It’s All Relative

If you’re like us, you might’ve woken up to some rude shocks this week, with the Nasdaq-100 and S&P-500 falling -2.9% and -1.4% respectively on Wednesday. Or maybe you had a solid position on Droneshield (DRO) that had been on a tear, only for it to shed -26% across two days.

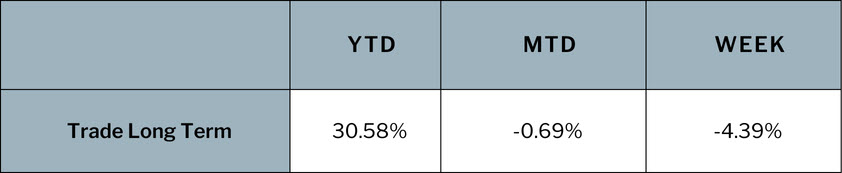

While days like this can be dread inspiring, it’s important to look at these events within the context of a wider time frame and portfolio, before making any panicked decisions. Take our Trade Long Term portfolio for example, it’s an aggressive strategy that looks for the biggest movers within the Nasdaq-100. Given this, it was on the receiving end of some of the week’s bigger falls. Yet while the week looks bad, the wider picture remains solid.

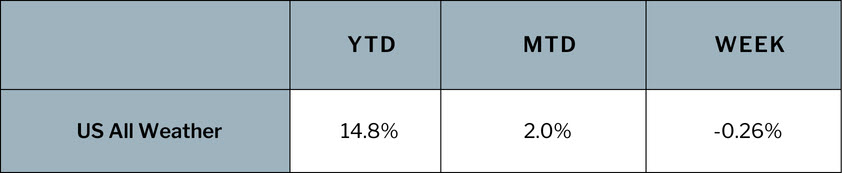

Now let’s take a look at our US All Weather strategy to see how it fared. The aim of the US All Weather is to offer low volatility returns, so naturally it came out of the week relatively unscathed.

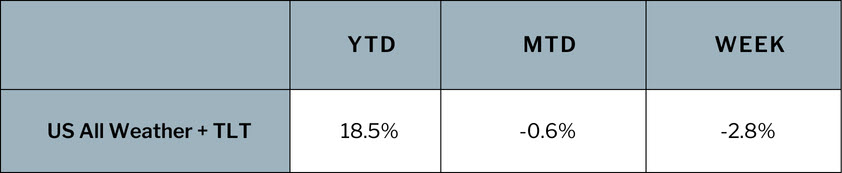

Now if we combine the two with equal 50/50 allocations, we can see the returns and the drawdowns now sit in between the TLT and US All Weather, and the overall equity curve has been smoothed.

Obviously the returns are lowered, but the ride is now much smoother. If you are a person who can handle volatility, then you may not be seeking to smooth the equity curve. However, if you’re looking for higher returns than the low volatility all weather, the combination of the two strategies may be what you’re looking for.

The Trade Long Term and US All Weather strategies are now both available through our The Chartist US or The Chartist Pro packages.