Buy and Hold: Is keeping it simple the best strategy?

Buy and hold is one of the oldest and most common trading strategies around. If the name didn’t give it away, buy and hold trading is when you buy a handful of value stocks and then sit on those stocks for long-periods of time, usually decades.

Buy and hold investing has long been a favourite of Australians, particularly older generations, as ASX companies tend to pay out higher dividends than US counterparts, and these dividends are taxed differently to capital gains or income due to franking credits and other considerations. Additionally, in Australia, stocks held for longer than 12 months receive a 50% discount on capital gains tax owed.

Those using a buy and hold strategy for the above reasons will generally be looking for large, stable companies, those that have been around for a long time with steady profits and tend to pay reasonable dividends.

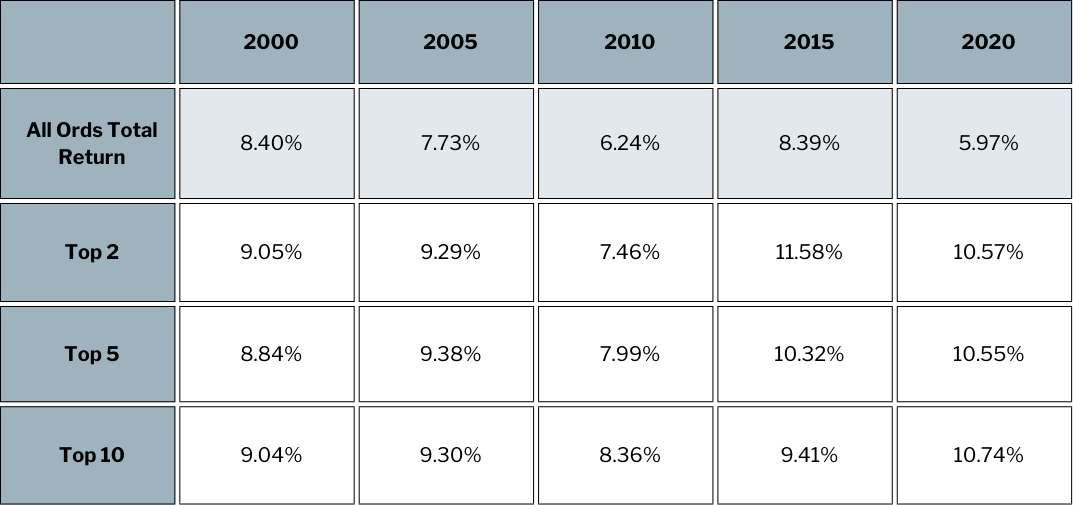

So how have buy and hold strategies fared over the years? Let’s do some backtesting to find out. We’ll run a series of tests buying the top 2, 5, and 10 ASX stocks by market cap at the time, then holding from then to now, to see what the CAGR is. We’ll reinvest any dividends straight back into the strategy to further compound the growth.

Across all periods and positions, the buy and hold strategy outperformed the larger ASX All Ordinaries. While I can’t say for certain, one of the reasons for this is likely tied to the stability of the top ASX companies. Looking under the hood, the top 10 companies by market cap remained largely unchanged across the time period. The stalwarts are notably comprised of large miners such as BHP and Rio Tinto as well as the big four banks, well-established companies that aren’t tied to fads or specific technology. These companies have survived many market cycles.

There are, of course, exceptions to this, such as Telstra. Which topped the list in 2000 but fell off after the DotCom bubble, or AMP, the only company from the 2000s batch to post a loss after 25 years.

But what we haven’t addressed yet is the drawdown. The buy and hold strategies from 2000 and 2005 all saw maximum drawdowns in excess of 50% during the GFC. As with any strategy, the question is, would you be able to hold your positions when their value declines by 50%? And if it did lose 50% of your capital, do you have the time and patience to wait 5 years to get back to breakeven?

This is the reason we introduced our All Weather portfolios, to provide a simple trading strategy that outperforms the market while greatly reducing the associated drawdowns. By moving away from stocks during market downturns and reallocating to stable assets such as gold and bonds, we can smooth out the equity curve across longer time periods.

You can view all of our portfolios and their metrics while on our 14 day Free Trial.