Be your own Fund Manager

Last week, we successfully launched our new course titled “Beginner’s Guide to Building Trading Systems,” and I’m thrilled that the response has exceeded our expectations. The level of interest and feedback received so far has been incredibly positive. I am excited to witness the progress of each participant as they develop their own unique strategies.

Today, I would like to explore several ways you can leverage the course, RealTest software and the all-important Norgate Data to fulfill your aspiration of managing your own money in a more systematic way. There is an undeniable satisfaction in constructing your own strategies that outperform established market players. Why pay management fees to others when you have the capability to do it yourself?

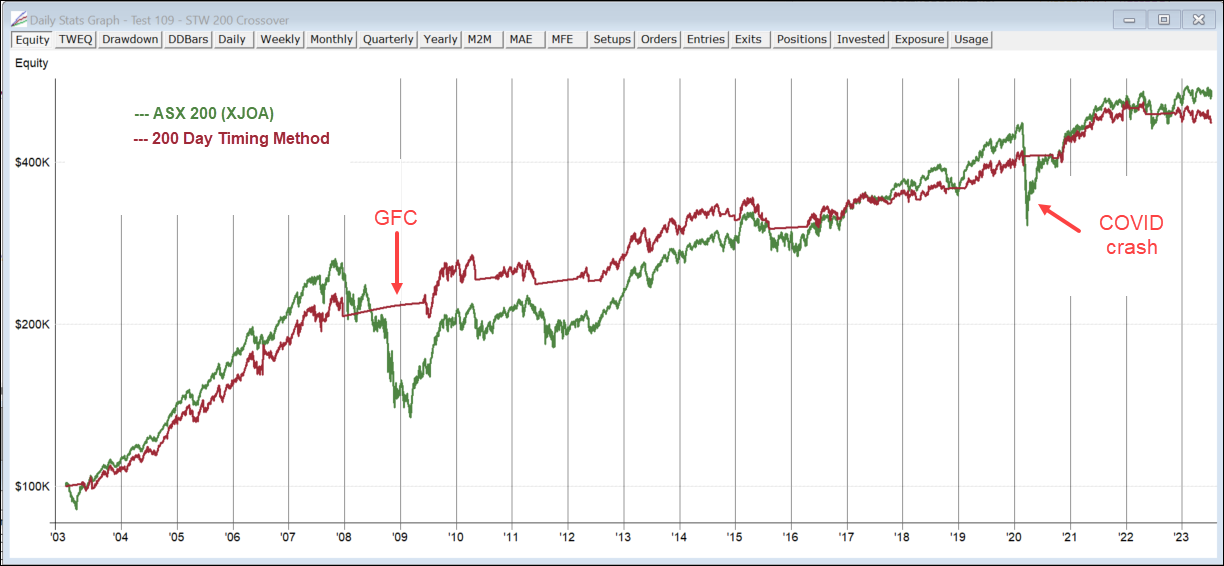

200 Day Timing Method

Back in 2009, in the wreckage of the GFC, I received quite a few requests from financial planners looking for ways they could passively grow their client’s assets yet protect the downside to some degree when things went awry.

A simple yet robust way to do this is to add a timing tool to the index ETF, in this case we’ll use the Australian ASX-200 ETF (STW). When the close of the STW is above its 200-day simple moving average, we’ll invest 100% in the ETF. When it closes below the 200-day, we’ll move to cash using the Reserve Bank cash rate.

The equity growth chart above shows a CAGR of 7% for the strategy, not quite as much as buy and hold. However, you can see that during the GFC and the COVID crash, the strategy took a defensive stance and went to cash. During the GFC, the strategy had a maximum drawdown of just -14.9% compared to the index of -49.4% and during COVID, the maximum drawdown was -6% vs. -32% for buy and hold. Job done.

Download the STW 200 Crossover code HERE.

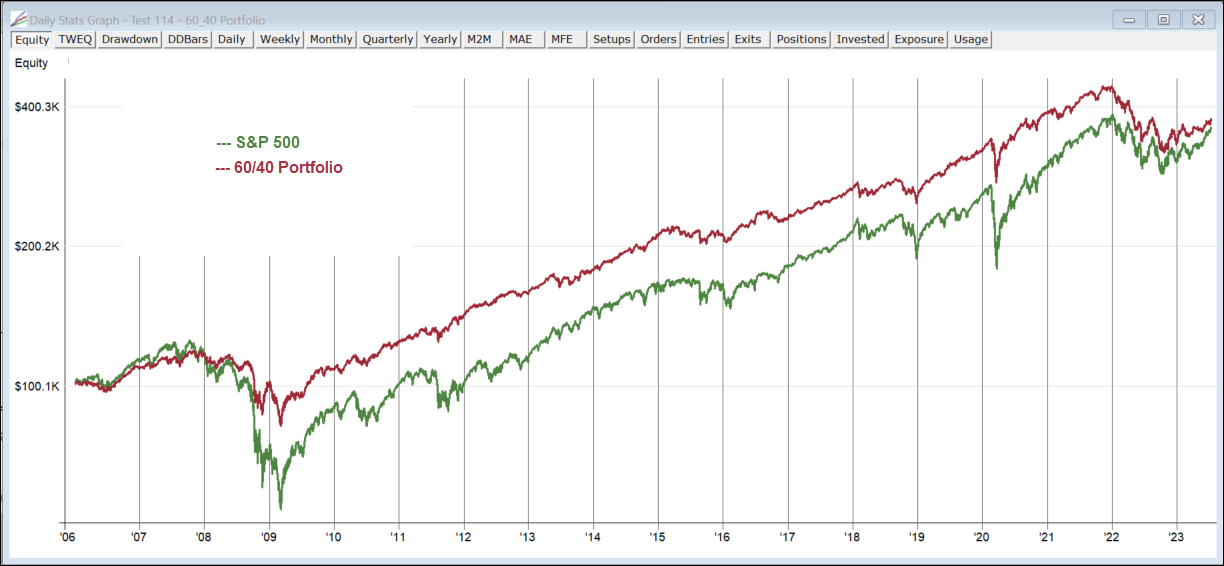

60/40 Portfolio

Another popular strategy that financial planners use, especially those that don’t believe in timing the market, is the 60/40 Portfolio. This investment strategy allocates 60% of the portfolio to stocks and 40% to bonds. This approach is based on the principle of balancing risk and return by diversifying investments across different asset classes. When the stock market performs well, the equity portion of the portfolio can generate significant returns. In times of market volatility or economic downturns, the bond allocation can help mitigate losses and provide a more reliable income stream.

The 60/40 Portfolio remains invested all the time, yet rebalances once a month. For this exercise we’ll use the Vanguard Total Stock Market ETF (VTI) and the iShares Treasury Bond ETF (TLT).

The equity growth chart above shows the 60/40 portfolio did mitigate volatility to some degree. In 2008, equities fell -37% while the 60/40 Portfolio ended the year down -13.4%. However, in 2022 persistently elevated inflation and aggressive central bank tightening campaigns put financial markets under significant pressure and gave investors nowhere to hide. The 60/40 Portfolio fell 22% compared to global stocks -19.5%.