A Timeless Strategy To Bulk Up Profits – Part 1

Let’s look at a timeless strategy to bulk up profits.

Deciding how many shares to buy is, for some traders, a figure randomly plucked out of the air.

Which is odd.

You see, the number of shares you buy is directly related to your risk.

If you don’t risk much, you won’t make much.

If you risk too much, you may blow up.

The ‘how many’ question is called position sizing. Two popular methods are outlined here.

But today let’s discuss position sizing with a twist.

One which can massively enhance your profits without increasing risk.

Some background…

The profitability equation consists of how often you win, how much you win when you win, and the frequency of trades you make.

I’m of the opinion that every trade has a random outcome. That I could be wrong as much as I am right. 50/50.

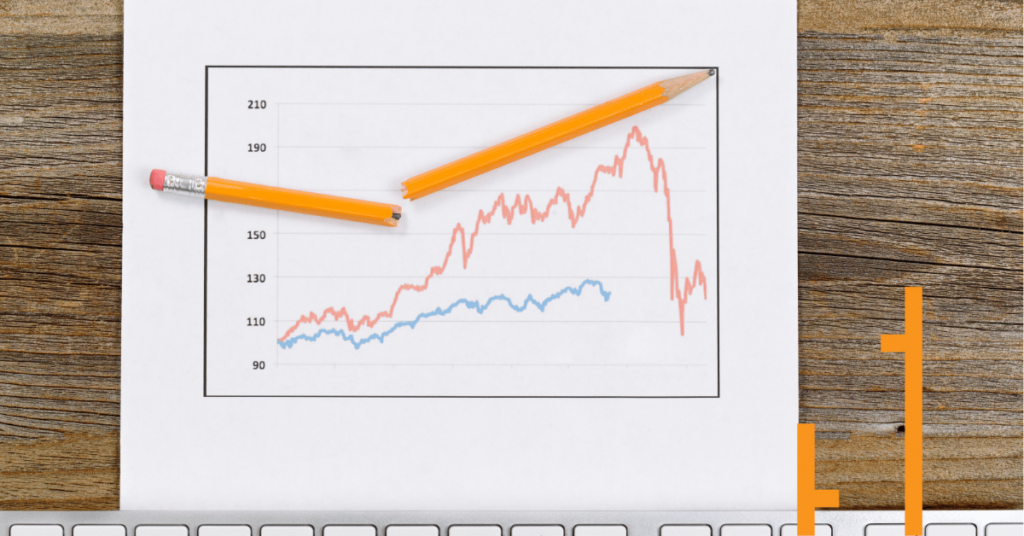

This can clearly be seen in my Growth Portfolio performance metrics over the last few years. Out of 73 trades, just 37 of my trades have been profitable – exactly 50%.

Yet the portfolio has doubled the return of the market in that time (+41% vs +20%).

Why?

Because my focus is on the one thing I can control; how much I win when I win.

And that is directly related to risk.

Now, if every trade is a 50/50 proposition, and risk is always an equal percentage of capital, how can we leverage those winners to be even larger?

The logical answer is pyramiding. But that’s not something I do.

What I have found to work is being selective.

Not selective to increase the win rate (we can never know ahead of time if a trade will be good or not).

I’m talking about being selective with the position sizing. In other words, choosing trades that will provide you with a bigger ‘bang for buck’.