Find a strategy. Validate It. Do It. That’s the key!

Find a strategy. Validate it. Do it. That’s the key to trading and investing success in a nutshell.

However, there are many myths that swirl across the online trading world about what works and what doesn’t so it’s very important to validate.

As an example let’s look at the Bearish Outside Reversal Day (BORD) which is a pattern commonly accepted as one that switches the trend from up to down, i.e. prices should fall after this pattern occurs. A BORD is a two-day pattern where the second day has a higher high, a lower low and a lower close from the day prior. But is it a valid bearish setup?

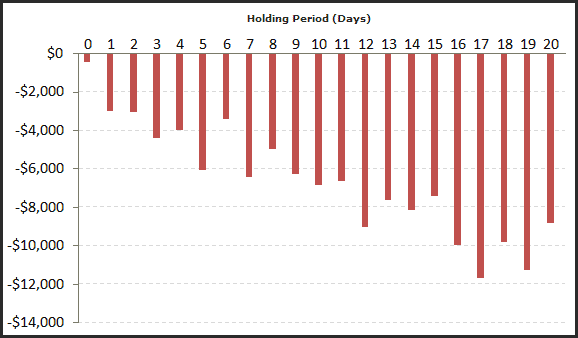

Let’s put it to the test and see what an unbiased computer simulation shows. We’ll await the pattern, sell on the next day’s open and measure how much profit we’ll make from the fall over the next 0 to 20 days. For this test we’ll use the SPDR S&P 500 ETF ($SPY) back to 1993.

The table below clearly shows there is actually no downside movement at all. Holding anywhere from 0 days through to 20 days creates a loss. Myth busted!

Source: Premium Data

But let’s think about that for a moment. If there is no profit from selling, is there profit available if we do the exact opposite, i.e. buy instead? The answer is yes. Here are some simple rules:

Setup: Today’s high is greater than yesterday’s, today’s low is lower than yesterday’s and today’s close is lower than yesterday’s.

Trigger: Buy tomorrow at today’s low on limit. Example, if today’s low was 195.0, then buy tomorrow at 195.0 limit.

Exit: Close the position on the next open after the first positive close. Example, if today’s close was 195.0 and yesterdays’ was 193.0, then exit the position on tomorrow’s open.

Below is the equity growth of $10,000 back to 1993 without any profits reinvested. You can see it’s a steady climb higher without any significant declines – even during the GFC. The winning percentage of trades exceeds 72% with a win/loss ratio of 0.88. The Profit Factor is high at 2.30.

Source: Premium Data

Like our $GDX strategy from last week, this is elegant in design and appears quite profitable. However, we need to put these systems through more of a stress test to ensure they’re actually robust and fit for trading. We’ll do that next week.

Not getting our weekly newsletter? Join Here.