Home › Forums › Trading System Mentor Course Community › Psychology › A Quick Word

- This topic is empty.

-

AuthorPosts

-

October 11, 2018 at 11:30 pm #101854

Nick Radge

KeymasterA nasty week in the markets.

After hitting new equity highs in recent months, my portfolio’s are now in drawdowns of between -8% and -14%.

Though they all remain within the realms of normal operations.

It’s a reminder that trading isn’t comfortable. Indeed it can get downright uncomfortable at times. If it were easy all the time then everyone would be doing it and be successful at it.

That’s part of the reason why 90% fail.

Those that succeed learn to dilute that level of unease when things go awry – and it happens to all great investors and traders. I spent many years years looking at the track records of all the greats – and they ALL go through periods of drawdown, self doubt, angst and being uncomfortable.

Buffett was written off in the late 90’s – his style outdated. He was too old. Dunn was written off after the GFC when he had a 60% drawdown. Druz, Parker, Abraham, Soros, et al.

They all go through periods of doubt and uncertainty.

But they persist.

They’re able to remove themselves from the monetary side of the equation and focus on the process, knowing that the process will generate the money over the longer term.

That’s the trick right there.

It’s also why the common saying: “Don’t trade with money you can’t afford to lose”.

It’s not actually about losing the money. It’s so you don’t become emotionally attached to the money and when you become detached from the money you’re more likely to follow the process.

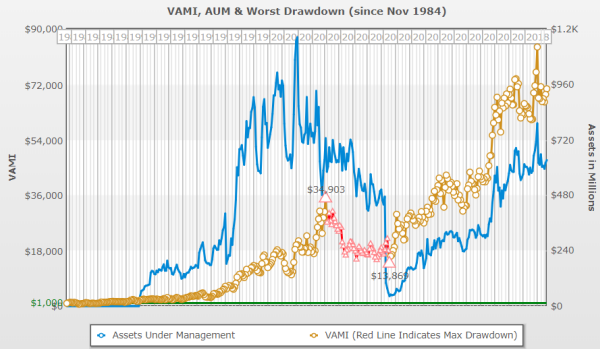

Here’s an interesting chart of Dunn Capital Management^. It overlays assets under management (blue) against equity growth (gold).

Notice the correlation?

I’m going to leave you with two thoughts.

Firstly, in reference to the above chart that provides an insight into a well phenomena of investor psychology; money chases performance. They pile in at the top and out at the bottom.

The exact lesson here?

If you have a strategy with a long term positive mathematical expectancy, you should be investing more when a significant drawdown takes place. Not exiting the strategy – which is what most people tend to do.

Secondly, if you sit at home and watch prices tick down against your portfolio then the little voice inside your head starts to speak at you. That’s normal.

But you need to distract it.

Take a more earthy approach.

Go for a hard run. Do something that will get your mind right off it. I do Crossfit, and during days like we’ve had this week I hit it damn hard.

But, I come back and follow the process. There is no money in my picture.

Nick

P.S. Remember, the best time to actually invest in a strategy with a long term positive expectancy is during a drawdown.

October 12, 2018 at 12:00 am #109271GlenPeake

ParticipantCheers Nick. Well said!!! Wise words as always!!

A feel sorry for your Crossfit weights/kettle bells etc

I’m actually in a really positive frame of mind atm, even with all the volatility etc. I have a new trading system which went live this week (timing is everything :cheer: ), but with the knowledge I’ve acquired via yourself/Craig and the Mentor Course, I know I have a trading system that is diversified and stress tested to the best of my abilities and have confidence in, so when times like this come around, I can pull the trigger each and every time.

Following the process and placing my orders again tonight without any hesitation (looking forward to it). :cheer:

Results since going live this week with my MOC.

Day 1: no fills

Day 2: down -6.6%

Day 3: down -0.3% (I expected a bigger decline when I woke up this morning and saw the DOW close negative again, but what do I know :cheer: …I should probably remind myself not to have any expectations )

)Cheers

Glen -

AuthorPosts

- You must be logged in to reply to this topic.