2020…

Not sure what others are experiencing this month on the Mean Reversion side..???.. but it seems the mean reversion trades have fired up nicely this month…. sample below for my 2 systems….. (no leverage in use)….

MR#1 Trades

MR#2 Trades

July 30, 2020 at 8:11 am #111928

July 30, 2020 at 8:11 am #111928Nick Radge

KeymasterDid you just put the mockers on these systems…still 2 sessions to go…

July 30, 2020 at 8:16 am #111929GlenPeake

ParticipantDoh!!!! 99% chance of that Nick!!!! lol

July 31, 2020 at 12:50 am #111930

July 31, 2020 at 12:50 am #111930Anonymous

InactiveDang, Glen!!! Nice! I did get a piece of that MRNA on my daily MOC system, too, but at 6% it was a bit less than yours. Great!

/edit

I googled “mockers”.August 1, 2020 at 3:16 am #111931GlenPeake

ParticipantJULY 2020 Stats

ASX WTT +6.51% (Up +17.63% since go live in JAN 2019…. Excluding dividends & interest)

US MR#1 +6.58%

US MR#2 +14.71%Monthly Rotational Systems

ASX100 ROTN: Index Filter DOWN, sitting in cash. (Index Filter GREEN for AUGUST…)

NDX100 ROTN: Index Filter DOWN, sitting in cash. (Index Filter RED for AUGUST)3 green returns in the systems this month…. The MR systems are humming along nicely atm……

In the WTT system…. the star performer atm is FMG.au, currently sitting @ approx 200% return…. stopped out in DEG.au for a -30% loss during the week…. no dramas…. Currently holding around 7 GOLD stocks in the WTT…. and am back to 100% invested.

August 1, 2020 at 3:56 am #111943TimothyStrickland

MemberNice Glen!

September 1, 2020 at 1:12 am #111944GlenPeake

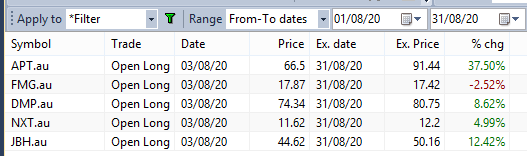

ParticipantAUGUST 2020 Stats

ASX WTT +4.78% (Up +23.15% since go live in JAN 2019…. Excluding dividends & interest)US MR#1 +4.10%

US MR#2 +5.32%Monthly Rotational Systems

ASX100 ROTN: +12.12%

NDX100 ROTN: Index Filter DOWN, sitting in cash. (Index Filter GREEN for SEPTEMBER)The WTT system is 100% invested, RBL.au & Z1P.au were the best performers, gaining 32% & 35% respectively for the month. FMG.au also tagged new highs ($19.56), before going Ex-Div and selling off yesterday…. it’s a juicy DIV @ $1 so all good there.

Dragging the portfolio down this month were all the GOLD stocks, around 7 positions, all of which were down for the month.Very pleased with the ASX100 monthly RTN system performance this month…. it ‘was’ up approx 16% 3 sessions ago, but a little weakness crept in over the last few sessions i.e. FMG.au & DMP.au. APT.au was the star performer. But overall, a solid return for the ASX100 RTN system considering that the XAO has been going sideways during this month.

ASX100 RTN Holdings for AUGUST

September 2, 2020 at 12:56 am #112059

September 2, 2020 at 12:56 am #112059Anonymous

InactiveIts a shame the last few session wore the shine off.

It’s a pity the NDX rotation was off for August. Seems everyone running this style in August had a good month. Still, as you say, it will be on for September and whilst there is some trepidation regarding this froth at the top of the market, I still reckon September is going to be a good month for momentum/long.

September 2, 2020 at 1:53 am #112088GlenPeake

ParticipantCheers Matt.

My Index Filter for the NDX is on the conservative side….. so yeah, I missed the last 1-2 months etc… but I’m OK with that… My other systems chipped away nicely during this time…So another tick for diversification…… But great to see others do so well!!!

Both DOCU & ZM were 2 of the stocks that entered into the NDX RTN system overnight. So we’ll see how they pans out.

Saw your tweet regarding discretionary trades overnight….. If you need a few ideas for intra-day trading/setups, then a few of the Day Trading books by Andrew Aziz are worth checking out.. and also check out his Twitter feed, in addition to #bbtfamily as traders post Daily Report Cards discussing their trades/setups etc… might provide a few ideas etc… also others point towards Mike Bellafiore books ‘One Good Trade’ and ‘The Playbook’, but there’s a lot of ‘fluff’ you have to read through to get to the good stuff…..

However, both books emphasize the same point…. BUY/SHORT stocks that have ‘Catalysts’ and are ‘Stocks in Play’ etc….

September 2, 2020 at 2:37 am #112093Anonymous

InactiveGlen,

Thank you very much for the tips on books, who to follow etc.

I’m not really looking for day trading methodologies to add to the arsenal right now. I am ore trying to look for good methods/systems on longer term stuff, breakouts, patterns, waves etc which might lead oen towards knowing which stocks may be making big moves imminently.

I read “One Good Trade” and honestly it had to be one of the hardest/longest books I have ever had to read. It is honestly filled with 99.999% of Bellafiore just pumping up his own tyres on how he runs his own shop and how awesome he must be… I did get through the whole lot eventually (took me ten times longer to read than any other book) but to be honest I could not see what the hype was about and where there was any actual magic for a strategy or a style of trade or how to identify and work a trade with examples. It is honestly just “You have to hit the tennis ball with the racquet”. Well, gee, no shit Sherlock, but HOW???? OK rant over….

I’ll check out the other references you gave. Thank you!

September 2, 2020 at 3:10 am #112095GlenPeake

ParticipantRE: The Bellafiore Book(s)…. Glad I’m not the only one that saw it that way lol….

I would describe the ‘Aziz’ books with good content, minus the ‘FLUFF’ and a few strategies (there is also a SWING Trade book as well) here: Swing Trade

September 2, 2020 at 3:51 am #112096Anonymous

InactiveThanks Glen.

I just purchased the Swing Trade book you referenced.

September 2, 2020 at 7:09 pm #112099Anonymous

InactiveGah I’d hate him for his returns except Glen is just too nice of a guy. Great August!

-

AuthorPosts

- You must be logged in to reply to this topic.