Can the presidential party predict the market?

There has been a lot of talk in the past week about political parties, policies, and their effect on stock market returns. Now, I’m not an economist, and I don’t want my inbox to explode, so I’m not going to talk about any specific economic policies or interpret anything as either good or bad. Rather, let’s look at some high-level historical data and see if we can interpret some patterns based on that data.

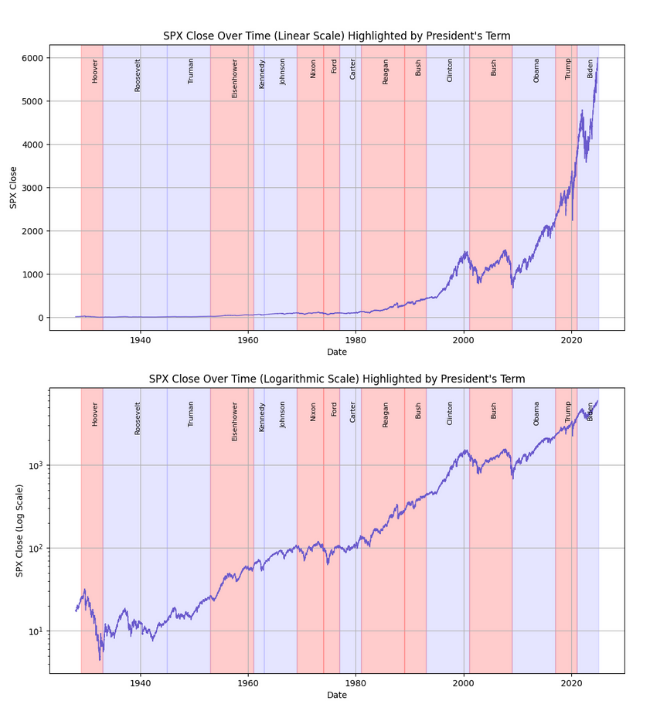

The charts below show the S&P 500 closing price over time plotted on both a standard linear and a logarithmic scale. For our purposes here, the logarithmic scale is more useful as more recent exponential data can appear misleading on a linear scale. At a high level, what this chart shows us is that on the whole, over long periods of time, the market progresses upward. Whilst there are some obvious falls and flat spots, most are recovered within that president’s term. Only three presidents, all Republicans, across this time span finished their term with the S&P 500 lower than when they started; they were Hoover, Nixon, and George W. Bush.

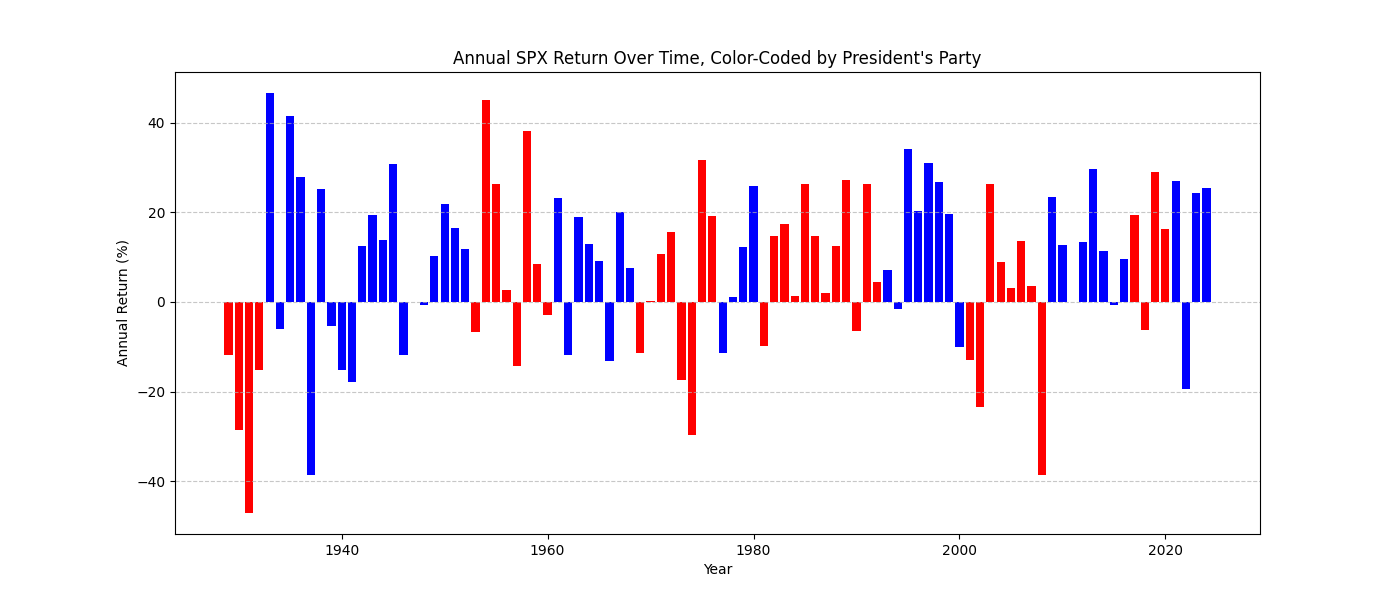

Now let’s take a look at the S&P 500’s annualised return over time. What is immediately clear is that regardless of the president’s party, the majority of years fall into the positive category. Across the time span below, 67% of years showed a positive return. Narrowing that down to party affiliation, 62.75% of Democrat years were positive compared to 71.11% for Republican.

All of this is to say, that there is no clear direct relationship between the president’s political party and the performance of the S&P 500. Market performance is determined by far more than just surface level party politics, but rather by specific domestic policy, global events, geopolitical relationships, and many other factors. What is clear, is that over time, regardless of the party in power, the S&P 500 trends upwards over long time spans.

To view our tried and tested portfolios and their returns over multiple presidential cycles. Take a Free 14 day trial of The Chartist Pro (AU & US) membership HERE to view our Systematic Portfolio Guidebook.