Buying Overnight vs During the Day

Let’s test buying overnight vs during the day. It’s a well-known anomaly – that gains in the S&P 500 occur overnight as opposed to during the day.Specifically I’m comparing buying the open and selling the close vs buying the close and selling the following day’s open.

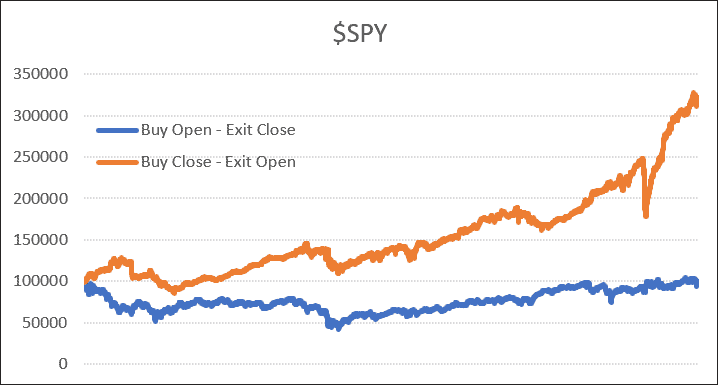

Chart 1:

The following chart shows the net distance the S&P 500 ETF (SPY) moves during the day, i.e. from open to close, vs the night move from close to next day’s open.

Since 2000, the net daily move has been zero, compared to the overnight change of 228%.

Before you get too excited, holding overnight is a 5.4% return before commissions are included. It’s an interesting anomaly but not worth trading given the results when commissions are included.

Above I mentioned the difference between holding during the day vs holding overnight.

Within the feedback I received it was mentioned that my results were ‘below’ what was shown elsewhere and that I had inadvertently run the exercise without dividends. As a rule of thumb I never test short-term strategies with dividends switched on, but in this case it’s an oversight that needed to be accounted for.

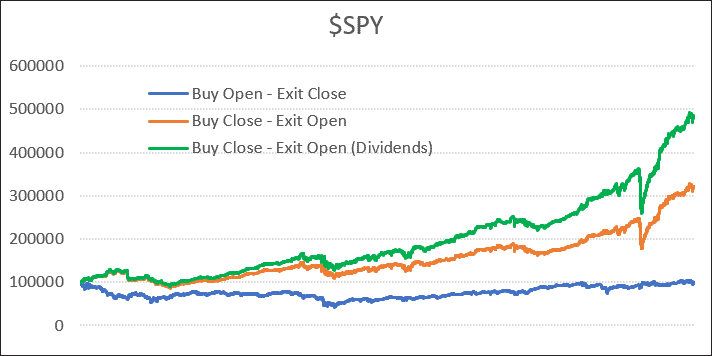

Chart 2:

So, here’s the updated version with dividends now included and thanks to those that pointed it out.

I also received a message from Tim C., an old trading floor buddy. Tim wrote:

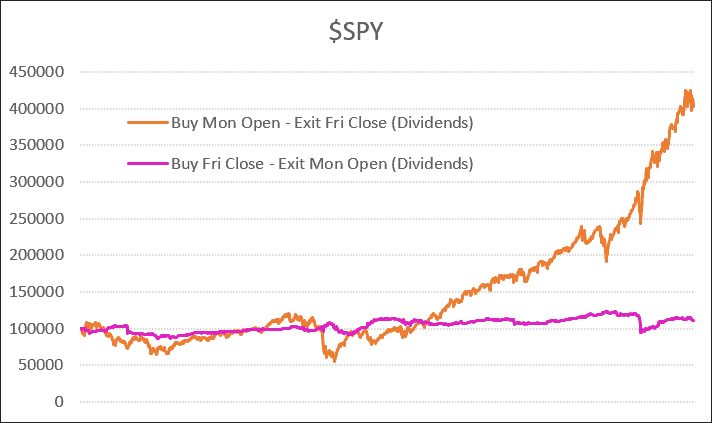

“This O/N v Day data is something I work on a bit and find fascinating.Another interesting one… I remember about 2014 testing buying SPI on Friday close and Selling Monday Open versus Buying Mon open and selling Fri close. The result was mind boggling if I recall. The Weekend trade way out performed buy and hold over the same period.”

Aligned with our current discussion we’ll test the theory on the S&P 500 ETF (SPY).We’ll buy Monday open and exit Friday close and compare with the weekend anomaly of buying Friday close and exiting Monday open.

In this case the standout winner is holding for the week rather than just the weekend.

Testing this theory on the Australian market may well have merit as well, as Australia will tend to react more on a Monday open after a Friday night move out of the US. Anyway, that’s something for another day.