Fear, Attention and Volatility

In markets, there is a well observed phenomenon known as Asymmetric Volatility whereby declining stock prices are met with increased volatility. Perhaps that seems obvious to you, as volatility is driven by uncertainty, but why do people tend to react disproportionately to losses compared to gains? This is known as loss aversion, in which individuals tend to perceive a loss as far more severe than a gain of equal proportion. To put that into numbers, most people would experience far more pain from a 5% loss than they would joy from a 5% gain.

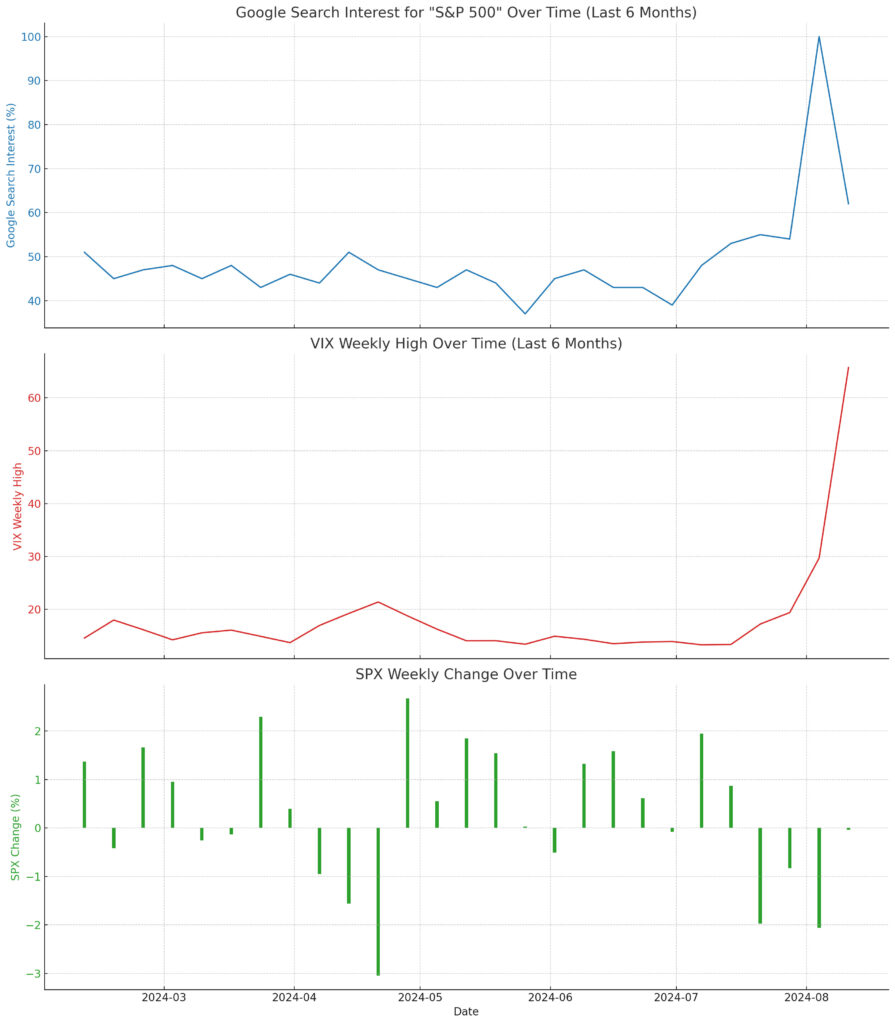

Another effect of this loss aversion is the attention investors pay to news. Individuals appear to seek out and pay more attention to negative news than positive news and react accordingly. Using Google search trend data, we can see that increases in the VIX Volatility Index correlate with searches for “S&P 500” an indication that as volatility increases, so too does attention to the market. We can then compare this to the change in the market returns and see that this attention and volatility correlates negatively with market returns.

Likely what we are seeing here is loss averting retail investors scrambling during market downturns and looking for guidance. We can see this especially well during last week’s massive falls in the Japanese markets, as search interest and volatility both rocketed.

Our advice in these situations is always the same; before you begin trading a strategy, come up with a plan, then stick to the strategy that has been tried and tested, as it will have already accounted for situations like this. Panicked decisions under pressure often lead to regret.

Take our 2 week free trail to explore our tried and tested strategies so you too can invest with confidence!