The Pareto Principle

The Pareto Principle, more commonly known as the 80/20 rule, states that for many outcomes, roughly 80% of consequences come from 20% of causes. In trading specifically, we can rephrase this to say that 80% of the profits will come from 20% of the trades. The inverse of that may also be true, with 80% of losses coming from 20% of the trades.

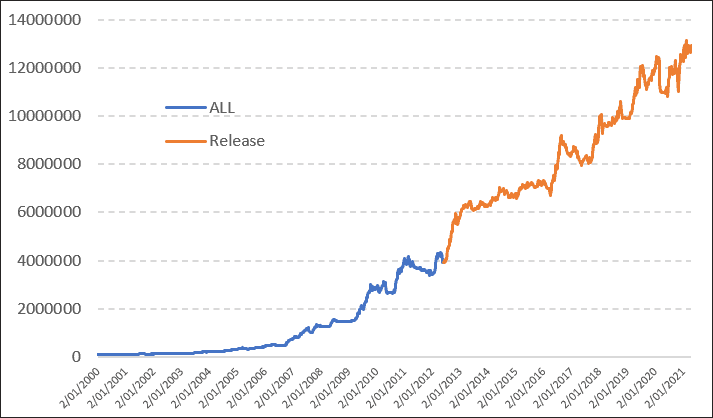

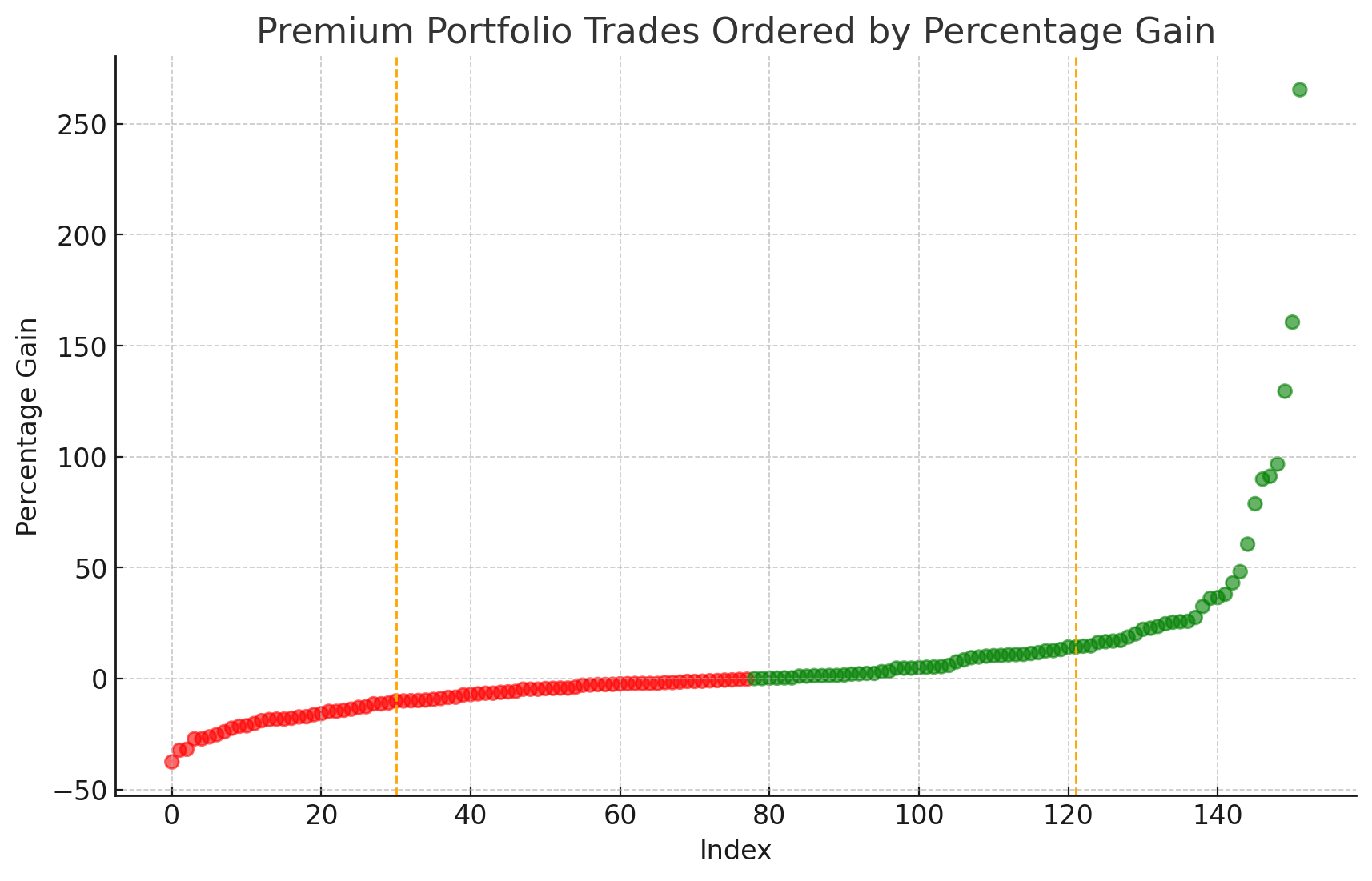

Analysing results from some of our systems, this appears particularly true when it comes to trend following strategies. These strategies are often built around a few exceptional runaway trades which bolster a system’s results significantly. The below chart shows the real-world percentage gains from our Trade Long Term Premium Portfolio, ordered from biggest loss to biggest win.

Through the chart, we can clearly see that the top 20% of trades, marked by the right vertical dotted line, clearly outweigh the bottom 20% of the chart. Although this strategy has a win rate around 50%, the hard skew in gains to the right is where the edge is found, and why the strategy outperforms indexes over time. The relatively low win-rate comes from the need to ride out “bad” times, else risk missing those trades with outsized gains. If you’re curious, the top five trades here in descending order are Tesla, Zoom Video, Tesla (again), NVIDIA, and Zoom Video (again).

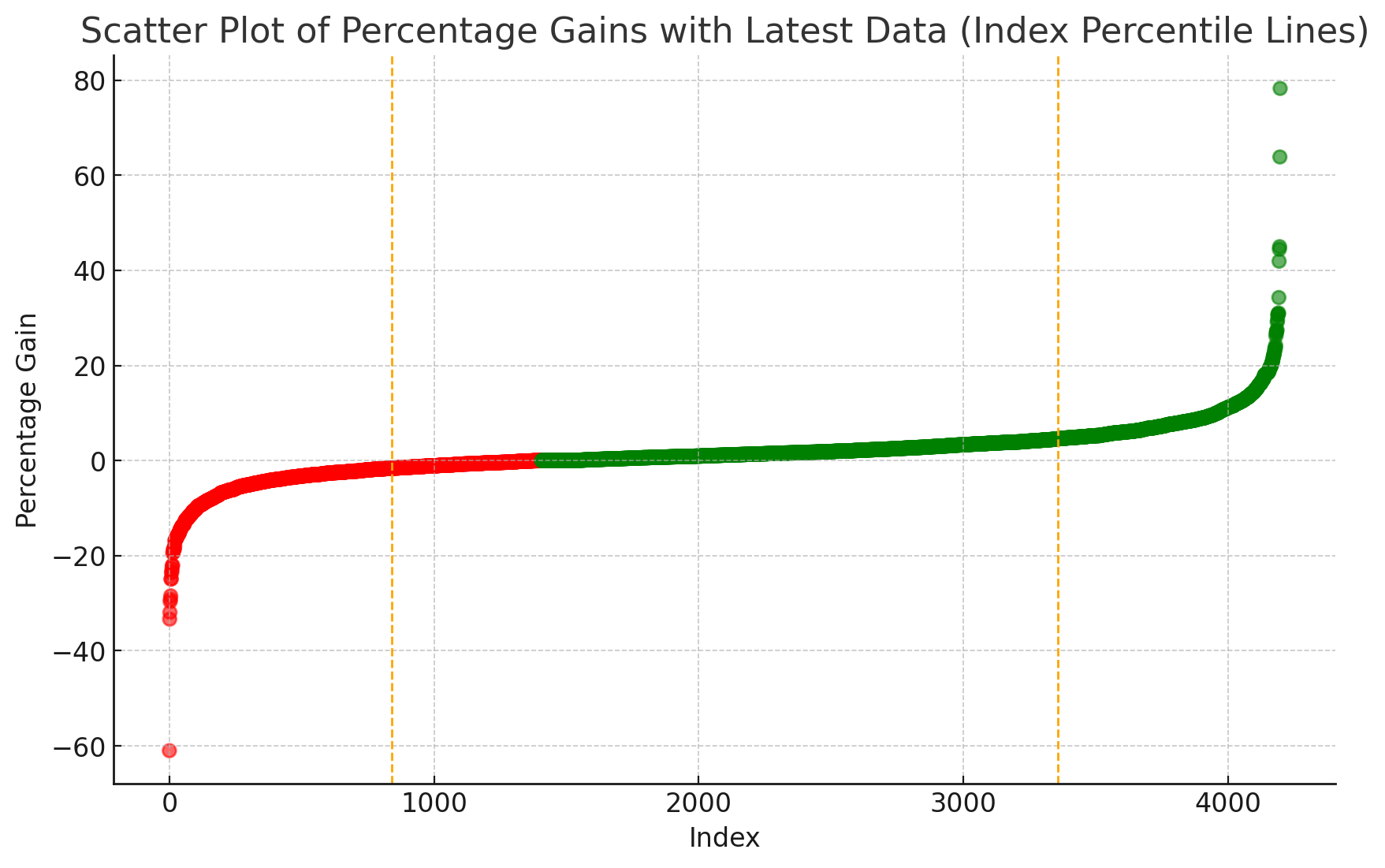

When we compare this to a backtest of the Mean Reversion Turnkey Strategy run on the ASX we can see a similar pattern. The much shorter hold time, however, means the wins are throttled back, and the frequency much higher. But we can also see that the win rate is much higher, meaning we don’t need wins to be as significant as the trend-following system to turn a profit. Nonetheless, it is clear here that the top 20% of the trades are doing most of the leg-work, while the middle section of single figure gains offers a baseline of small profits.

The message here is simple; understand your system. If you understand the characteristics of your system, you set your expectations correctly when it comes to the day-to-day performance. If I was running this Mean Reversion strategy I would not be phased by period of lackluster performance. When running a momentum strategy like the Trade Long Term portfolio, I understand the win rate is 50/50, and that we’re searching for that 20% to have the most impact.

Through backtesting we can analyse and better understand the characteristics of our systems. If you’re interested in developing your own strategies, consider our Beginner’s Guide To Building Trading Systems, or our turnkey code systems.