A Timeless Strategy To Bulk Up Profits – Part 2

We laid some basic framework to position sizing, specifically how being selective with position sizing can greatly enhance profitability.

How exactly is this done?

Long term readers will be aware of the Bang For Buck filter which I developed back in the late 90’s. The initial goal was to select one stock over another when too many opportunities existed and not enough capital.

Over the years however I have realised this filter can be used in an entirely different manner, specifically as an entry hurdle within a trading system itself.

Let me use a visual example to explain.

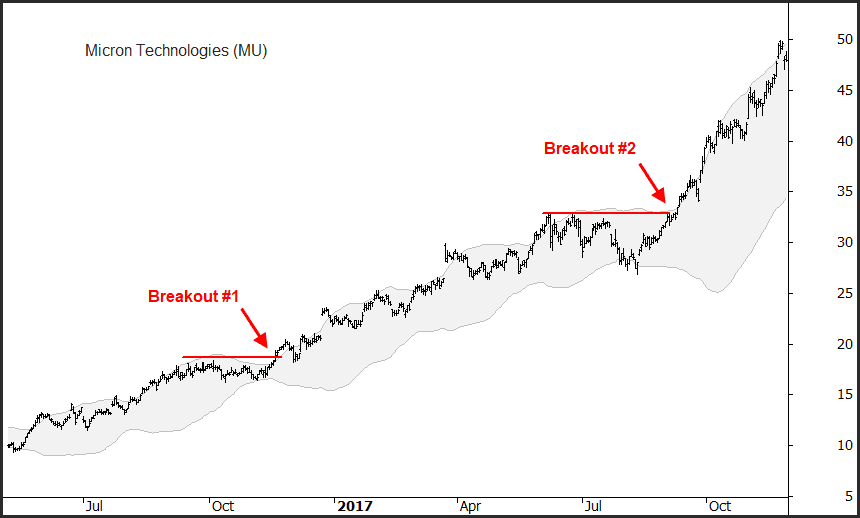

The following chart shows Micron Technologies in a steady uptrend. I have overlaid a simple 50-day Bollinger Band cloud.

There have been several sideways consolidations before the trend resumed. In both the instances shown a profitable trade would have developed, but Breakout #1 would have been substantially more profitable than Breakout #2.

Why?

The Bollinger Band cloud highlights the volatility of the share price. Therefore…

The higher the volatility (wider bands) the greater the distance from the entry point to the initial stop loss point.

Higher volatility = smaller position size = smaller profit.

The lower the volatility (tighter bands) the lower the distance from the entry point to the initial stop loss point.

Lower volatility = larger position size = larger profit.

The Bang For Buck filters the relative volatility of the stock in comparison to it’s closing price so it will automatically provide us with trades offering a bigger reward for the same risk.

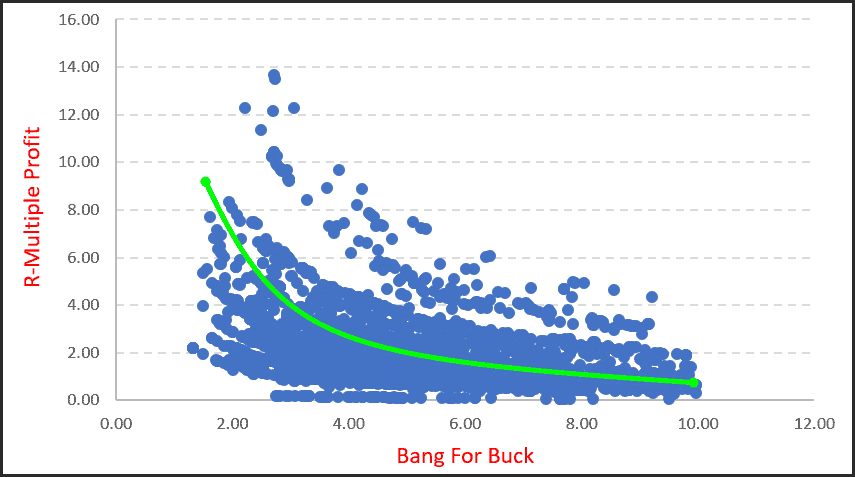

The following scatter chart shows 1000 random trades using a Bollinger Band entry of varying widths or volatility. To measure the effect of volatility each trade is assigned a 10% profit meaning the profit, as measured by R-multiples (return on initial risk), will be determined by the position size. In turn the position size is determined by the volatility at entry.

The Y-axis shows the R-multiple compared to the Bang For Buck reading on the X-axis.

In summary it can be seen that larger profits are made when the Bang For Buck filter is deemed low. You can greatly enhance your profitability by only selecting trades that have a low volatility entry compared to all possible trades.

In the example above we could select only trades where the Bang For Buck is less than 4.

It is not necessary to use Bollinger Bands. The same filter can be applied to discretionary patterns, such as Darvas Boxes, or price channels etc.