Are you Ready to Diversify into the US Market?

Long-term readers will know a key philosophy of mine is to diversify across strategies, markets and even time frames. Trading just two strategies on two markets can greatly enhance diversification and equity growth over the years.

This week, let’s take a look at the US Momentum portfolio which nicely goes hand-in-hand with the ASX monthly strategy

Once again, it’s a systematic strategy meaning there is no human emotion involved. Being a complete portfolio we tell you which stocks to buy, how many shares of that stock to buy and when to sell. There is no guesswork.

How does a monthly strategy work?

The US Momentum Portfolio is an active investment strategy that attempts to keep users fully invested when the market is rising and automatically revert to cash during sustained bearish markets such as witnessed during the GFC.

The strategy derives its buy and sell signals using non-disclosed mathematical algorithms tested by Nick Radge over many years of data and market conditions.

To generate above-market returns using the US Momentum Portfolio, it is recommended the user apply the strategy for a minimum of 3 years to gain exposure to a full investment cycle.

How does the US Momentum portfolio work?

The US Momentum Portfolio trades once a month and does not require any monitoring during the interim periods.

Signals are generated after the close of business on the last trading day each month.

Existing positions that do not meet the new months’ signals will be sold on the next open. Any new position to be added to the portfolio will be bought on the next open.

The number of positions will vary each month with a maximum of 20. Sometimes the portfolio may hold excess cash.

What’s the Perfomance?

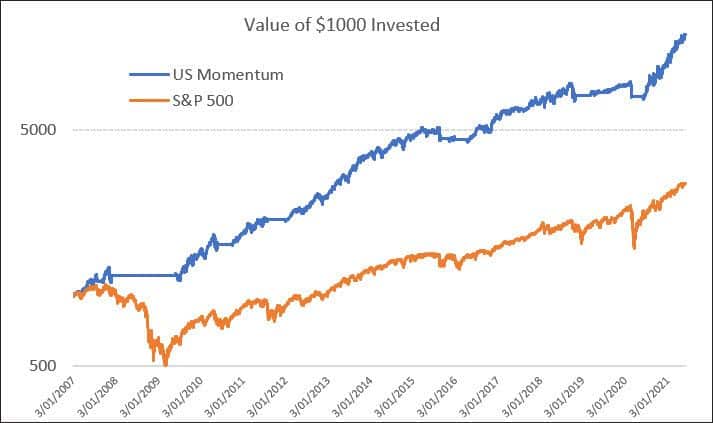

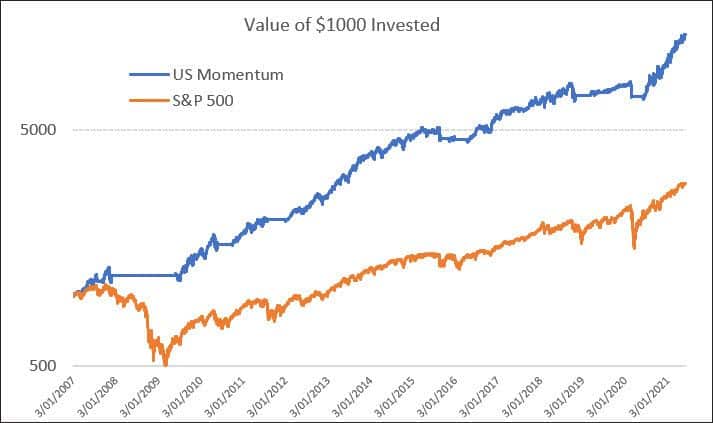

The US Momentum has an annual return of 19% with a maximum drawdown of -20%. The chart below shows simulated equity growth from 2007 onward. ^Refer to the Performance Disclaimer below

FAQs

What kind of returns does the strategy have?

The US Momentum shows an annual return of approximately 19%^ with a maximum drawdown of -20%.

Does Nick Radge personally trade this strategy?

Absolutely.

When do you buy?

Buy ALL stocks listed to become 100% invested when you start following the strategy.

What broker do you use?

We use Interactive Brokers for this portfolio but you can use the discount or online broker of your choice.

Do I need to convert my local currency to US dollars?

That will depend on the broker. Interactive Brokers will allow you to keep your local currency and they’ll convert to US dollars when the trade is executed.

Do you use leverage?

No.

Do you trade short?

No. Research and experience show that being in cash is more stress-free than attempting to trade bear markets.

How much does the US Momentum cost?

The US Momentum is part of our The Chartist US or Pro memberships which start at $1200 incl. GST for a 12-month membership.

What payment methods to you accept?

Payment is via credit card however we can also provide an invoice if you would like to pay via bank deposit.

Is the membership tax deductible?

Check with your accountant or tax advisor.