Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Canada Market

- This topic is empty.

-

AuthorPosts

-

November 14, 2022 at 3:09 am #115218

JulianCohen

ParticipantNo IB Asia…Singapore/HK

November 14, 2022 at 8:04 am #115219KateMoloney

ParticipantMore info RE: IB

https://www.interactivebrokers.com/lib/cstools/faq/#/content/30125910

IBKR accepts opening orders for only a limited number of stocks and ETFs listed on the Canadian Securities Exchange (CSE). Generally speaking, these stocks are limited to those having a market cap in excess of USD 400 million. Orders for other securities listed on the exchange are only accepted for closing existing positions.

November 14, 2022 at 8:09 am #115217TerryDunne

ParticipantJulian, my initial thinking was that stocks on the TSX are less likely to be microcaps while stocks on the smaller exchanges are more likely to be microcaps. No real science, just a hypothesis.

November 14, 2022 at 10:53 am #115220KateMoloney

ParticipantGot a little bit more research to do, but at this stage think I’ll be canning the idea of trading in Canada unless I can find a solution re: microcap stocks.

Either find a way to trade them, or eliminate micro cap stocks from the data with market caps under 400M and see how it tests.Norgate offered solutions which I don’t think are viable (eg trade TSX composite and Small Cap indexes).

I have tried increasing the vol filters on backtesting to reduce micro cap stocks. (eg average T/O 5 – 10M, 500,000 – 1M average shares traded)

CAGR 31% and 17% maxDD … checked the backtests and there are still stocks being traded with market caps under 400MI am currently playing with “All Canadian Past and Present: Excluding Smallcaps”…..

https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-smallcap-index/#overview

https://www.spglobal.com/spdji/en/regional-exposure/americas/#indicesNovember 15, 2022 at 2:47 am #115223JulianCohen

ParticipantTerry in RT I can exclude the CSE exchange from the backtest. I’m not sure how to do that in Amibroker.

Marsten said all PURE stocks are in the CSE and it’s the PURE ones we want to exclude. I tested without all the CSE exchange stocks and the CAGR went down 2% but the MDD stayed the same, so that is fine for me.

I’m going to trade it that way for the remainder of the year and see what happens.

November 15, 2022 at 4:52 am #115224Craig Fisher

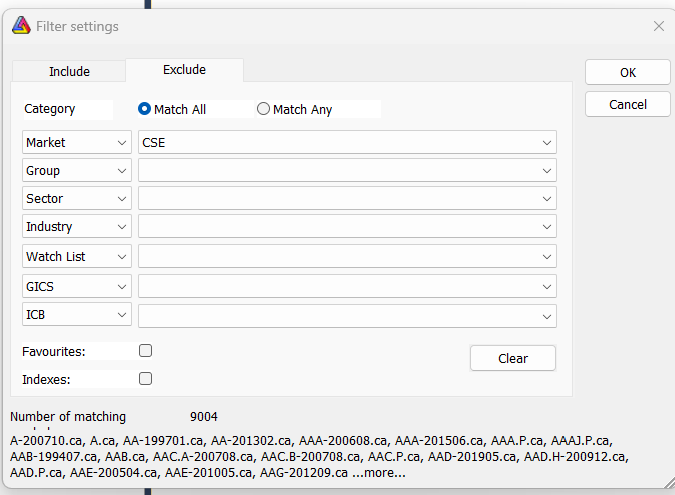

KeymasterJust exclude CSE in the Market section of the analyser filter options.

November 15, 2022 at 5:14 am #115225KateMoloney

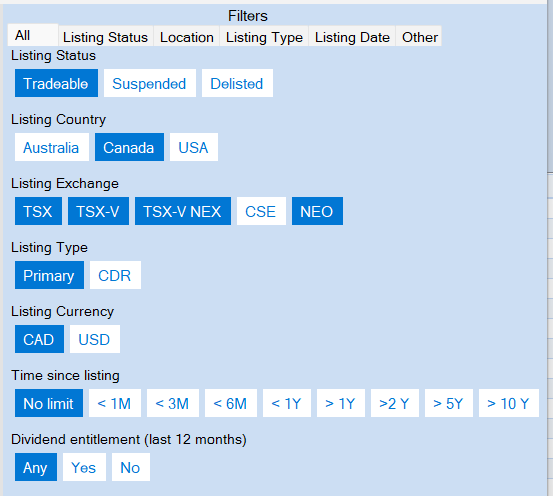

ParticipantWith AB I can create a present watchlist without CSE stocks, but I can’t create a historical one without CSE.

Excluding CSE stocks on AB filter settings reduces historical list from 9755 stocks to 9004.

See how it tests now ….

November 15, 2022 at 5:20 am #115226KateMoloney

Participant

For present CAD watchlist.

November 15, 2022 at 5:31 am #115227KateMoloney

Participant November 15, 2022 at 5:51 am #115228

November 15, 2022 at 5:51 am #115228KateMoloney

ParticipantThank you Julian and Craig for your input.

Ran a backtest, CAGR down 2% and drawdown about the same.

November 15, 2022 at 8:20 am #115229JulianCohen

ParticipantExcellent. Matched my results too.

November 15, 2022 at 9:43 am #115230KateMoloney

ParticipantFrom Richard at Norgate. I asked him if its possible to set up a watchlist of stocks that have a market cap of 400M or more.

Richard Dale (Norgate Data)Nov 15, 2022, 19:07 GMT+11Hi Kate,

PURE is the old name for the CSE. CSE originally started as an alternative trading venue for TSX-listed stocks but has grown to become a place of listing too.

There’s two things at play here.

The first is that you want to generate orders for stocks that are not listed on CSE. You could do this by creating a dynamic watchlist in the Watchlist library that excludes CSE. You might to consider excluding TSX-V NEX, NEO and possibly TSX-V, at the same time too. Alternatively, just amend your rule in AmiBroker to exclude those exchange(s) in your trading signal (e.g. AND MarketID() != 26 AND MarketID() != 27 AND MarketID() != 28)

For specifically filtering on the current (not historical) MarketCap you could also include that in your rules too. More details about how to access it here:

https://norgatedata.com/amibroker-usage.php#fundamentals

eg.Code:mktcap = NorgateFundamentals(“mktcap”);

The second is that you are trying to backtest on non-CSE listed securities (including those that have been delisted) or a marketcap-specific range. Norgate Data doesn’t have that capability, but we are checking the feasibility of having the capability of determining the listing venue for each date (at least back until the big exchange restructure in 1999).

Regarding CSE and NEO – they are relatively new listing venues and not necessarily just microcap companies. NEO is well-known for its CDRs and ETFs. CSE is known mostly for microcap and other “interesting” ventures, but there are a few current listings with more than CAD 400M market cap:

The good news is that since these exchanges are relatively young there’s not a lot of switching of listing from one exchange to another. It does happen but it should be relatively rare enough that it’s of no issue.

On TSX-V there’s only about 24 with a market cap above CAD 400M:

TSX-V is a little harder as companies have “graduated” to TSX in the past and also been demoted.

If you wish to trade the microcaps you’ll need to have a chat with your broker about exactly what restrictions they have in place and if there’s any mechanism to remove that restriction. I’d certainly be interesting about hearing what they have to say as it might also guide us on future developments.

Best regards,Richard Dale, B.Sc. (Hons) Comp Sci

Norgate DataNovember 15, 2022 at 10:42 pm #115168KateMoloney

ParticipantLoaded some orders last night excluding CSE market listed stocks, had no problem. Running a very small account but not 100% confident I can rely on the backtest data.

Currently doing a manual check of backtested stocks vs the price / estimated market cap at the time of the trade to see if excluding CSE stocks rectifies the problem.

Have put some enquires into other brokers to see if they offer micro cap stocks in Canada.

Does anyone know a broker we could try?

Hi Kate,

Historical market caps are notoriously hard to resolve due to the complexity of capital markets.

Various complex/under-reported/late reported events cause this to be a very time-consuming exercise including:

Off-market capital raising

Share buybacks

Employee/executive share issues/vesting

Performance share issues/vesting

Restricted/escrow share conversions

Exercise of Company Options (aka Warrrants in Canada)

Convertible securities (such as debt-to-equity instruments)

Mergers

De-mergers/spinoffs

Complex capital restructuring

Since there’s no standardised reporting of market cap incorporating these (and other) events on a timely basis, it’s unlikely we can perform this accurately to the level required for backtesting at a retail price point.

Have you verified with your broker what the exact restrictions are for trading Canadian securities? Is it a market-cap basis? Or is a listing venue? What rules were used in the past? etc.

Best regards,Richard Dale, B.Sc. (Hons) Comp Sci

Norgate DataNovember 18, 2022 at 1:51 am #115231KateMoloney

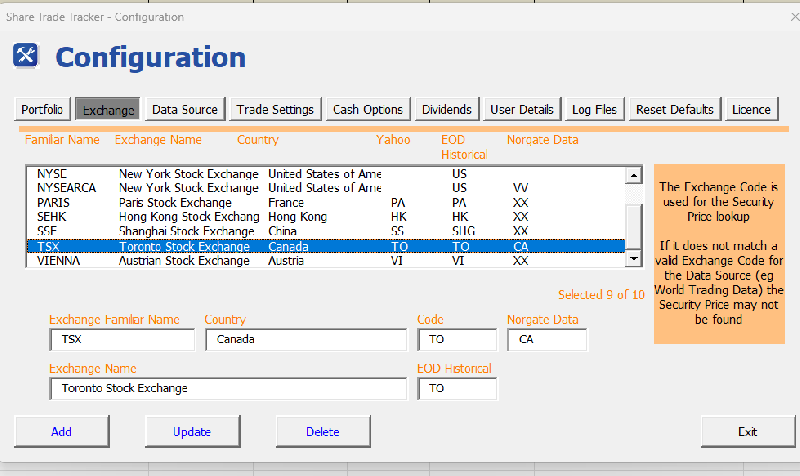

ParticipantSTT – had to make this adjustment to get updated price info on Canada stocks

December 31, 2022 at 12:07 am #115236

December 31, 2022 at 12:07 am #115236KateMoloney

ParticipantRe: Canada Swing I’m trying to figure out what IB data to use for tax returns in Australia.

Put several enquires into IB 3 – 4 weeks ago and have had no response. My accountant has looked at it, but I’m not sure I agree with his answer. (accountant hasn’t been as present in his accounting business last 6 – 8 months, looking at changing in the new year)

IB show trade data for CAD trades. These figures match my STT figures.

Then IB convert the CAD figure into AUD, I have asked IB how this figure is calculated.Also, IB show the forex data, from AUD to CAD and back again. I would have thought you’d use this data for tax returns, as it encompasses the forex conversion and (maybe) the P & L on the CAD trades. Again waiting on IB to confirm.

Anyone have any ideas?

-

AuthorPosts

- You must be logged in to reply to this topic.