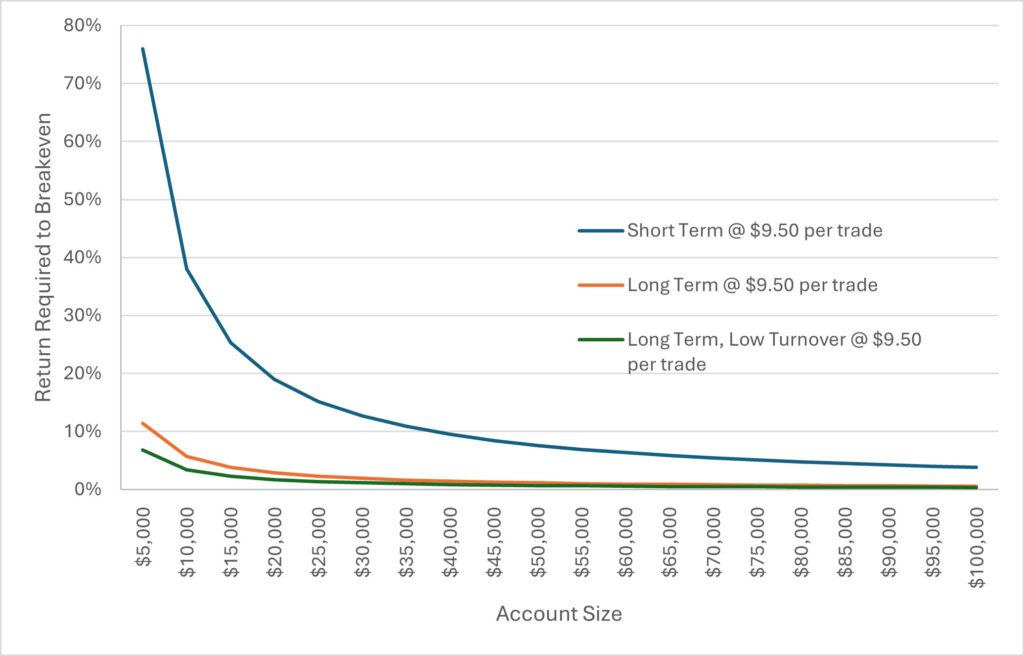

Commission Drag Visualised

The cost to trade is something that new traders often overlook in their trading plan. While commissions may seem small initially, they can quickly accumulate, creating a significant drag on systems which may make some strategies unviable.

We have previously written about how different commission structures can affect commission drag, so today let’s visualise how commission drag effects differing account sizes.

We’ll look at three strategies here and base the commission rate off broker SelfWealth, which offers $9.50 per trade. The first strategy is short term and trades 200 times per year. The second strategy is long term, and trades 30 times per year, based on the frequency of our ASX Growth Portfolio at 10 positions. The third strategy is a long-term, low turnover strategy based on our ASX Momentum which trades a maximum of 5 positions. We will judge their viability against account size by looking at the return required to breakeven.

What is immediately obvious is that the short-term strategy requires a much higher return to breakeven regardless of the account balance used. The short-term strategy does not become viable until around the $35,000 account size mark, when the return required drops toward 10%. The longer-term strategies, meanwhile, are clearly better suited to smaller account sizes than the short-term counterpart.

This chart demonstrates the importance of factoring commissions into the testing or planning of a strategy, as ignoring these could leave the trader in for a shock. Note that all performance metrics displayed on The Chartist site factor in commissions.

This isn’t to say that trading short-term strategies is a bad idea, just that the system needs to be better prepared to handle the drag. Some ways to do this are:

- Increasing the allocation to each position, while lowering the total number of positions.

- Increase the overall allocation of the strategy.

- Change brokers to a low fee or % percentage-based structure.

If you’re interested in following along with our membership strategies, similar to those above, sign up now for a free 14-day trial.