Thanks Nick.

I used to use Option 1, adding the AddToComposite Function described in the article. Once the CBT eliminating selection bias was introduced it gave me errors when adding the code. Probably a logical explanation for it which is beyond my understanding.

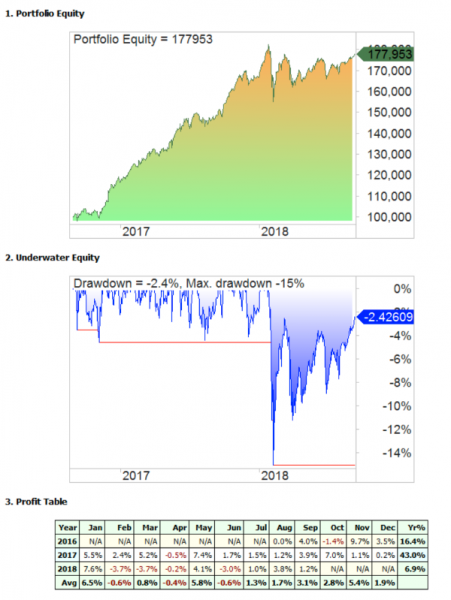

I have now used the export to excel option, (option 2 in the article) and then importing the combined equity curves and running a buy & hold on the equity curve to get the metrics for my portfolio of strategies.

It is a little cumbersome, but it does give good information / metrics of combining my trading strategies traded in a portfolio and worth the exercise.

I did a backtest from the time I started trading systematically after doing the course and assuming I would have traded the strategies as I have settled on now i.e. NDX Momo, 2 x MRV, MOC & an ETF swing strategy.

The main difference between my live results and doing this exercise is a reduced DD due to the CBT eliminating selection bias and the addition of the NDX Momo which I only started trading recently which a larger allocation of capital.

A good exercise to go through.

If anyone knows of an easier way of doing it in Amibroker rather than exporting to excel it may be a quicker option.

I have attached my portfolio equity curve using a nominal $100k starting capital