Big Trends in Big Stocks

When interest rates stay at lower levels we expect more money to flow into risk assets such as equities. In 2014 we saw higher yielding stocks benefit from this, and this is what we considered at the time:

There is a lot more upside to come as that money moves further into the smaller cap area of the market, as has been the case in the US markets over the last few years

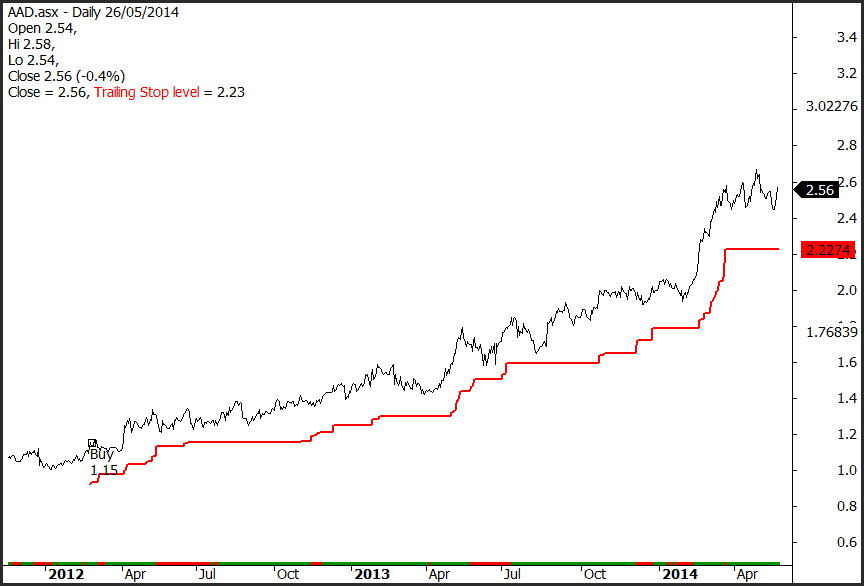

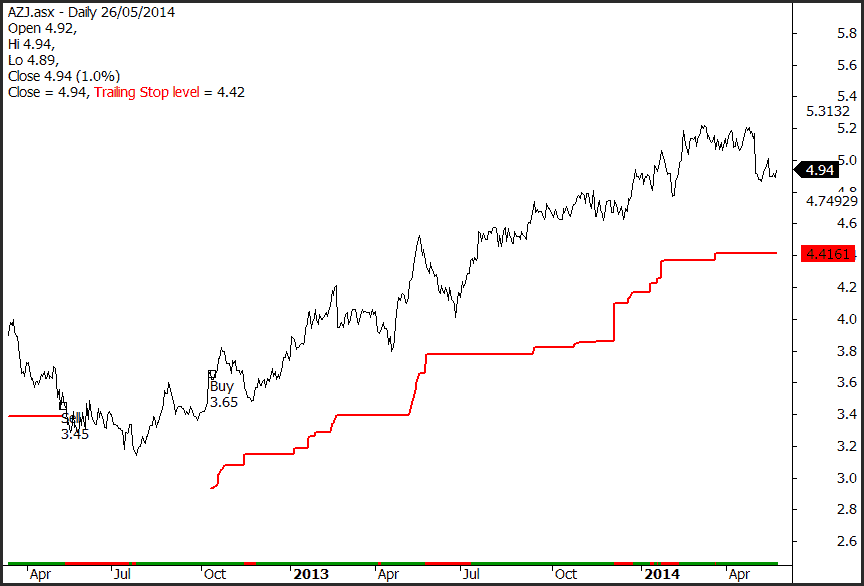

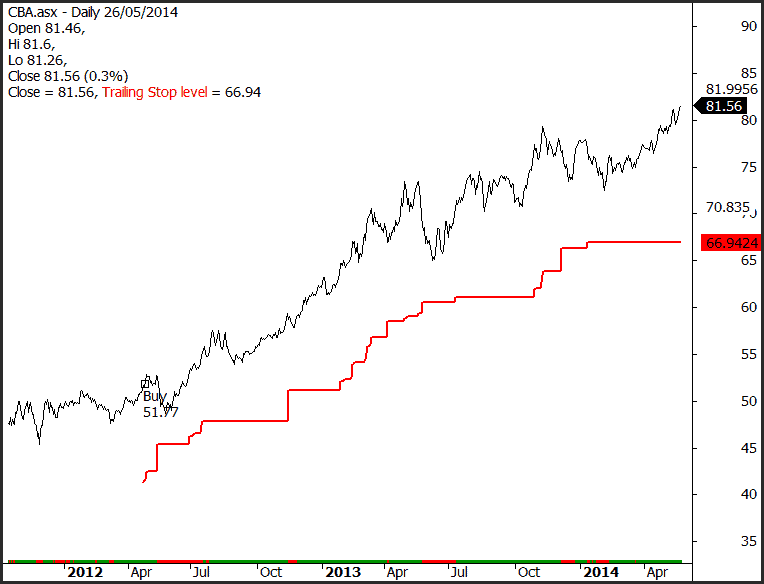

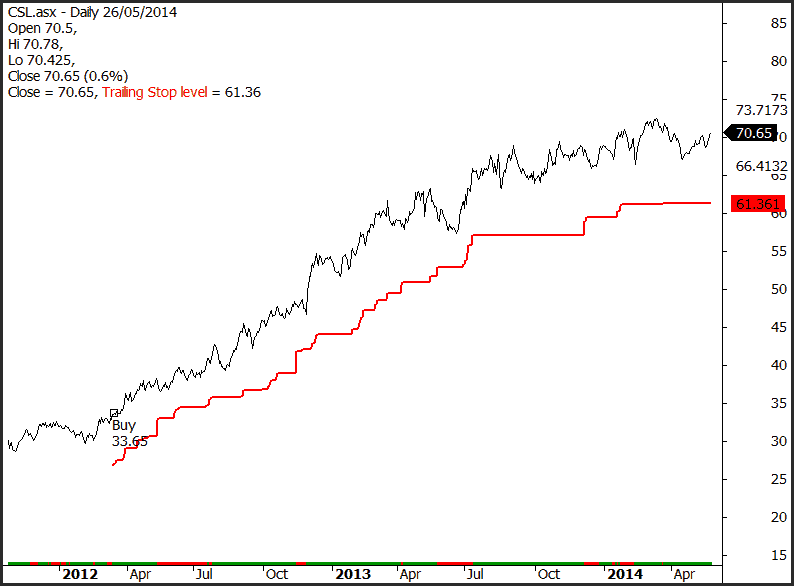

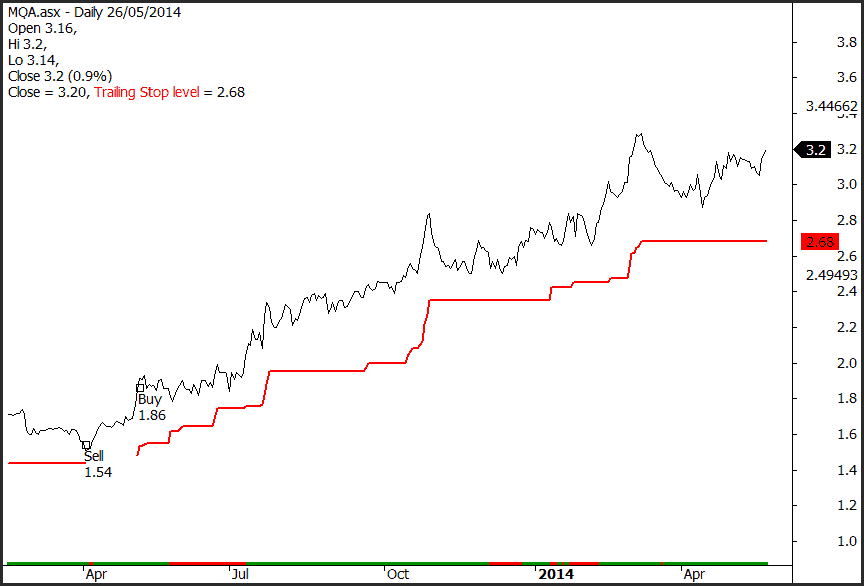

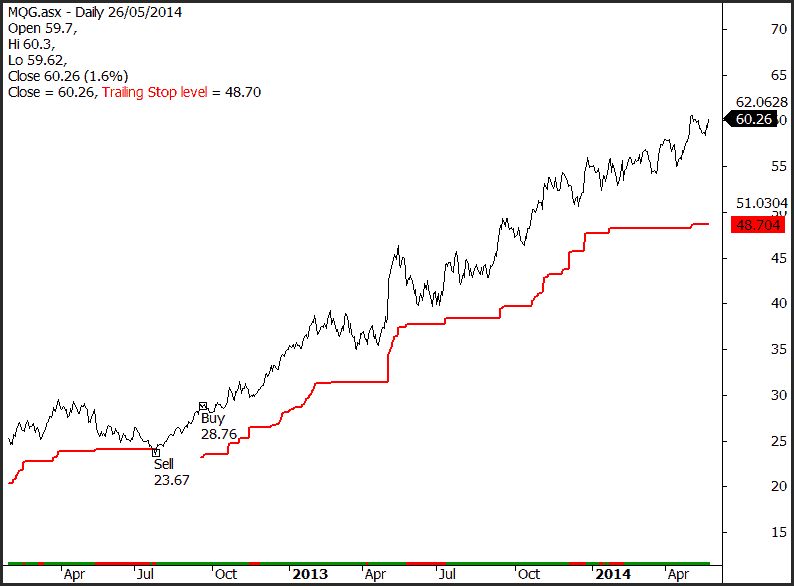

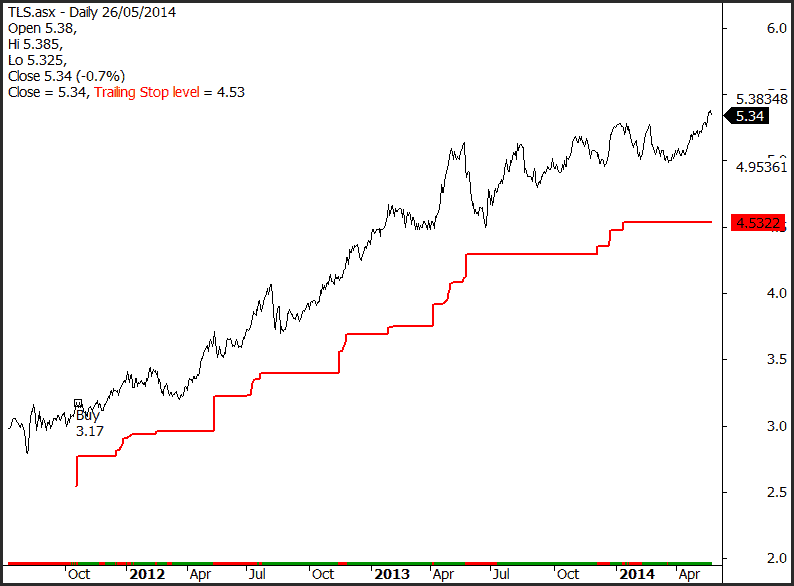

Using an active trend following strategy, which is fully discussed in Unholy Grails and shown in real time via our very popular Growth Portfolio service, is an extremely time efficient way to manage your assets. Stay with stocks as they trend higher, and many times travel well above their so-called theoretical valuation levels.

Here’s some examples that our clients are currently profiting from (the red line is our exit point should the trend reverse)¹.

Ardent Leisure (AAD)

Aurizon (AZJ)

Commonwealth Bank (CBA)

Learn why the Growth Portfolio can help you.

CSL Limited (CSL)

Macquarie Atlas (MQA)

Maquarie Group (MQG)

Telstra (TLS)

A small investment can make a huge difference to your investments.

¹ Past performance is not indicative of future returns.