Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Canada Market

- This topic is empty.

-

AuthorPosts

-

December 31, 2022 at 12:52 am #115339

TerryDunne

ParticipantHi Kate,

I believe that you translate each leg of the trade at the FX rate for that day. I do that and I also convert everything else (charges, interest, fees etc) at the rate applicable for the transaction date. There will be a difference between this calculation and the NAV and I call that difference FX gain/(loss).

I hope I understood your question and that this helps.

All the best for 2023!

January 30, 2023 at 6:47 am #115345KateMoloney

ParticipantCanada Update:

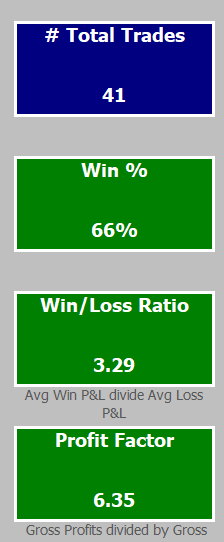

After a few months trial on a small account, my weekly swing Canadian system is now running at full capital allocation.

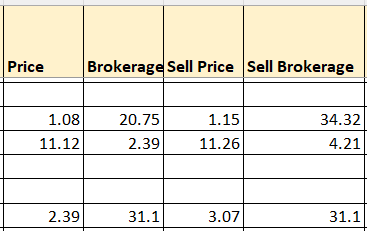

I will be watching closely over the next 6 months to see how slippage and forex impact the systems bottom line.Brokerage is fairly high for lower priced stocks, but eliminating lower priced stocks from the system reduced the CAGR too much. So again, will monitor this closely.

I’ve had to apply a bit of logic to my thought process because I don’t think some things can be tested easily (e.g the impact of forex exchange on the bottom line of the system).

One thing I did was reduce the number of trades where possible. This can be done using a higher stretch and/or regime filter. The CAGR reduces about 5-8% but the maxDD reduces a lot more (-35% max DD to 16% max DD). The worst drawdown is March 2020, the rest of the backtest the maxDD was around 15- 18%.

Positives of Canada

[list]

[*]Diversification of universe

[*]Stocks (so far) have higher % moves than ASX stocks for the ASX weekly swing

[*]Back tests show a higher return than the ASX Swing strategy

[*]Being weekly the system is fairly easy to implement

[/list]

Negatives

[list]

[*]Higher cost of brokerage

[*]Haven’t figured out a viable way to hedge forex exposure (at this stage hoping the exposure will even out over time)

[*]Potential for stocks to swing against you – in the back test the worst trade lost 60% in a week, it is quite common for stocks to drop 20%+, so need psychological fortitude to handle it

[*]At least 80% of my trades so far have been mining/oil/gas/exploration, so there is very little industry diversification

[*]Need to log in Saturday morning local time in case some TSX stocks were bought on Friday morning before 11am TSX time

[*]Unsure if backtests can be replicated in real life due to potential issues with data – must exclude CSE listed stocks – which you can test on, however my understanding is norgate didn’t think historical data on the exchange for each stock was accurate … hence why I am treading carefully

[/list]

Exiting positionsSo far I have been using MOC orders to sell, placing them on Friday afternoon local time, and then checking the broker account Saturday morning in case orders were bought over night.

Stats since October 2022

January 31, 2023 at 8:23 am #115169

January 31, 2023 at 8:23 am #115169JulianCohen

ParticipantMy Canada results are not so good.

Only 7 trades though so a small sample size. I’m -1.47%

I have my stretch at 0.8 ATR

January 31, 2023 at 10:05 am #115396KateMoloney

ParticipantThat is quite a high stretch Julian.

Does your system have no regime filter?

-

AuthorPosts

- You must be logged in to reply to this topic.