Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Anatomy of a Trading System

- This topic is empty.

-

AuthorPosts

-

January 28, 2016 at 8:44 pm #101411

Nick Radge

KeymasterIt may seem odd that I bothered to post articles about trading systems and ideas, but I want to show you WHY this can be beneficial. As has been stated before, I’m not the most imaginative guy around and I’ll be the first to confess I’m not the smartest. By trolling the internet you come across ideas, and sometimes from very smart people. These ideas can slowly morph to become part of a system that may be compelling to you.

Here’s an example.

Yesterday I was reading an article by Gary Antonacci who is well known for his work on Dual Momentum strategies. Indeed, our very own US Momentum model is based on similar traits. However, in his article there was a single line that piqued my interest. He stated,”…momentum in one month windows is mean reverting”

I’d not heard this before on an academic level. Antonacci is basically saying that over longer windows (3 month – 12 month) momentum persists, yet on 1 month intervals is mean reverts.

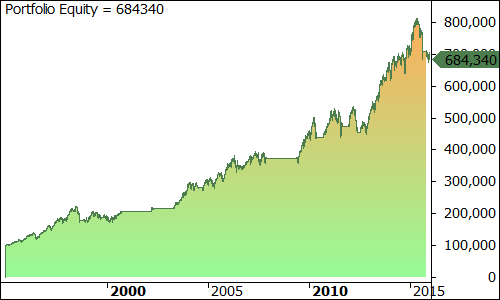

So obviously I put it to the test. I used our US Momentum model and re calibrated the lookback to 1 month. I then ranked the stocks and bought the ‘weakest’ in the group. Rebalance each month. Here’s the equity growth chart:

Now I’m not suggesting that this is in anyway an appropriate outcome, but it could well be used as a starting point for more research.

_

January 28, 2016 at 10:49 pm #102607Anonymous

InactiveThanks for posting these ideas Nick.

It would be interesting to test a momentum system that uses different look back periods within the 1 system. As an example, you have 2 longer-term look back windows to rank upward momentum, maybe 12 months and 3 months, and either take the average of the 2 or weight the 2 individual results to get a final momentum score. Both the period lengths and weightings could be set as parameters to test different combinations and sensitivity.

I wonder if using a combined score of 2 periods would yield better results that just 1 period.

Then the final look back period could be short, say 2 weeks to 1 months, and either reversed, like you did above, or used just as a threshold.

If set as a threshold, in simple terms the system is saying, we buy the strongest momentum stocks but exclude anything that has rallied strongly over the past 2 weeks, as short term strength tends to mean revert. Depending on how often the portfolio is re balanced, if the stock pulls back, it may well make the list the next week/month.

January 28, 2016 at 10:56 pm #102612Nick Radge

KeymasterYep, that’s a great idea. I’m quite sure the guys at Dunn Capital use a signal ranking method based on Swarm Theory. I think they use some 100 signals then rank and position size accordingly.

The alternate is to actually trade both the upward momentum (lookback = 6 to 12 months) AND the short term reversion lookback (1 month). Be interesting to see how they would operate together.

As will be the most likely answer in this section, “Test It”

.

December 13, 2016 at 9:06 pm #102613WENKIT LUI

ParticipantHi Oliver and Nick,

I’ve started doing some online research into mean reversion regimes and found the above idea i.e. buying the weakest momentum stocks using a one-month lookback period, quite interesting because it’s a mean reversion strategy derived from a momentum-based strategy.

I stumbled on something similar last night called the Clenow Plunger strategy.

Article: http://www.followingthetrend.com/2014/06/a-counter-trend-indicator/

Rules: http://www.followingthetrend.com/?mdocs-file=2643&mdocs-url=falseAgain, it’s a mean reversion strategy derived from a momentum strategy, in this case Andreas Clenow’s.

Just wondering if you (or anyone you know) has tested these rules before and if yes, how it compares with the Antonacci mean reversion strategy described above?

I’m still making my way through the trading system mentor course and haven’t reached the point of testing system ideas…probably getting a little ahead of myself, but this is interesting

December 14, 2016 at 1:19 am #105971

December 14, 2016 at 1:19 am #105971LeeDanello

ParticipantKit Lui wrote:Hi Oliver and Nick,I’ve started doing some online research into mean reversion regimes and found the above idea i.e. buying the weakest momentum stocks using a one-month lookback period, quite interesting because it’s a mean reversion strategy derived from a momentum-based strategy.

I stumbled on something similar last night called the Clenow Plunger strategy.

Article: http://www.followingthetrend.com/2014/06/a-counter-trend-indicator/

Rules: http://www.followingthetrend.com/?mdocs-file=2643&mdocs-url=falseAgain, it’s a mean reversion strategy derived from a momentum strategy, in this case Andreas Clenow’s.

Just wondering if you (or anyone you know) has tested these rules before and if yes, how it compares with the Antonacci mean reversion strategy described above?

I’m still making my way through the trading system mentor course and haven’t reached the point of testing system ideas…probably getting a little ahead of myself, but this is interesting

Plunger AFL

This might give you a start. -

AuthorPosts

- You must be logged in to reply to this topic.