Home › Forums › Trading System Mentor Course Community › Progress Journal › Glenn’s Jornal

- This topic is empty.

-

AuthorPosts

-

May 1, 2021 at 4:55 am #113232

Nick Radge

KeymasterSolid results Glenn! Well done.

May 1, 2021 at 3:27 pm #113233TimothyStrickland

MemberNice Glenn!

May 29, 2021 at 8:20 am #112576GLENNPREECE

MemberMay 2021

ASX

ASX100 Rot +1.22%

WTT -5.55%USD

NDX100 Rot – 3.94%

RUI Rot +2.18%

MR3000 -4.06%A pretty slow month, but in the end was much better than what the middle of the month suggested it could have been.

Introduced an MR strategy on the R3000 this month. Still working out how best to systematize it, but so far so good. Did have one slight hiccup, where after a very very long lunch, I was in no state to place my trades in the evening. Thankfully the market went up and I actually made money. Lesson learnt always place trades in the morning :0

Happy trading!

July 1, 2021 at 7:09 am #113312GLENNPREECE

MemberJune 2021

ASX

ASX100 Rot +2.38%

WTT -11.07%US Market

NDX100 Rot +14.16%

RUI Rot +10.05%

MR3000 +2.16%Positive month overall up 5.9% across my entire portfolio. WTT has taken a hit over the past couple of months but its kinda to be expected… Next work for me is more portfolio analysis and risks assessments. I want to test overall expected impacts of the systems and how different portfolio weightings might minimise risk.

Happy trading all.

July 1, 2021 at 10:05 pm #113512OmarAouane

Participantimpressive results on your RUI Rot system Glen ! Was a very tricky month fro momemtum.

Cheers!July 31, 2021 at 3:05 am #112577GLENNPREECE

MemberJuly 2021

ASX

ASX100 Rot +14.5%

WTT +7.75%

B&H +2.29%US Market

NDX100 Rot +20.21%

RUI Rot +11.02%

MR3000 +13.39%All and all a pretty solid month. A lot of gains in the NDX system, from one stock, which no doubt we are all holding, e.g. MRNA. I am most likely going to ditch my RUI – Monthly Rotational. I’ve never really been comfortable with the system, and whilst some of the numbers look okay on the surface, believe there is too much variability in the likely returns. Instead I have been testing a cross market / index rotational system, taking the best of the US and ASX markets. So far looks pretty promising.

7 more weeks until we land back in Sydney. If someone could sort of the mess down there before we arrive that would be great

Happy trading all…..

September 1, 2021 at 7:44 am #113644GLENNPREECE

MemberAugust 2021

ASX

ASX100 Rot -10.18%

WTT +3.345%

B&H +8.01%

US Market

NDX100 Rot +5.05%

MR3000 +16.06%TS Rotational -2.43%

Total Portfolio Performance = +1.88%

Happy trading!

Happy trading all…..

September 1, 2021 at 9:12 pm #113782MichaelRodwell

MemberHey Glenn,

What did the damage on your ASX100 system?

I feel like I’ve dodged a bullet (for once!).

Cheers

September 2, 2021 at 12:25 am #113802GLENNPREECE

MemberHey Michael,

I run an aggressive ASX rotational system with only 3 position, but with a smaller portfolio to help de-risk. Overall it has low drawdowns but still susceptible to bigger drops. I was carrying the miners, LYC & MIN, who both took a hit last month. It was also carrying REH, will also fell out of favour.

The overall system is still up 40% YTD (excl Dvds) so I’m not going to complain.

Cheers

Glenn

September 20, 2021 at 5:03 am #113812KateMoloney

ParticipantNice YTD return !

September 30, 2021 at 11:33 pm #112578GLENNPREECE

MemberSeptember 2021

ASX

ASX100 Rot -11.57%

ASX WTT –-2.38%

ASX B&H -5.25%US Market

NDX100 Rot -1.01%

MR3000 -0.29%TS(ASX/US) Rotational -12%

Total Portfolio Performance = -4.93%

Sea of red this month with the ASX dragging down the overall results.

More importantly we have made it back to Sydney (not without its dramas), so may be posting a few questions soon, as will need to sort myself out on how best to deal with Australian tax again…yay…

Happy trading all!

Glenn

Happy trading all…..

October 1, 2021 at 3:05 am #113913TimothyStrickland

MemberRough month Glenn. You said you are in 3 positions only for the ASX100 Rot? I am curious, what was your max drawdown in testing? That is a similar setup to my NDX Aggressive.

I ask because I think you mentioned your drawdowns weren’t that bad. My max drawdown for the NDX Aggressive was pretty high, I think around 35% maybe even 40.

October 1, 2021 at 4:14 am #113921GLENNPREECE

MemberYeh a bit of a lumpy month Tim, but those are expected from time to time in this game, right???

Actually wasn’t that bad, as it comes down to the amount of capital allocated to each system…

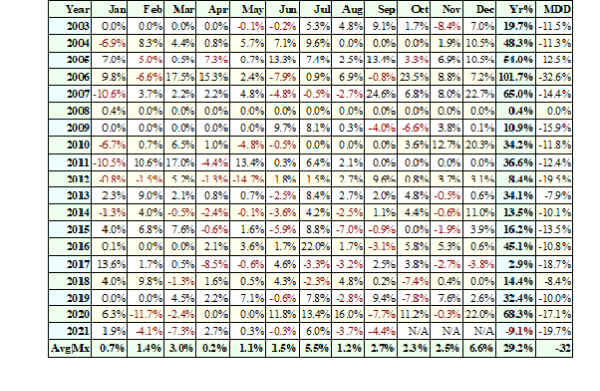

Actually wasn’t that bad, as it comes down to the amount of capital allocated to each system…Have attached the backtest results from 2003,,Its run pretty well except for 2006 with 32% DD, but I balanced that against the substantial gains that year of +101%…generally the DD is around 20% which is well within my tolerance. The recovery rate is also very strong…

Run over shorter timeframes the results improve of course….but I like looking at the longer picture for some perspective on what I might be facing…..

November 14, 2021 at 10:08 pm #112579

November 14, 2021 at 10:08 pm #112579GLENNPREECE

MemberOctober 2021

ASX

ASX100 Rot +3.26%

ASX WTT +2.37%

ASX B&H +1.69%US Market

NDX100 Rot +0.41% (Annual = 102.5%)

MR3000 +6.20%

TS(ASX/US) Rotational +0.06%Total Portfolio Performance = +1.69%

Well its been 12 months since I implemented my first rotational system on the NDX and have no complaints over its performance being up 102.5%, so a big shout out to Nick and Craig for all their helping me implement it. All other systems are also ticking along nicely as well. I haven’t had much time of late to focus on looking at any new systems as the move back to Sydney has been a wee bit distracting… This will be a new year focus. Would like to get one more MR system in play…and also another rotational or long term system for my Super… Also still need to get myself structured properly here in Australia as no more tax free capital gains….

Happy trading all!

Glenn

Happy trading all…..

November 14, 2021 at 10:16 pm #114047KateMoloney

ParticipantNDX has done well … nice work Glenn

-

AuthorPosts

- You must be logged in to reply to this topic.