Could I Trade a Leveraged ETF?

I received a question from a member of our Trade Long Term service and I feel it’s worth investigation.

Is it possible to simplify the Trade Long Term strategy by just trading a leveraged ETF rather than the individual stocks?

As I always say, let’s test it.

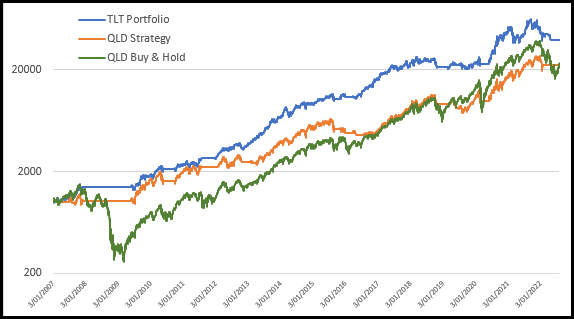

For this exercise we’ll compare the existing Trade Long Term (TLT) strategy (monthly signals) with the ProShares Ultra QQQ (QLD) ETF. In laymans terms, QLD is a leveraged ETF that is heavily weighted to technology stocks, like the ones we trade in the Trade Long Term portfolio. Using a leveraged ETF gives better ‘bang-for-buck’ than a regular index tracking ETF. But also means greater volatility and deeper drawdowns.

This ETF was listed in late 2006, as such the test start date is January 1st 2007. We’ll invest 100% of our capital into the ETF and buy or sell based on the TLT strategy regime filter.

The standout feature from this equity curve is the massive drawdown during 2008. The TLT strategy and the QLD strategy comfortably sat on the sidelines protecting both financial and psychological capital.

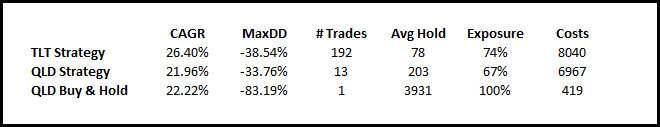

Here’s the hard data.

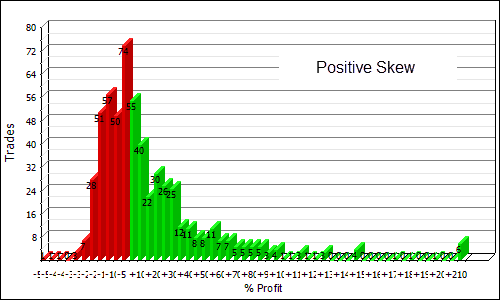

Nothing really surprising with the results. You will never beat the index trading an index ETF. Although perking up the return profile by using a 2x leveraged ETF is certainly a way to go. What can be seen is a solid reduction to the drawdown and therefore a considerably better risk adjusted return.

Another insight is that I optimised the regime filter for the QLD and found that the default TLT regime filter is almost spot-on optimal.

In summary, a good result for someone looking to simplify the process although a 5% per year reduction in performance will certainly add up over time.