Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Futures Markets

- This topic is empty.

-

AuthorPosts

-

August 26, 2018 at 10:20 pm #109039

Nick Radge

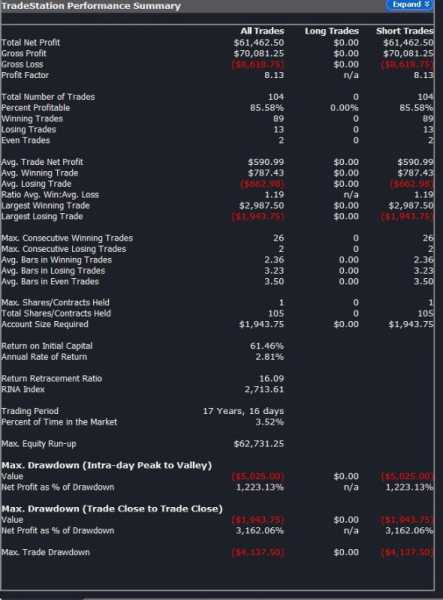

KeymasterHere’s a good example I pulled off Twitter today.

Some considerations:

1. There are 104 trades over 17 years – that’s 4080 sessions of which you participate in just 2.5%. That’s a lot of waiting around. Assume you therefore trade many systems like this (Tim Rhea trades 100 apparently), then that’s a lot of monitoring, a lot of reoptimisation and a lot of measuring of system operating conditions.

2. If we extrapolate this out and use the minimum capital, which would equate to a drawdown equal to 20%, then the annual return is 7.57%. That’s not a particularly strong MAR ratio.

August 28, 2018 at 6:22 am #107247

August 28, 2018 at 6:22 am #107247RobGiles

MemberThanks Nick, agree that’s a fairly ordinary return. Dumb question but how did you calculate the minimum capital?

I’m noticing that most of these guys (Tomas Nesnidal, Kevin Davey, Unger) quote performance from ‘successful students’ but don’t give you a) the amount of capital they are trading with or b) the max risk per trade that they have exposed themselves to in order to achieve the stated return. In my mind this gives a meaningless return statistic, as you have no idea what the MAR ratio or the CAR is.

They all seem to re-optimize “regularly” as well, using walk fwd analysis, to keep the systems in line with current conditions – that sounds like a lot more re-optimising than we’ve been taught to conduct in the mentor Course….curve fitting sounds more apt.

Not easy to find honest education on the futures space it seems.

August 28, 2018 at 9:40 pm #109061Nick Radge

KeymasterYes, the walk forward analysis is reoptimising.

The report shown here is produced by TradeStation which is how I started my systems approach back in the early 90’s.

About half way down the page you can see a number ‘Account Size Required” which is calculated from the largest single loss (shown just above).

Therefore the assumption is that you only need enough capital to satisfy the single largest loss, which is BS.

The report suggests the maximum intra day drawdown is -5025 based on a single contract. I made the assumption that the average punter can handle a 20% loss of capital and extrapolated that -5025 out accordingly.

** NOTE #1**

I should also point out here that a LOT of people start trading with a very small sum of money, i.e. $2000, with the full intent of blowing it completely. You will regularly read people blow themselves up 3, 4 or 5 times using these style systems because they use that Account Size Required number. They’re not approaching this like we do, from a more measured risk management approach. They’re looking to make a 100%+ return but based on bugger all capital.***Note #2***

These trading competitions are somewhat dodgy. They are run by brokerage firms and they induce hundreds of traders, most with very small sums of money, usually less than $10k. Many participants simply use ‘risk’ money, or money they actually intend to lose. So they take on complete risk of ruin in order to be the lucky one to survive and win. This is why you see so many score 600% returns. They do not trade like this in the real world, and for every one we hear about, another 900 drop their full wad.August 29, 2018 at 2:58 am #109065RobGiles

MemberThanks Nick, that’s exactly what I thought was going on. These guys that bang on about winning competitions in order to sell courses are really just relying on attracting people that know bugger all about survivor-ship bias.

-

AuthorPosts

- You must be logged in to reply to this topic.