Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › ASX Swing Trade

- This topic is empty.

-

AuthorPosts

-

October 6, 2022 at 5:38 am #102240

KateMoloney

ParticipantBought the ASX Swing trading code and am currently running tests, making slight changes to the code.

Wondering if anyone else on this forum is doing the same and wanted to swap notes?

I’ve run optimization tests on the strategy, looking to see where I can make the system my own.

The biggest impact so far has been changing the ranking system.

If I run the original code VS a different ranking system, the CAGR and max DD are very similar, yet only 25%-30% of the trades are the same.On the original code, the biggest hit to the strategy was in 2020. The biggest weekly drawdown (2020) was -15%, and that was with a slightly higher stretch than the original code.

October 6, 2022 at 6:12 am #115087JulianCohen

ParticipantI have bought it Kate. I must admit I didn’t even consider changing the ranking…off I go then

Happy to swap notes if you want to email me

October 6, 2022 at 6:30 am #115094KateMoloney

ParticipantJulian Cohen post=13438 userid=5314 wrote:I have bought it Kate. I must admit I didn’t even consider changing the ranking…off I go then

Happy to swap notes if you want to email me

Sent you an email Julian.

I found ranking to be the best change. Surprised you didn’t think of this given I’m the rookie

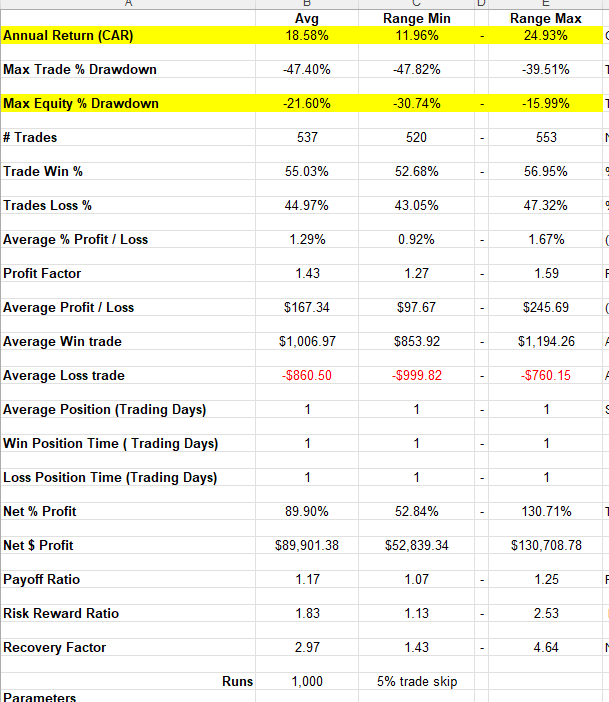

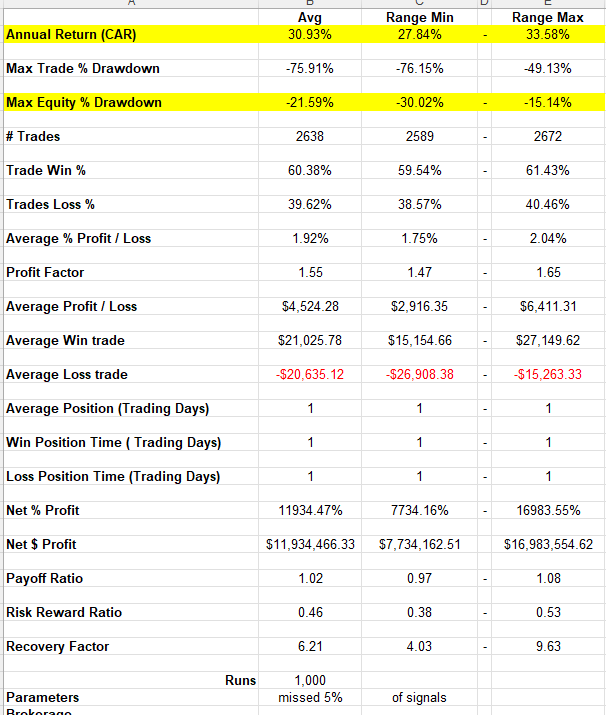

Run MCS on the system 2019 – 2022, and 2005 – 2022.

1,000 runs skipping 5% of trades.Short term there is a larger variation in results … currently investigating this …

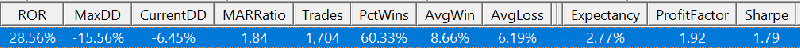

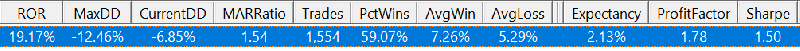

Below is MCS for original code

MCS 2019 – 2022

MCS 2005 – 2022

October 6, 2022 at 6:32 am #115095

October 6, 2022 at 6:32 am #115095KateMoloney

ParticipantAlso, all my tests so far are on 50% margin.

Used IB comms in settings 0.08% and $6 per trade min.

Test without dividends.

October 6, 2022 at 6:36 am #115096KateMoloney

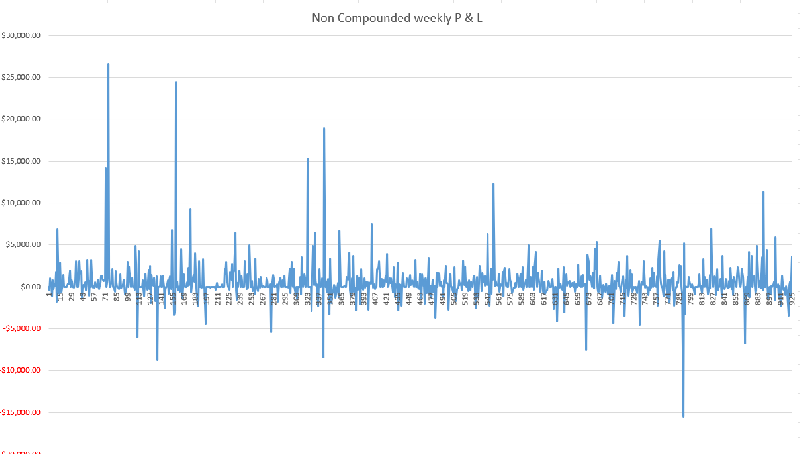

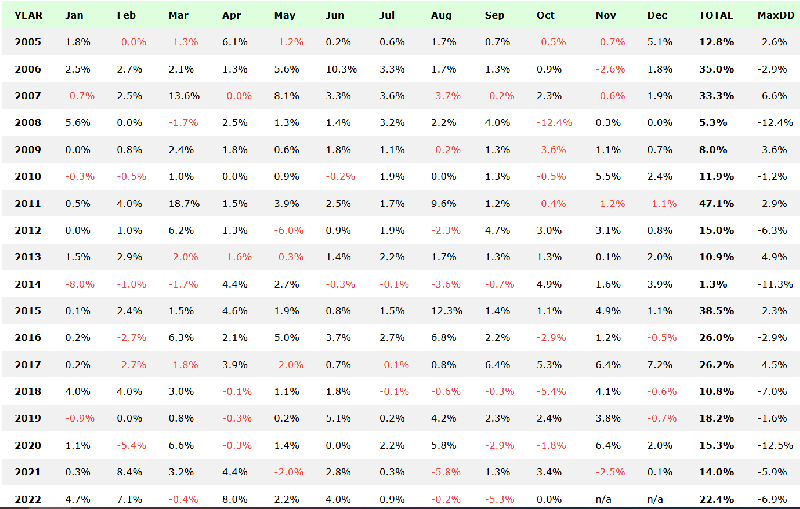

ParticipantWeekly Non Compounded P & L

Original code with a slightly higher stretch

50% margin 2005 – 2022

October 6, 2022 at 8:08 am #115097

October 6, 2022 at 8:08 am #115097TerryDunne

ParticipantStreuth, nice stats Nick/Kate!

October 6, 2022 at 8:30 am #115099KateMoloney

ParticipantTerry Dunne post=13443 userid=719 wrote:Streuth, nice stats Nick/Kate!Nick and the team did a great job with this strategy.

Might be something for you Terry ….October 6, 2022 at 8:55 am #115100TerryDunne

ParticipantI must say, stats like that are pretty compelling…

October 6, 2022 at 10:07 pm #115101KateMoloney

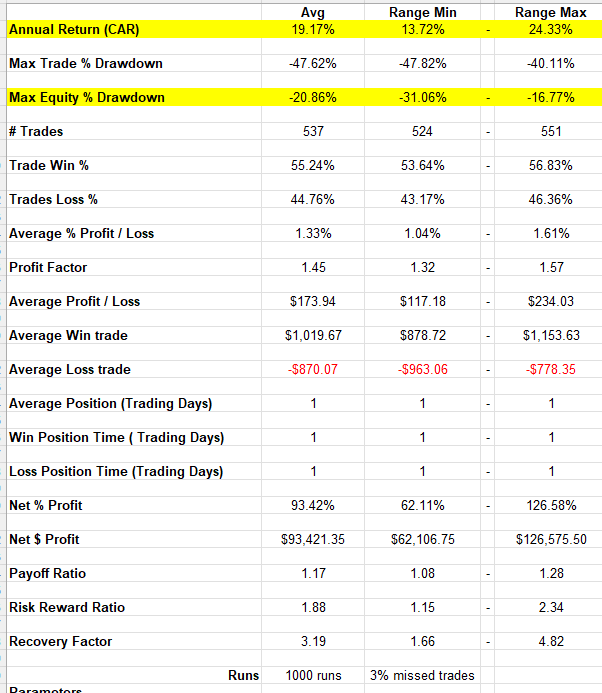

ParticipantMCS 3 year 2019 – 2022, 1000 runs skipping 3 % of trades.

Going to run MCS on other short term periods to see if there is as much variation, given the largest drawdown to the strategy was in 2020.Prior to June 2022, the MOC strategies produced very similar MCS results on short term VS long term.

Still wrapping head around weekly/monthly strategies, but takeaway so far is to expect short term results to vary from longer term CAGR / max DD figures. It should even out with the longer term implementation of the strategy.

October 6, 2022 at 10:12 pm #115088

October 6, 2022 at 10:12 pm #115088JulianCohen

ParticipantI’ve not bought a turnkey strategy before so I wasn’t thinking about testing it or changing it in any material way.

However following your lead Kate I have made adjustments to it.

I won’t post any screenshots as I am patently no good at doing that…look at the state of Terry’s journal as proof of that..not sure why it is so hard on this forum.

Anyway I have it now with a 28% CAGR and -16% MDD with a turnover filter set for a higher position size: I want to exclude all the low liquidity entries as they are often missed fills anyway so adversely affect the backtest.

Expectancy is 1.53% with MAR 1.79, W/L Ratio of 1.3 and Profit Factor 1.68

October 7, 2022 at 4:44 am #115089danielbarbaro79

MemberI’m working through it as well, but probably a little behind you Kate

my note keeping is pretty poor , but happy to share ideas if you need anyone else to bounce off

current i have changed 1 entry criteria, this diffrentated trades possibly 40%, for similar CAR

the couple of rankings i use on other systems did not improve results , but did not destroy them either

i’m slow on excell and comparing results – just running some MCS now and possible trial live trading next week

current returning about 21%CAR / 10% DD no leveragecheers

Dan

([email protected])October 7, 2022 at 7:54 am #115104GlenPeake

ParticipantI’m yet to purchase Nick’s turnkey code…. so I’m unfamiliar with the inner workings….. But he’s publicly disclosed a fair bit in terms of the ‘raw ingredients’ i.e. position size universe etc.

So here’ my current development / work in progress build to compare against…

NOTES:

– This is the cash account version….. no leverage involved.

– No index filter (not sure if the turnkey is using an index filter).

– I’m using a turnover / average turnover filter of $3mil…. reducing this filter to $1mil ramps up the results considerably, but contains too many ‘sketchy’ / unrealistic trades imo.

– I’m using an adjustable stretch based on the PDI/MDI of the $XAO

– The period between 2012-2014 and also post GFC is fairly flat

– Test period between 2005-2022

– All ASX Stocks universe

– Min Share price filter of .20cents$1mil Turnover Filter version (Less realistic trades)

$3mil Turnover Filter version (More realistic trades)

Monthly Stats

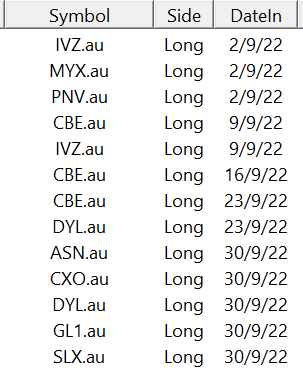

Sample trade list for Sept (Nick posted a trade list on twitter from the turnkey code leverage version for last weeks trades and there was some correlation of ticker symbols between what he posted and my version).

October 7, 2022 at 11:45 am #115106

October 7, 2022 at 11:45 am #115106KateMoloney

ParticipantGlen, your a wizard! One day I hope to be half as smart as you …..

Dan, sounds like you’ve made a lot of progress. 40% different trades sounds like a decent difference from the initial code.

Keep us updated on your progress.Have you looked at liquidity filters as per Julian and Glen?

I’ve been looking at price filters, started with $30 – $1000. It produced a negative return, but trying other options as I type…..October 7, 2022 at 10:37 pm #115107danielbarbaro79

Membernice work Glenn ,

Hey Kate , yea have been experimenting with filters – was considering leaving at default turnover for testing , upping the filter past 2M slows CAR quickly , however DD stays stable . I will re run all the parameters later with a 3M turnover and see if things can be improved. . Experimented with Price , current draft the min needed to stay at .2 but the high price i moved to $50. there was some benefit in raising the max , but not much. did some MSC with 5% skip , its super consistent. the other point of interest in the build was adding leverage 10x stocks is much more stable (results double) than 20 stocks. (DD goes x 3 ) need to make sure i’v not over optimized

October 7, 2022 at 10:41 pm #115090ScottMcNab

ParticipantI may be remembering this incorrectly but I seem to recall from a few years ago that there was quite a few posts regarding experiments members had performed and possible benefit (in terms of getting live results to match backtests) to be gained for ASX short term systems by testing with the buylimit needing to be a tick lower to trigger a fill in the backtest….apologies for being too lazy to search for it but some (most) here will have a better memory

-

AuthorPosts

- You must be logged in to reply to this topic.