Forums › Trading System Mentor Course Community › Trading System Brainstorming › All Weather Discussion

- This topic has 100 replies, 13 voices, and was last updated 20 hours, 35 minutes ago by

GlenPeake.

-

AuthorPosts

-

August 13, 2023 at 2:19 am #102266

Nick Radge

KeymasterIn light of recent changes to my own retirement account structure, and others taking an interest, I thought I’d post some info and data on my research down the All-Weather rabbit hole which has been going on for about 8 – 10 months now.

The original concept of the All Weather strategy comes from the massive Bridgewater Hedge fund. You can read that full story HERE

Salem Abraham, once a pure trend following CTA, has also moved to the All Weather model with his Fortress Fund. You can read that story HERE.

And lastly, Tom Basso, also once a pure trend follower, has moved into the same style and has recently published his book All Weather Trader, although from what I hear, its quite a more convoluted way of doing things.

The portfolio is intended to be relatively simple and easy to implement, with a mix of stocks, bonds, commodities, and currencies or ‘alternates’. Alternates can be anything – it looks like Abraham uses his old CTA trend-following model, but you could use Bitcoin, a covered call ETF etc etc

The core of the All Weather portfolio is a combination of 30% stocks, 40% long-term bonds, 15% intermediate-term bonds, and 15% commodities. The specific allocation is meant to be relatively stable over time, which is achieved through regular rebalancing.

The return profile is moderate and stable return with low volatility and low drawdowns.

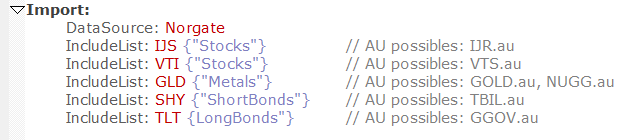

The following is an example that uses 5 ETFs, each of which has an equal allocation of 20%. Each gets rebalanced back to 20% at the end of the month (IBKR makes this very easy with their Rebalance Portfolio tool). This would be deemed very conservative, essentially a 60/40 portfolio.

This portfolio, as is, has a CAGR of 9.2% with a maxDD of -14.8%. A few tweaks to the portfolio weights could get a little more juice out of it.

An important aspect here is to be very careful with the selection of ETFs for two reasons:

1. Many ETFs have limited data

2. They open themselves up to curve fittingTo overcome #2 I have built my two strategies solely using the highest liquidity ETFs in each sector. I have now got two of these All Weather portfolios, the main one trades US ETFs and is what I’m using to manage my retirement account. The other is an Australian version that trades ASX ETFs and we’re essentially going to use that for Shartru advisors to put their clients into.

You can also improve the performance a little more by adding a simple timing tool, albeit that’s not the initial intention of the All Weather idea. However, it makes sense to me in light of major and sustained bear markets in these instruments, i.e. stocks in 2008 and bonds in 2022 (up until 2022, Bridgewater had a max drawdown of some 13%, which blew out to 28% because of the bonds rout)

My two versions both use a simple timing tool

US

CAGR: +19.3% maxDD -14.7%ASX

CAGR: +11.4% maxDD: -9.8%The code above is what I have been using, but you could also use standard rotation coding as well, especially if you had a larger universe of ETFs that you wanted to use.

Zach has been playing with an ASX version using the rotational code on all listed ASX ETFs. It holds 5 positions with a CAGR of 9.3% and maxDD of -10.6%

Anyway, food for thought and happy to answer any questions.

August 13, 2023 at 5:02 am #115714GlenPeake

ParticipantThanks for the insight/update Nick. I hadn’t heard of the All Weather portfolio until you started chatting about it.

August 13, 2023 at 5:40 am #115722Nick Radge

KeymasterHere is another type, called the Dedalo Four strategy, albeit starting to move away from the All Weather concept. It’s essentially an 80/20 portfolio, so 80% growth assets and 20% defensive.

It trades both the Vanguard Total US market and Vanguard Total World markets, plus the Vanguard International Bond ETF. In this example, I have added a timing tool, C > MA(C,200), to enter and exit.

CAGR: 9.3% maxDD: -10.9% (note: I have brought this one back into AUD)

If anyone knows, I’d like to know how to create a annualised volatility metric into the results table for RT

August 13, 2023 at 6:52 am #115723JulianCohen

ParticipantI think

Volatility: stddev(S.NetPct,20) * sqr (252)

I think that gives you 20 day annualised std dev

but maffs and spelink were never my strong point

August 13, 2023 at 4:01 pm #115715LEONARDZIR

ParticipantThank you for sharing Nick. Pretty exceptional results for a relatively conservative portfolio. As a timing tool do you mean using a moving average filter for each of the assets in the All Weather Portfolio? Any chance you will share the complete details of the portfolio in the US or offer it as a product?

August 13, 2023 at 9:50 pm #115716Nick Radge

KeymasterJulian – thanks for that. Works well

Len – unsure at this stage how we’ll move forward with the US version. In terms of a timing tool, just keep it simple. C > 200sma or ROC(C<240) > 0 etc

August 14, 2023 at 12:11 am #115726LEONARDZIR

ParticipantThank you Nick.

August 14, 2023 at 8:29 am #115727RobertMontgomery

ParticipantNick,

Thanks for sharing your research and insights as I find this type of strategy fitting my risk tolerance and lifestyle at the moment.

Tom Basso is listed as the Chairman of the Board for this fund https://www.standpointfunds.com/fund … posting returns similar to the above. https://www.standpointfunds.com/fund

Does anyone have the performance data for the Bridgewater fund?

The Abraham fund returns are here as well. https://www.abrahamtrading.com/performance-archive

August 15, 2023 at 2:37 am #115717LeeDanello

ParticipantFirstly, many thanks Nick for sharing, tis something I’ve been considering from an SMSF perspective as well…much appreciated.

With regard Australian ETF equivalents would anyone have come across a reasonable resource for matching, or not as the case may be, US to AU ETFs?

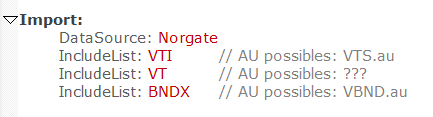

With regards the scripts above, I’ve just started to research and have identified the following as possible candidates to explore further…welcome any thoughts as to reasonableness.

August 15, 2023 at 3:26 am #115728

August 15, 2023 at 3:26 am #115728Nick Radge

KeymasterThere is a full list of Australian ETFs here

https://www.marketindex.com.au/asx-etfs

As stated, be wary of history. I should add that liquidity can be deceiving. Most of these ETFs will have market makers that can and will step in to make a price.

In terms of using AUD ETFs as per my code, you would go:

IncludeList: STW.au>STW

IncludeList: BOND.au>BOND

IncludeList: GOLD.au>GOLDThen

AllocSTW: 0.333

AllocBOND: 0.333

AllocGOLD: 0.333August 15, 2023 at 2:34 pm #115729LEONARDZIR

ParticipantNick , in your twitter post you mentioned that you added BTCUSD as one of your assets in your all weather portfolio. Is there an ETF that you use or are you trading BTC directly with an outfit like Coinbase? Thanks

August 15, 2023 at 9:47 pm #115730Nick Radge

KeymasterBITO is the ETF ticker.

Prior to its inception use BTCUSD as a proxy (ensure you use a large start capital to facilitate the high price of BTC)

August 15, 2023 at 10:20 pm #115731LEONARDZIR

ParticipantNick, Thanks again.

August 17, 2023 at 8:27 pm #115718ScottMcNab

ParticipantThanks for sharing Nick. It would seem to lend itself to replacing the stock etf component with a simple 5 stock EOM rotational system on XTO or NDX perhaps…moving away from all weather type of system again but still relatively low effort….guessing bump for both cagr and maxDD…something for the weekend

August 17, 2023 at 11:48 pm #115733Nick Radge

KeymasterAn interesting idea Scott. That could be run as a standard rotational.

One thing I would be mindful of is the monthly rebalancing between the stock component and all other components. That could be challenging from a coding perspective, albeit I’m sure it could be done. The other is that we’d want each stock component rebalanced each month as well. From what I can gather, the constant rebalancing is what keeps the volatility low. -

AuthorPosts

- You must be logged in to reply to this topic.