Dealing With Takeovers

How to deal with takeovers…..

One of my slogans is, “If you trade long enough, at some stage you’ll get a slap across the face“.

In other words you’ll be riding a nice trend higher, then out of a blue something happens and a large gap down wipes out gains and puts you into a loss.

Get over it.

Because the other side also occurs, namely, ‘If you trade long enough, sometimes you’ll get lucky“.

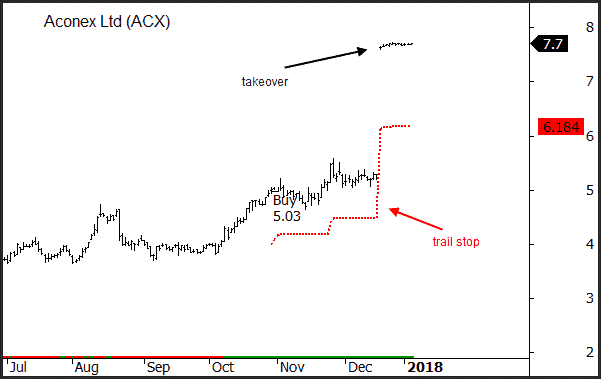

The Growth Portfolio recently initiated positions in Aconex Limited (ACX). A month later a takeover offer some 50% higher was announced.

We got lucky.

In many instances these takeovers take time to be approved. In this case it won’t be until March 2018.

That’s a long time for cash to be tied up without any upside – especially when the market is moving steadily higher.

But there is also a chance a counter offer comes in and boosts the share price even further.

So how do we manage these trades?

Our research and extensive experience suggests, more often than not, a counter offer will be made within the first two weeks of the initial takeover offer.

Once a takeover is announced we wait 2-weeks. If no counter offer takes place we exit the position and allocate the cash to a new trade.

In strong markets it’s important to ensure you work your cash as hard as possible. Letting it sit for an additional 3-months with minimal upside potential is not optimal.

So allocate it elsewhere and potentially get on board a new trend.