Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Canada Market

- This topic is empty.

-

AuthorPosts

-

November 3, 2022 at 6:05 am #115180

TerryDunne

ParticipantNick, please know that I did not intend any of my comments as criticism.

For a noise buyer like me the Weekly MOC concept is such an exciting new avenue that I want to apply it wherever I can!

November 3, 2022 at 6:09 am #115181TerryDunne

ParticipantJulian, I guess my concern is the LOC aspect. Like not getting up in the middle of the night to place orders, I’m not getting up in the middle of the night to change LOC orders…

Your lot rounding rules seem very reasonable to me! I’;ll probably steal them

November 3, 2022 at 8:43 am #115182

November 3, 2022 at 8:43 am #115182JulianCohen

ParticipantWhy do you need to get up to change anything. Basket Trader is all automatic. You place orders that have a sell order attached if executed. On Saturday when you wake up you just log your fills and go down the pub to spend your ill gotten gains

November 3, 2022 at 10:04 am #115183TerryDunne

ParticipantThat sounds nice…

Perhaps I’ve misunderstood. I thought the orders to close positions were limit on close and there would be a potential need to move the limit price so that it didn’t exit before the close?

November 4, 2022 at 12:03 am #115184JulianCohen

ParticipantNo the closing orders are MOC, or on the ASX market orders placed at a certain time. So you can set them in advance.

I’m using RT to do this so it creates the relevant orders automatically. It basically creates a Limit Order for entry and an if filled closing order GAT (Good After Time). For the ASX this is set to 15:58 so I get the sell price as close to the close as possible…on the ASX it’s impossible to know before hand what price to place to get the closing auction, so I’m allowing for a bit of slippage on the exit…not a big deal

I’m planning for the TSX to do the same thing. I’ll let you know next week as I’ll try a test set of orders to see what happens.

November 4, 2022 at 6:31 am #115185KateMoloney

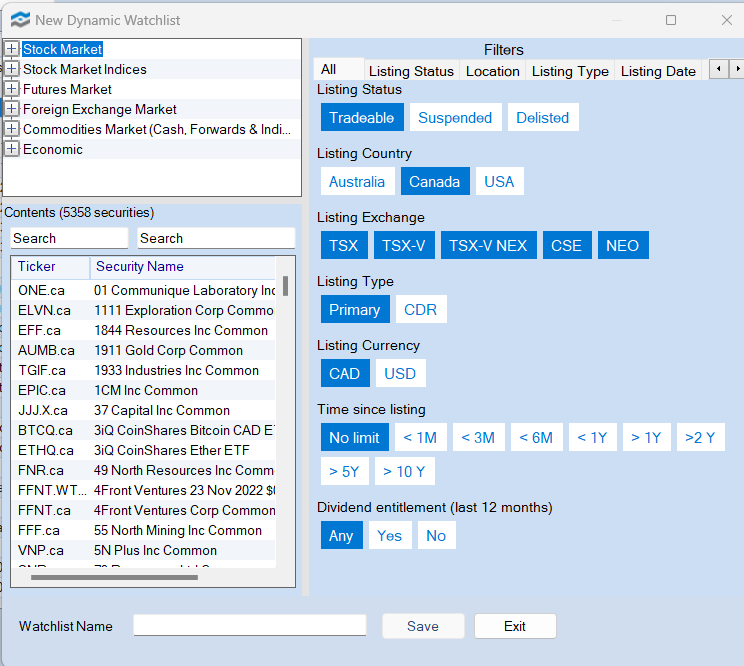

ParticipantSetting up Canadian watchlist (for some reason it deleted when my computer did a software upgrade …). Now setting up the watchlist is different to when I initially set it up.

These are the settings I’m using for “All present Canada stocks”

I decided not to include USD stocks as there were only 190 on the TSX and I didn’t want to mess with different currencies.

Re: listing exchange – I ticked all of them, but need to research it further to understand it.

November 4, 2022 at 6:54 am #115186

November 4, 2022 at 6:54 am #115186TerryDunne

ParticipantKate, FWIW I’ve set up my Canadian watchlist in exactly the same way.

One of the unresolved issues I have is whether orders for stocks on the CSE (for example) can be placed using SMART/TSX as the exchange…

November 4, 2022 at 8:43 am #115187KateMoloney

ParticipantTerry, I’m going to start with a small account and see.

Best way to understand it is with skin in the game.November 4, 2022 at 2:41 pm #115167LEONARDZIR

ParticipantOut of curiosity, why doesn’t this work in the US market?

November 9, 2022 at 3:40 am #115188KateMoloney

ParticipantSomething to be aware of (for Australia IB accounts trading in Canada).

FX Offering

IBKR Australia can only support currencies in AUD, USD, HKD, EUR and GBP and you can convert between these currencies. If you have cash balances in currencies other than IBA supported currencies (AUD, USD, HKD, EUR or GBP) these will to be converted into your nominated base currency.

IBAU clients, when permissioned, can trade in any market available across the IBKR network, even those outside the 5 supported currencies above. However, upon your instruction for any market outside the 5 supported currencies, IBKR Australia will automatically execute Forex conversions to ensure non-supported cash balances be cleared.

For example, if an IBKR Australia client using a Cash account wishes to buy JPY denominated securities, as long

as the client has sufficient available funds, the trade is permitted. To settle the trade, IBKR Australia will convert the existing cash balances into JPY. Similarly at a later date, if the same client wishes to sell their JPY denominated securities, IBKR Australia would automatically convert the JPY proceeds to the base currency by day end, once again leaving no residual JPY cash balances.If an IBKR Australia client using a margin account has any positive or negative cash balances outside of the 5 supported currencies, it will be automatically converted to base currency by day end.

November 10, 2022 at 10:32 am #115189KateMoloney

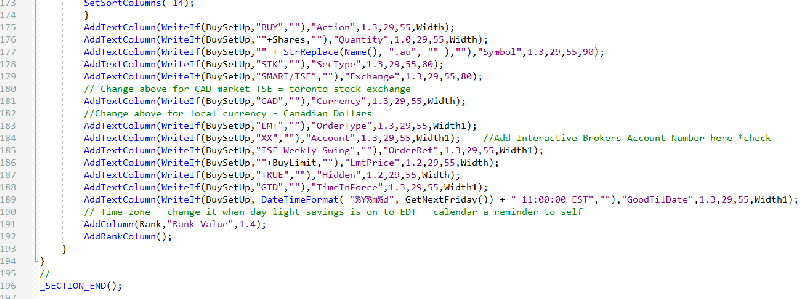

ParticipantLoaded some small orders on TSX today as a test. Still ironing out a few things.

Made following changes to the code.

Re: timezone, not sure if this will need to be changed for day light savings from ET to EDT.

November 11, 2022 at 1:02 am #115193

November 11, 2022 at 1:02 am #115193JulianCohen

ParticipantI’ve had orders on all this week but no fills so far. I have a 0.8 stretch and from backtesting this year has been quite meh! so I’m not expecting much.

The orders look fine on IB so that’s something at least.

November 11, 2022 at 4:51 am #115194KateMoloney

ParticipantI had 2 orders fill last night.

The rest were cancelled by IB.

Error message was boardlot orders can’t be hidden orders. Going to adjust a few things in the code and try again next week.

November 11, 2022 at 11:09 am #115195TerryDunne

ParticipantHi Kate,

What’s a boardlot order?

November 11, 2022 at 8:59 pm #115196KateMoloney

ParticipantHi Terry

See my first post.

-

AuthorPosts

- You must be logged in to reply to this topic.