Benefits of the Growth Portfolio – Long Term trading

Benefits of the Growth Portfolio are many. Let’s look at the benefits here.

The Growth Portfolio is a systematic approach to find stocks that may offer sustained upward trends. By capturing longer term trends, we are able to get the highest risk adjusted rewards. The Growth Portfolio will only ensure you buy stocks trending higher, exit stocks that may be turning lower and not allow you to enter stocks that are trending down. We also have no interest on fundamental valuations. Just because a stock is priced low and represents fundamental value does not mean it can’t go lower, therefore, we will not look to buy until it starts pushing higher.

Benefits of the Growth Portfolio for Active Asset Management

The Growth Portfolio is a systematic approach to find stocks that may offer sustained upward trends. By capturing longer term trends, we are able to get the highest risk adjusted rewards. The Growth Portfolio will only ensure you buy stocks trending higher, exit stocks that may be turning lower and not allow you to enter stocks that are trending down. We also have no interest in fundamental valuations. Just because a stock is priced low and represents fundamental value does not mean it can’t go lower, therefore, we will not look to buy until it starts pushing higher.

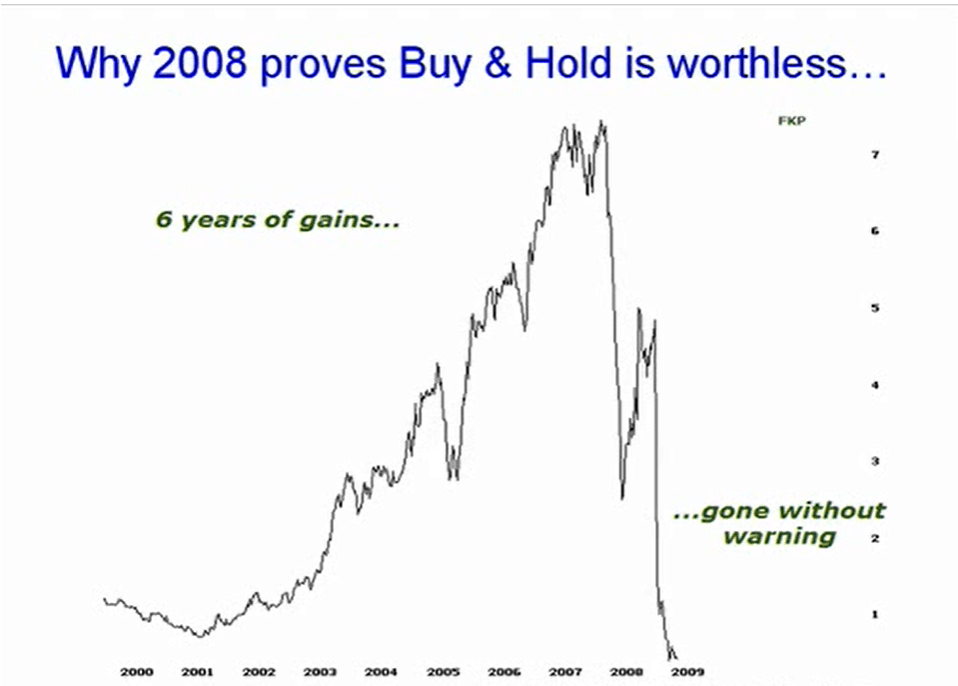

2008 should prove itself as a landmark turning point for the theory of Buy & Hold. FKP is just one example of many, many examples where Buy & Hold investors have been caught very badly and burnt.

You can see here that this stock trended very strongly all the way from 2001 to 2007. On the way up, there were reasonable dips included. The question is, how do we know when this is a dip or when the market is going to completely collapse as it did from 2007 and is still collapsing today? The answer to that is that we simply don’t know. However, an active management approach such as the Growth Portfolio or such as the self-managed super fund timer (no longer available) takes all the information; price information, volume information and volatility information into account, and ascertains, rightly or wrongly, that the stock should be entered and when the stock should be exited.

You can see in this example that we were able to purchase the stock down here in 2001 and exit the stock way up here in 2007, before the final collapse.

Note that the system does not attempt to find the absolute top, it simply registers a trailing stock behind the market and when enough is enough, it will exit the trade. If the stock then reverses and travels higher, the portfolio will look to initiate a new position.

The benefits of the Growth Portfolio are numerous:

- The Growth Portfolio will keep you on the right side of the market.

- It should reduce volatility.

- It will revert to large cash positions during bear markets.

- It will simplify the stock selection process, which is an important attribute.

- It is simple to operate and manage.

- It keeps transaction costs low and allows you to use a discount broker.

- Importantly, it removes emotion from the decision-making process.

We commonly get asked why there is no actual analysis provided with the Growth Portfolio. The reason being is the Growth Portfolio is based on mathematical algorithms that have been programmed into the computer software. These algorithms are not available for sale or have never been disclosed. Programming allows the strategy to be tested on historic data, which in turn allows the user to determine its validity going into the future.

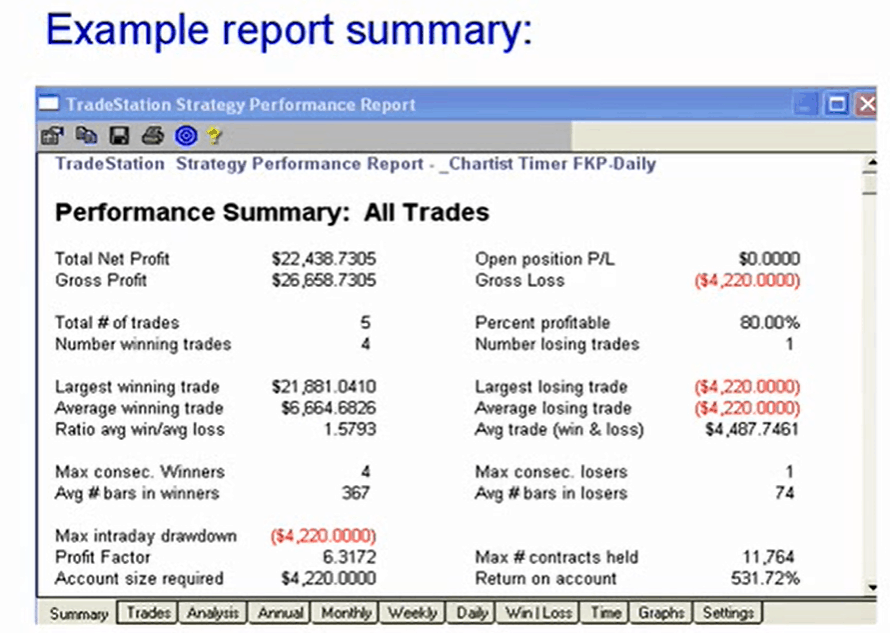

Here is an example report for FKP since its inception. You can see in this particular report that the system has made five trades of which four have been profitable. We have an 80% profitability. You can also see that our $10,000 investment has now generated profits of over $22,000 after commissions. Having this information gives us confidence to be able to trade the system.

The Growth Portfolio will hold positions for an average of 10 months. However, this will be determined by the trend of the stock and the trend of the market. During very bullish periods of time, our positions may be held for longer. During negative times, the positions may be held for a shorter period of time.

Trading Signals

The number of signals given will be also determined by the current market conditions. During strong bull markets, as we saw in 2004 through to 2007, there will be a lot of signals. During bear markets, 2008 onwards, potentially there will be a lot less signals. The signals are given daily. If a new buy is recommended, you will see that highlighted on the front page of the chartist website and you can then log in and see the details of that trade.

The Growth Portfolio is designed for ease of use. When an order is received, all you have to do is place a limit order to buy or sell the stock the next day on the open. Most brokers facilitate a limit buy or sell order, and you want to make sure that you enter or exit on the next day’s open. We will tell you exactly when to exit the position and we’ll help you manage the trade as it develops.

New Trade Recommendations

Let me explain how a new trade recommendation is made. When there is a new recommendation, you will find the details in the top of the box. In the left-hand section is the code of the stock, the company name and the yield. The next section is particularly important because it outlines the risk of the market and the risk of the individual stock, and combined, these will tell us how many shares to actually buy.

In this example showing here, I have suggested that the risk of the market is high. That is because it is very volatile or it is trending strongly down. If the risk of the market is low, we will generally have a very low volatility environment and we will have a strong uptrend. Secondly, we have the individual risk of the stock.

In this particular example, the risk is low. We have a low volatility situation and we have an uptrend. The combination of both of these factors tells us how many shares to buy. In this situation, the trading advice being given is that we only buy half of our normal position size, and that is because of the high market risk. We do not want to buy full position size if we have a high market risk. So when we have low market risk and low stock risk, we can then buy the full position size. However, otherwise, we’ll only buy half. This area here tells us where the approximate initial stock will be. However, the algorithms used in this system will always ensure that our loss, if there is a losing proposition, will always be a small valuation of the account.

Trade Management

Ongoing trade management will also be offered to you. If we take a look at the lower portion of the box here, you can see that we currently have two open positions.

XYZ Trading Limited, on line number one. We entered at $3.50 on 15th of January, the current price is $4. We have a profit of 14.2%. And as you can see, the market and stock risk are both low. We have no reason to amend this position, so the trading advice is to continue to hold. However, with ABC Global Group, which we purchased at $5 on the 12th of January, we’re sharing a 20% profit, but the individual stock risk is now considered high. This generally comes from a massive increase in volatility. And the advice in this particular situation is that we exit half the position. A common question we get is, how many shares do I buy? If you are an aggressive investor, we suggest you divide your capital by 10 and allocate equal portions to each particular tray that is recommended.

Once those portions are used up, you will negate the next trade and continue to hold your 10 positions until one is removed. Once one is removed, you can then take the next buy order that comes through. If you are a conservative investor, we suggest dividing your capital by 20. If you’re more advanced, you can use the initial stock indicator and use fixed fractional position sizing. If you are just new to the system, you should not buy any current open trades. You should wait for the next signal before initiating a position.

The Growth Portfolio attempts to find the optimum buy point. A trade that is already in play may not be at that optimal buy point. In order to be successful with this model, you should take a long-term approach to applying the strategy. Trends do take time to develop. I also recommend patience.

Exhibit Patience

This is a long-term application of a strategy that will take time to produce rewards. It is important that you allow profits to ride and don’t get too excited if we’re making a large profit on a position. We simply do not know how far a stock can go and all we want to do is ride it for as long as it’s going to go higher. Do not be concerned with losing trades. They are part and parcel of the business of trading and we give ourselves a favorable expectancy using this model. I reiterate, patience is critical to benefit from the Growth Portfolio. I firmly believe the difference between successful traders and unsuccessful traders are those that do not exhibit patience.

I’ve attempted to address questions that are most common, however, you may have more questions. You can contact me via email here.

NOTE: This video was recorded in 2010. The Growth Portfolio still operates today but the website has been updated and will look different to what you’re seeing in the video. The strategy is the same. Nick and Trish Radge continue to trade the Growth Portfolio in their SMSF.