Should’ve, Could’ve, Would’ve

After exceptional returns or long running rallies, influencers and trading ‘gurus’ like to post statements like “If you had invested $10,000 in NVIDIA in 2014, that would now be worth $2,741,317”.

But the thing is, you didn’t, and more often than not, the person making this statement didn’t either.

So, let’s go back to 2014 and take stock of the situation. It’s 2014, Brazil has just lost a home ground World Cup semi-final 7-1 to Germany. In a moment of genius inspired by Pharell’s optimistic smash hit Happy, you presciently decide to invest in semiconductor stocks, because hey, computers seem to be sticking around.

Reasoning that those who have shown success with semiconductors in the past will likely continue to do well into the future, you find yourself a list of the top 5 chipmakers by market cap at that time: Intel, BroadComm, Qualcomm, Texas Instruments, and Analog Devices. Whoops, no Nvidia. At that point in time, Nvidia was known for its GPUs and mainly associated with PC gaming. In March of 2014, Nvidia CEO Jen-Hsun Huang declared “We are no longer a chip company. We are a visual computing company.” as he spruiked the company’s new android phone processors ideal for mobile gaming. Nvidia hadn’t started down the Artificial intelligence path, which was still associated with RoboCop and Terminator rather than lazy art and cheating on your homework.

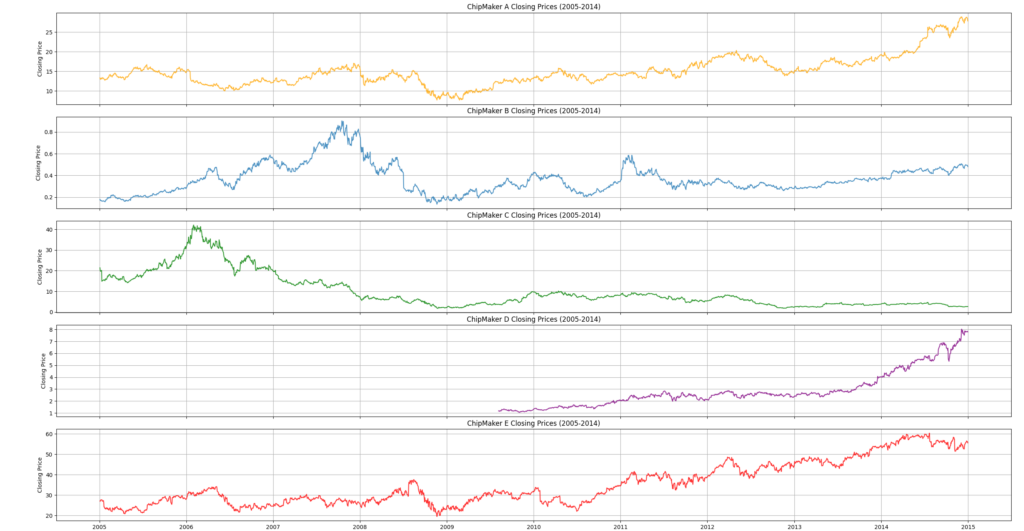

But nonetheless, you change criteria and pick five semiconductor stocks that are showing potential. You plot their past ten years of price history and see the charts below:

Based on these five plots, which stocks will you be choosing? Remember, you’re going to be holding this for the next decade.

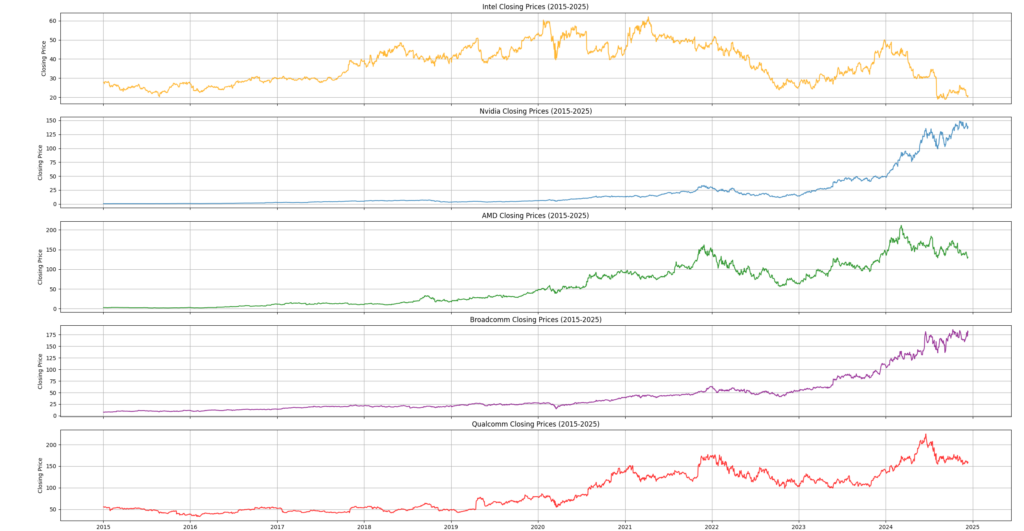

You can see the following decade of price returns below. The good news is, only ChipMaker A (Intel) finished that period with a loss. Sorry if you picked that one.

A few more things to note, all of these had full years (or more) of plateau or decline, would you have held through these periods, and if you hadn’t, would you have timed the re-entry well enough to get the full benefit?

There are over 8,000 stocks to choose from on the US market, the likelihood of choosing the biggest moves individually with a decade of foresight is incredibly low.

You are far more likely to succeed by casting a wider net and basing your investments off well tested and proven methodologies. Everybody wants to be the hare, but as we know, over the long haul, the turtle will come out on top.