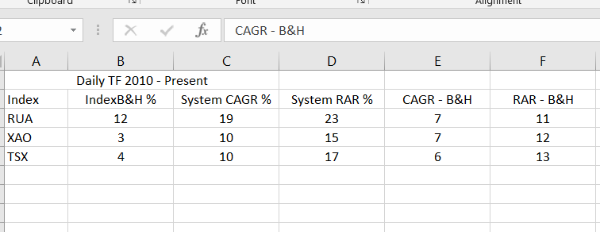

I am continuing to experiment with longer term systems ..be interested to hear how others are analysing them…Looking at ways to compare performance of a system across different markets for 2 reasons:

1. to see if I curve fitted the system to the market it was designed on

2. to try and separate alpha from beta to compare performance of different systems

At the moment I am simply subtracting the Index B&H from the CAGR and RAR from the backtest but I am not sure if there is a better/more valid way to do this ? In the example above of 2010 to present the daily TF system performs sig better on the RUA but the comparison I am using currently suggests that this is due to the “beta” of the RUA rather than under performance of the system on the Aussie or Canadian markets per se ??