A Nasty Week in the Markets

A nasty week in the markets last week.

After hitting new equity highs in recent months, my portfolios are now in drawdowns of between -8% and -14%.

They all remain within the realms of normal operations.

It’s a reminder that trading isn’t comfortable. Indeed it can get downright uncomfortable at times. If it were easy all the time then everyone would be doing it and be successful at it.

That’s part of the reason why 90% fail.

Those that succeed learn to dilute that level of unease when things go awry – and it happens to all great investors and traders. I spent many years looking at the track records of all the greats – and they ALL go through periods of drawdown, self doubt, angst and being uncomfortable.

Buffett was written off in the late 90s – his style outdated. He was too old. Dunn was written off after the GFC when he had a 60% drawdown. Druz, Parker, Abraham, Soros, et al.

They all go through periods of doubt and uncertainty.

But they persist.

They’re able to remove themselves from the monetary side of the equation and focus on the process, knowing that the process will generate the money over the longer term.

That’s the trick.

It’s also the basis of the common saying: “Don’t trade with money you can’t afford to lose“.

It’s not actually about losing the money. It’s so you don’t become emotionally attached to the money. When you become detached from the money you’re more likely to follow the process.

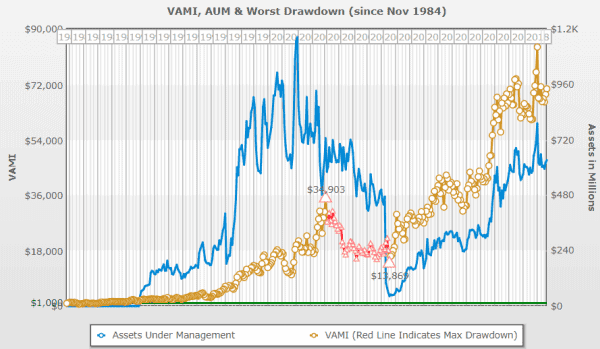

Here’s an interesting chart of Dunn Capital Management^. It overlays assets under management (blue) against equity growth (gold).

Notice the correlation?

I’m going to leave you with two thoughts.

Firstly, in reference to the above chart that provides an insight into investor psychology; money chases performance. They pile in at the top and out at the bottom.

The lesson here?

If you have a strategy with a long term positive mathematical expectancy, rather than dump the strategy when a significant drawdown takes place, you should be investing more in it.

I know. Friggin’ hard to do that. But I did say this game wasn’t easy.

Secondly, if you sit at home and watch prices tick down against your portfolio then the little voice inside your head starts to speak at you.

Yep – that’s normal. But you need to distract it.

Take a more ‘earthy’ approach.

Go for a hard run. Do something that will get your mind right off it. I do Crossfit, and during days like we’ve had this week I hit it damn hard.

But, I come back and follow the process. There is no money in my picture.

P.S. Remember, the best time to actually invest in a strategy with a long term positive expectancy is during a drawdown.