Australian Banking Outlook 2018

Fundamentally Australian Banking stocks are under pressure.

They smashed out more than $30 billion in combined earnings in 2017.

Yet are these former darling growth and dividend providers going to be the dogs of 2018?

There’s nothing like a Royal Commission to bring upside momentum to a grinding halt.

Let’s use a ‘bake a cake’ analogy to explain.

On top of the Royal Commission let’s add into the mixing bowl rising bad loan charges, slowing asset growth and higher funding costs.

Then add intensifying competition for deposits, property prices potentially taking a breather in Sydney and Melbourne and a retail sector continuing to struggle.

The bowl is starting to get a little heavy.

But we’re not done yet.

We also want to add in household debt at around 200% of disposable income, combined with a pinch of low wage growth.

When we put this cake into the oven it may rise as it always has and everything should be business as usual.

But add in higher interest rates and deteriorating labour conditions.

Banks will be under more pressure in relation to bad loans. A loss of reputation and lower confidence by foreign investors.

Suddenly our cake has turned into a pancake.

It isn’t going to rise again until we can reduce some of the bad ingredients and start adding some sprinkles.

It’s going to be a big year for the Banks. Commissioner Hayne expects a summary of known misconduct by the end of the month.

So should we be investing in the Australian Banking sector in 2018?

The Chartist’s ASX Chart Research provides a fundamental and technical outlook on the banking sector and where it’s heading, combined with trade recommendations as they become available.

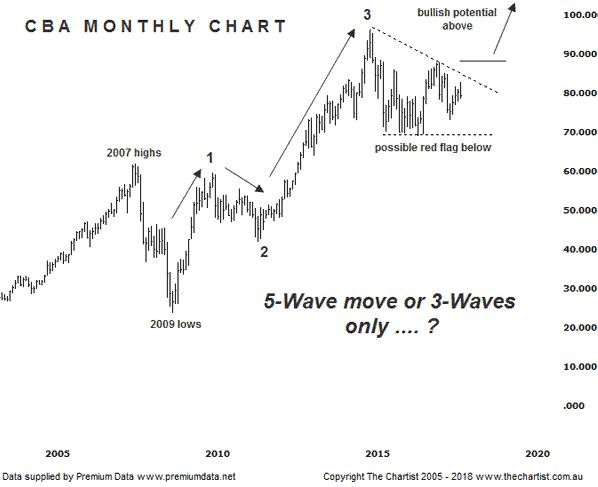

The CBA monthly chart below is a classic example of what we’re currently looking at technically from a longer term view.

The technical picture remains constructive, albeit prices are in a large consolidation stage that may last through 2018. It’s imperative for the longer term bullish argument that price remains above $60.00. Any probe below, places the stock into a much larger corrective move where new highs will not be seen for several years.

2018 is going to be a defining year for the Australian Banking Sector.